Top Net Buyers by Investor Type Diverge in First Week of New Year

Focus on Semiconductor Tax Benefits and Real Estate Regulation Easing

[Asia Economy Reporter Son Sunhee] Since the beginning of the new year, foreigners and institutions have been concentrating their purchases on Korea's leading semiconductor companies. This is interpreted as a 'dual buying spree' following the government's announcement to expand tax credits for semiconductor investment companies. The top stock for net purchases by Donghak Ants was Samsung SDI.

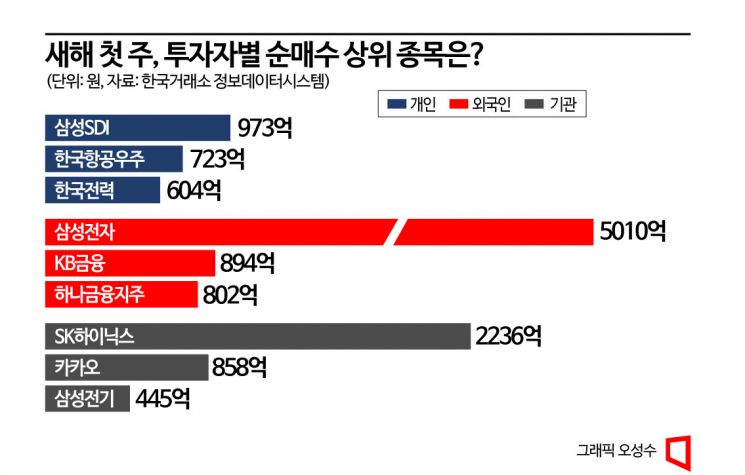

According to the net purchase status by investor type compiled by the Korea Exchange Information Data System on the 9th, during the first five trading days of the new year (January 2-6), the top stock for net purchases by foreigners was Samsung Electronics, with net purchase transaction value reaching 501 billion KRW. This was followed by KB Financial Group (89.4 billion KRW), Hana Financial Group (80.2 billion KRW), and Shinhan Financial Group (66.9 billion KRW). The net purchase transaction value of Samsung Electronics by foreign investors was overwhelmingly large, about 5.6 times that of KB Financial Group, which ranked second.

Samsung Electronics announced on the 6th that its consolidated operating profit for the fourth quarter of last year was preliminarily estimated at 4.3 trillion KRW, a 69.0% decrease compared to the same period last year. This figure was lower than market expectations, leading to an 'earnings shock' evaluation. Although segment-specific results were not disclosed, the industry speculates that the semiconductor division's poor performance had the greatest impact. Do Hyunwoo, a researcher at NH Investment & Securities, said, "Samsung Electronics' poor performance is expected to continue into the first quarter of this year," and particularly predicted that "it will record its first quarterly loss in the semiconductor division since the 2008 global financial crisis."

However, as Samsung Electronics is expected to reduce related investments this year to adjust semiconductor supply, price increases are anticipated to appear from the second half of the year. Researcher Do said, "The supply reduction effect due to investment cuts is expected to be concentrated in the second half of the year when inventories decrease, rather than in the first half," adding, "Through this, memory semiconductor performance improvement will appear from the second half of this year, and in 2024, when supply shortages are maximized, there is a possibility that performance will improve significantly beyond industry expectations."

Excluding Samsung Electronics, large domestic financial holding companies lined up in the top ranks of net purchases by foreign investors during the first week of the new year. This is interpreted as reflecting expectations that related loans will increase due to the government's easing of real estate regulations.

The stock most sold by foreign investors since the new year was POSCO Chemical, with a net sale scale of 75.5 billion KRW. This was followed by Korea Aerospace Industries (50.3 billion KRW) and LG Energy Solution (41.3 billion KRW), which also saw large net sales by foreign investors.

The top stock for net purchases by institutional investors in the first week of the new year was SK Hynix, with a total purchase amount of 223.6 billion KRW. Following were Kakao (85.8 billion KRW), Samsung Electro-Mechanics (44.5 billion KRW), Hyundai Construction (35.4 billion KRW), etc. Similar to Samsung Electronics, SK Hynix's fourth-quarter performance last year is widely expected to be poor, but the strong buying by institutions is interpreted as driven by expectations of an industry rebound. Cha Min-sook, a researcher at Korea Investment & Securities, said, "Although earnings estimates have been revised downward, there will be no additional negative factors beyond what the market expects," and added, "If the possibility of a turnaround due to earnings direction and industry improvement is confirmed, the stock price will begin to rebound. Therefore, considering that the stock price has been excessively adjusted and the rebound timing is not far, we recommend bottom-fishing and increasing weight."

Individual investors bought the most of Samsung SDI (97.3 billion KRW), one of the representative stocks of secondary batteries. This was followed by Korea Aerospace Industries (72.3 billion KRW), Korea Electric Power Corporation (60.4 billion KRW), and CJ CheilJedang (55.7 billion KRW), which ranked high in individual net purchases.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.