7% Tax Credit for 11 Months When Paying 1 Year in Advance

[Asia Economy Reporter Kiho Sung] The Seoul Metropolitan Government announced on the 11th that it has sent the annual automobile tax payment notices to 1.3 million vehicles (40%) out of 3.25 million registered vehicles this year.

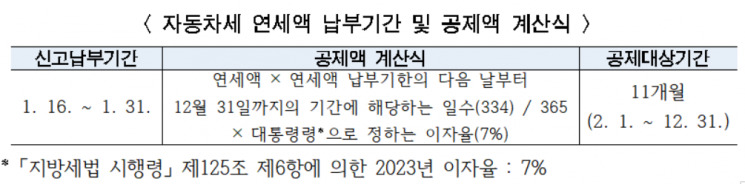

The automobile tax is usually billed in two installments, each half of the annual amount, in June (first installment) and December (second installment). However, if the vehicle owner applies, the full annual amount can be paid at once in January. When paying the full annual amount in January, a tax credit of 7% is applied to the 11-month portion of the tax (from February 1, the day after the January 31 payment deadline, through December 31).

The scale of sending the annual automobile tax payment notices increased by 70,000 vehicles from last year’s 1.23 million vehicles totaling 270.1 billion KRW to this year’s 1.3 million vehicles totaling 293.1 billion KRW, with the total tax credit amount reaching 20.1 billion KRW.

The January lump-sum payment benefit for automobile tax varies depending on the vehicle’s engine displacement. For electric vehicles, unlike internal combustion engine vehicles where tax is applied based on engine displacement, a flat rate of 100,000 KRW is applied, so applying the 6,400 KRW tax credit can further reduce the automobile tax burden.

Applications for the annual automobile tax payment can be made through the internet ETAX site and the mobile app STAX, or by visiting or calling the tax department of the relevant district office.

For taxpayers who paid the automobile tax in a lump sum last year or have applied for lump-sum payment this year, the city sends the automobile tax payment notices (by mail or electronic notification), so those who paid last year do not need to apply separately.

If a vehicle is transferred or scrapped after paying the annual automobile tax, the tax for the unused period excluding the ownership days can be refunded. Also, even if the taxpayer moves to another city or province within the year, the payment record is linked, so no additional automobile tax payment is required at the new address.

Han Young-hee, Director of Finance at Seoul City, stated, “We hope many citizens will benefit from the tax savings by paying the annual automobile tax in January, and we ask for active participation in applying for the local tax electronic notification (ETAX system) to enjoy tax credit benefits and contribute to carbon neutrality.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.