Hong Kong Stock Market ETF with Large Big Tech Weight Posts Double-Digit Returns

Chinese Government Shifts from Regulating to Supporting Platform Companies

[Asia Economy Reporter Minji Lee] Amid the excitement in the Greater China stock markets fueled by China's easing of its 'zero-COVID' policy, the surge in COVID-19 infections has created a divergence in fortunes between China and Hong Kong.

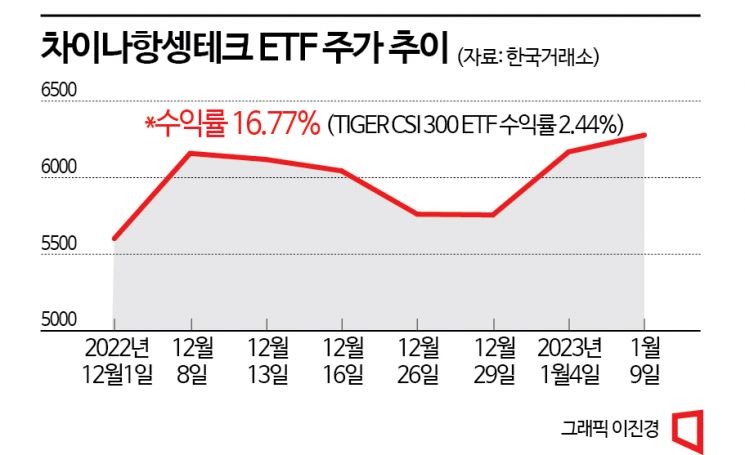

According to the Korea Exchange on the 10th, from December 1 last year to January 9 this year, the TIGER China Hang Seng Tech Leverage Exchange Traded Fund (ETF) posted a return of 47.53%, the highest among all listed ETFs. Following were KODEX China H Leverage (32.56%), KBSTAR China MSCI China (19%), KODEX China Hang Seng Tech (16.77%), and TIGER China Hang Seng Tech (16.62%). The commonality among these ETFs is that they invest in the Hang Seng Tech Index, which bundles 30 technology stocks listed on the Hong Kong Stock Exchange. Even the MSCI CHINA ETF includes major technology stocks listed on the Hong Kong Stock Exchange such as Tencent, Alibaba Group Holdings, Meituan, and JD.com among its top 10 holdings.

The situation is different for ETFs investing in mainland China indices. During the same period, KODEX China Shenzhen ChiNext rose only 4.78%, ACE China Mainland CSI300 (3.5%), SOL China Mainland Small and Mid Cap CSI500 (3.4%), and TIGER China CSI300 (2.44%) also recorded single-digit low returns. These ETFs invest in companies listed on the mainland China stock exchanges, with the 'CSI 300, 500' indices comprising 300 or 500 stocks selected based on criteria from the Shanghai and Shenzhen Stock Exchanges.

The widening performance gap between mainland China and Hong Kong stock markets is attributed to the spread of COVID-19 and expectations of the Chinese government's easing of big tech regulations. In mainland China, the rapid spread of COVID-19 has dampened expectations for economic activity recovery, whereas the Hong Kong market, with a high proportion of big tech companies, is showing strong gains supported by moves from Chinese authorities to lift corporate regulations. On the 9th, major Chinese media reported that Chinese authorities have "basically completed the special rectification of platform companies' financial businesses," signaling a shift in policy direction from regulation to support for platform companies.

With signs of a changing stance by the Chinese government toward big tech companies, investor interest in the Hong Kong stock market is expected to grow further. Considering that COVID-19 cases in mainland China could surge explosively until February, the mainland stock market is likely to experience high volatility. Yeonju Sung, a researcher at Shin Young Securities, analyzed, "The Hong Kong market is likely to rise in the short term due to the stabilization of exchange rates as the US interest rate hikes near their end, easing of big tech regulations, relaxation of mainland China's quarantine measures, and increased expectations for capital inflows from stimulus policies."

However, for long-term investment, the mainland China stock market is promising. If the National People's Congress and the Chinese People's Political Consultative Conference (the 'Two Sessions') held on March 4-5 announce fiscal policies to revive the economy, the actual fiscal effects are expected to be reflected in corporate stock prices in the second half of the year. Suhyun Park, a researcher at KB Securities, advised, "Money will flow mainly into consumer-related sectors such as dining, airlines, and leisure, as well as infrastructure sectors like renewable energy. It is advisable to increase the proportion of Hong Kong stocks in the short term until February, and then expand the weighting of Chinese stocks (A-shares, CSI500) during the Two Sessions season."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.