Ministry of Economy and Finance Affiliated Agencies Conduct Individual Work Reports

[Asia Economy Sejong=Reporter Kim Hyewon] The National Tax Service (NTS) is considering exempting startups, innovative small and medium enterprises (SMEs), and job-creating companies from regular tax audits to boost economic vitality. Additionally, the eligibility for the corporate tax credit and exemption consulting system will be expanded to all SMEs, and tax support for export SMEs will be broadened.

On the 9th, the NTS reported these plans in the '2023 NTS Major Work Promotion Plan' during the Ministry of Economy and Finance's external agency chiefs' work briefing.

This year, the NTS's key tasks are divided into four main areas: ▲ stable procurement of revenue budget ▲ support for livelihood economy and export promotion ▲ realization of fair taxation ▲ systematic management of personnel and organization.

Strengthening Tax Support for SMEs... Some Regular Tax Audits May Be Exempted

The most notable aspect is the strengthened tax support for SMEs. In addition to existing support such as extension of payment deadlines, exemption from tax payment guarantees, and priority review of R&D tax credits, the NTS is expected to add exemption from regular tax audits for 'startups, innovative SMEs, and job-creating companies.'

The current eligibility for the corporate tax credit and exemption consulting system, which is provided to small corporations with revenue between 10 billion KRW and less than 100 billion KRW in the previous tax year, will be expanded to all SMEs. The NTS also plans to establish more dedicated teams at regional offices to provide prompt and accurate consulting.

Since September last year, the NTS has been conducting tax consulting for business succession (currently ongoing with 150 companies), and it plans to increase the proportion of export companies and long-established companies when selecting target companies.

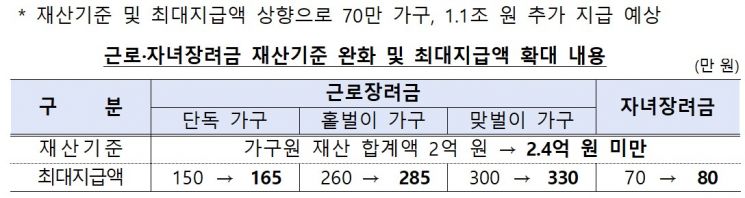

To help small taxpayers improve cash liquidity and quickly overcome difficulties, the NTS will implement early refund payments and extensions of filing and payment deadlines, and continue the 'Refund Recovery' program targeting personal service income earners with limited tax experience. Furthermore, the asset criteria and maximum payment amounts for earned income and child tax credits will be raised, providing an additional 1.1 trillion KRW to 700,000 households.

Commissioner Kim: "We Will Meticulously Manage Tax Revenue Progress"... Tax Audits to Follow a Relaxed Policy

In response to the weakening tax revenue base due to this year's economic slowdown, the NTS plans to participate in the Tax Revenue Estimation Committee and the Ministry of Economy and Finance-led Tax Revenue Estimation Task Force (TF), and closely monitor progress through monthly tax revenue situation meetings.

Commissioner Kim emphasized, "We will increase the predictability of tax audits so that companies can focus on their business activities and substantially reduce the audit burden felt by taxpayers. However, we will concentrate investigative efforts on unfair tax evasion, offshore tax evasion, tax evasion closely related to people's livelihoods, and new types of tax evasion, responding strictly."

In particular, the NTS plans to gradually expand the dedicated tracking teams at tax offices and strengthen tracking investigations of high-value and habitual tax delinquents through collaboration with local governments. It will also conduct on-site tracking of suspects involved in luxury lifestyles, asset concealment, and fund outflows using big data analysis, as well as asset tracking through planned analysis of irregular asset concealment activities.

Internally, the NTS will revise personnel and organizational management systems. The newly established Personnel Planning Division in December last year will prepare mid- to long-term personnel management plans and improve personnel standards to help excellent employees grow early. There is also interest in whether personnel exchanges with the Ministry of Economy and Finance's Tax Policy Office, which have been pointed out inside and outside the National Assembly, will take place. Commissioner Kim stated, "We will actively implement internal restructuring according to government personnel operation plans and reduce frontline workload by reallocating personnel from regional offices to tax offices."

The NTS plans to review the opinions discussed in this work briefing and announce the '2023 National Tax Administration Operation Plan' at the nationwide tax office chiefs' meeting scheduled for the 2nd of next month.

Until now, the Ministry of Economy and Finance's external agency work briefings were held in a simplified meeting format at the beginning of the year, but from this year, they will be conducted individually for each agency. Deputy Prime Minister and Minister of Economy and Finance Choo Kyung-ho said in his closing remarks, "Since the economic situation is expected to be challenging throughout this year, more active support from the tax side is needed to boost economic vitality and stabilize people's livelihoods. Tax system reforms alone have limitations, and efforts by the NTS, which is responsible for actual implementation, are essential to complete this." He urged the NTS to make every effort to stably procure the revenue budget and strengthen tax support.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.