First 15 Trillion Won Loan Since October 18 Last Year

If Borrowed Over 91 Days, 10% Annual Interest Applies

Risk of Forced Sale Looms, Requires Careful Management

[Asia Economy Reporter Lee Jung-yoon] The interest rates on margin loans, commonly known as stock 'debt investment (debt-financed investment),' have surpassed 10%. Meanwhile, as interest rates have risen, the scale of margin loans has gradually decreased to the 15 trillion won level.

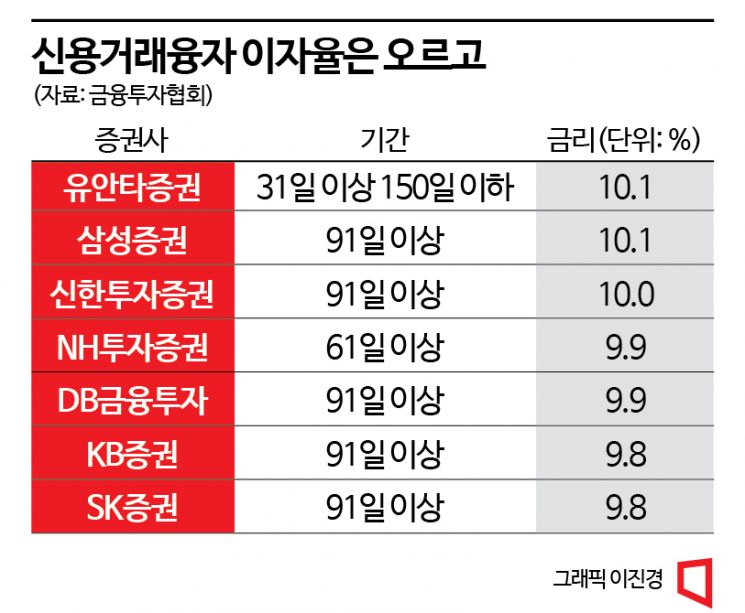

According to the Korea Financial Investment Association on the 10th, the interest rates for margin loans of 31 to 150 days at Yuanta Securities and over 91 days at Samsung Securities stood at 10.1%. Shinhan Investment Corp. also raised its interest rate for over 91 days by 0.25 percentage points from the previous 9.75% to 10%.

NH Investment & Securities’ interest rate for over 61 days and DB Financial Investment’s for over 91 days were both recorded at 9.9%, approaching 10%. KB Securities and SK Securities’ interest rates for over 91 days were 9.8%.

Following a series of domestic and international rate hikes, major securities firms have continued to raise margin loan interest rates. On the 4th, NH Investment & Securities increased the interest rate for 1 to 7 days (QV customer accounts) from 4.9% to 5.4%, and the rate for over 61 days from 9.5% to 9.9%. KB Securities raised the rate for within 7 days from 5.3% to 5.5%, and for 8 to 15 days from 8.6% to 8.9%. Hi Investment & Securities also increased rates by 0.2 to 0.5 percentage points.

Margin loans refer to securities firms lending funds to investors for stock purchases using the stocks as collateral. Each securities firm calculates interest rates based on the loan period and lends funds accordingly. Generally, the longer the period, the higher the interest rate. If interest payments are not made beyond the period, overdue interest is charged. Because investing in stocks is a high-risk product with significant risk, higher interest rates are applied compared to unsecured loans.

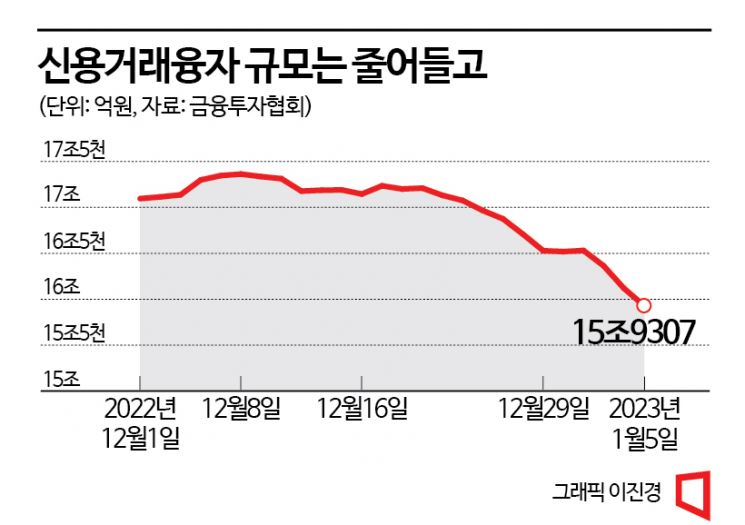

As the stock market has fallen into a slump and interest rates have risen, the burden of interest costs has led to a downward trend in the scale of margin loans. After recording 17.096 trillion won at the beginning of last month, it slightly increased to 17.3627 trillion won on the 8th of the same month. However, it then decreased to 15.9307 trillion won as of the 5th of this month, falling to the 15 trillion won level for the first time since October 18 of last year.

The market expects interest rate hikes to continue. A financial investment industry official explained, "Since it is a period of inflation and rising base rates, interest rate increases are natural. Even if investors bear high interest, it is not a big problem if the stock market supports it, but since that is not the case, concerns are emerging about leveraged investments."

With rising interest rates combined with volatile market conditions, individual investors who borrowed to invest are suffering from the double burden of forced liquidation and increased interest costs. As of the 5th of this month, the ratio of forced liquidation to unpaid balances was 5.9%, but on the 2nd and 3rd of this month, it was 11.0% and 13.0%, respectively. Heo Jae-hwan, a researcher at Eugene Investment & Securities, said, "Forced liquidation risk increases when expectations of stock price rises are broken and prices decline. Since interest rates are high and costs are significant, and forced liquidation risk is also high, appropriate risk management is necessary."

Amid the growing burden of margin loan interest, financial authorities have initiated institutional improvements to provide investors with sufficient information. There have been criticisms that some securities firms have different interest rates for face-to-face and non-face-to-face margin loans, but only face-to-face rates are disclosed on the Korea Financial Investment Association website. Accordingly, the Financial Supervisory Service plans to require disclosure by account opening method. Additionally, it will strengthen guidance on interest rate calculation methods and explain detailed interest costs with specific examples of loan situations.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.