Expert TF 2nd Meeting... "Full-Scale Discussions Next Month"

[Asia Economy Sejong=Reporter Lee Junhyung] The government is accelerating the introduction of the inheritance acquisition tax. The introduction of the inheritance acquisition tax is expected to ease the tax burden on heirs.

On the morning of the 6th, the Ministry of Economy and Finance announced that it held the 2nd meeting of the "Expert Task Force for the Introduction of the Inheritance Tax Acquisition Tax System." Previously, in October last year, the Ministry formed the expert task force and held the 1st meeting to introduce the inheritance acquisition tax.

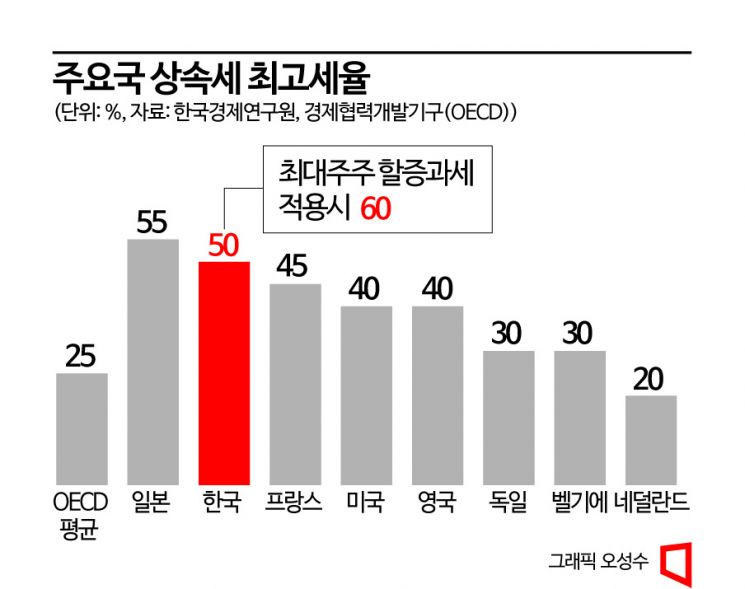

The inheritance acquisition tax is a tax levied only on the portion of the inheritance acquired by each heir, not on the entire estate. The current inheritance tax applies an estate tax method that taxes the entire estate. The problem is that applying a progressive tax rate of up to 50% (up to 60% when the major shareholder surcharge is applied) excessively increases the tax burden on heirs.

Another issue with the current inheritance tax system is that the inheritance tax has a different taxation system from the similar gift tax. Currently, the gift tax applies the inheritance acquisition tax method. In contrast, the inheritance tax adopts the estate tax method, which is criticized for undermining the consistency of tax law.

Accordingly, the expert task force focused on discussing cases of major countries such as Germany and Japan that have introduced the inheritance tax acquisition taxation system at the meeting. Among the 23 OECD member countries with inheritance tax, only four countries, including Korea, the United States, the United Kingdom, and Denmark, adopt the estate tax method rather than the inheritance acquisition tax.

The task force plans to review the necessity of benchmarking each country's system through comparative analysis of major countries' systems. This is to prepare specific measures to convert the existing estate tax method of inheritance tax to the inheritance acquisition tax.

The 3rd meeting of the task force will be held next month. At the 3rd meeting, the task force plans to intensify discussions on the introduction of the inheritance acquisition tax based on simulation results. A Ministry of Economy and Finance official said, "We plan to continue reviewing the transition to the inheritance acquisition tax through opinion gathering via research projects, expert task forces, and public hearings."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)