Western Digital Attempts to Acquire Kioxia

Big Deal Expected to Reshape NAND Market Landscape

[Asia Economy Reporter Kim Pyeonghwa] The merger rumors between Japan's Kioxia and the U.S.'s Western Digital, major players in the global NAND market, have reignited, drawing attention from the NAND industry. While negative outlooks dominate regarding the merger possibility, some predictions suggest that if successful, Western Digital's market dominance could surpass Samsung Electronics, the current number one player.

Bloomberg reported on the 4th (local time) that Kioxia and Western Digital have begun discussions for a merger. Citing sources familiar with both companies, it added that related negotiations have been ongoing since the end of last year.

Kioxia and Western Digital are major players ranking 2nd and 4th respectively in the global NAND market. They jointly operate a NAND factory in Japan in the form of a joint venture (JV). There was an attempt to merge in 2021, but it was aborted.

Bloomberg noted that since the merger is in the early discussion stage, the negotiation outcomes could change. However, it added that the need for a merger could be significant to enhance business competitiveness in the NAND market.

Western Digital is known to have anticipated the possibility of a merger since the time of Toshiba Memory, Kioxia's predecessor. If this merger succeeds, it is predicted that Western Digital could acquire Kioxia and increase its market share, potentially aiming for the top spot in the NAND market.

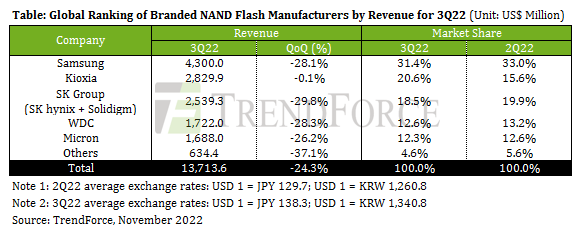

According to statistics released by market research firm TrendForce, as of the third quarter of last year, Western Digital held a 12.6% share of the global NAND market, ranking 4th. Kioxia held 20.6%, ranking 2nd. Combining their shares would amount to 33.2%, surpassing Samsung Electronics' 31.4%, the current leader.

In this case, another domestic player, SK Hynix (18.5%), is likely to be pushed from 3rd to 4th place in the NAND market. Since SK Hynix is part of the Korea-U.S.-Japan consortium, the largest shareholder of Kioxia, it is a positive factor that SK Hynix could gain voting rights shares in Western Digital through Kioxia.

Negative outlooks prevail regarding the merger possibility. As semiconductors have emerged as a core of national technological security, regulatory barriers from various countries have increased concerning mergers and acquisitions (M&A). Relatedly, Reuters assessed that "the M&A obstacles Western Digital faced in 2021 are now much more challenging."

SK Hynix has stated it will carefully monitor the situation going forward. At CES 2023, the world's largest electronics and IT exhibition held in Las Vegas, U.S., SK Hynix Vice Chairman Park Jung-ho told reporters, "We are monitoring how the Japanese government will approach SK Hynix's investment in Kioxia."

Meanwhile, following the merger rumors, Western Digital's stock price rose on market expectations. On the 5th (local time), Western Digital closed at $35.23 per share, up 6.60% from the previous day.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.