Donga Membership Rights, Annual Market Trend Analysis

Average of 100 Nationwide: 220.53 Million KRW

0.47% Increase from Early Year... High, Medium, and Low Prices Decline

Namchon CC

Namchon CC

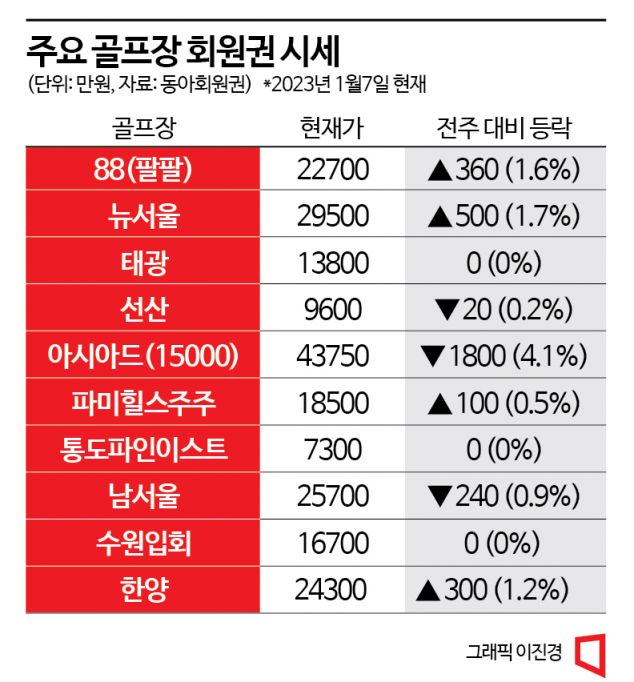

Last year, the golf membership market recorded a slight upward trend centered on major listings. By price range, the ultra-high price segment performed well, leading the upward trend. In contrast, both the high-price and mid-to-low price segments showed a downward trend compared to the beginning of the year. Since the start of the new year, inquiries about transactions have increased, creating an atmosphere where buyers are weighing the timing of deals.

According to the annual analysis by Donga Membership Exchange on the 7th, the average price of 100 major memberships traded nationwide as of the end of last year was 220.53 million KRW, up 0.47% from the beginning of the year. By price range, the ultra-high price segment rose 13.29%. However, the high-price segment fell 7.68%, the mid-price segment fell 7.65%, and the low-price segment fell 5.99%, resulting in a slowdown in annual growth.

By region, the average price in the central region was 249.29 million KRW, up 2.63% annually compared to early 2022. By item, the ultra-high price Namchon rose about 23%, from 1.5 billion KRW at the beginning of the year to 1.84 billion KRW at the end of the year. Due to low trading volume, the relative volatility was large. Among the declining items, the low-price Ipo fell the most, dropping about 27% from 45 million KRW at the beginning of the year to 33 million KRW at the end of the year. Listings have steadily increased, but buying demand has disappeared as a result.

In the Yeoju area, the decline in Geumgang, Blue Heron, and Solmoro, which had led the upward trend, was significant. Geumgang fell from 190 million KRW at the beginning of the year to 137 million KRW at the end of the year, Blue Heron from 205 million KRW to 160 million KRW, and Solmoro from 102 million KRW to 81 million KRW, respectively. Park Cheon-ju, team leader of Donga Membership Exchange, predicted, "With increased transaction inquiries in the new year, the early battle of wits between sellers and buyers will intensify."

In 2022, the average price in the southern region was 146.09 million KRW, down 8.05% from the beginning of the year. The main traded items experienced significant declines. Yongwon recorded 91 million KRW at the beginning of the year and 79 million KRW at the end of the year, and Tongdo Pine East also dropped from 90 million KRW to 73 million KRW. These memberships saw rapid price increases until the first half of last year, but as buyers became more cautious, selling offers also fell.

Dongbusan and A-One also saw prices drop by 30 to 50 million KRW compared to the beginning of the year as low-point buyers completed transactions. High-price memberships could not avoid the downward trend either. High-priced listings were not resolved, and transactions were made according to buyer offers. For example, Bora recorded 600 million KRW at the beginning of the year and 550 million KRW at the end of the year. Gyeongju Sinra, which had steadily maintained an upward trend around 155 million KRW at the beginning of the year, dropped to 130 million KRW at the end of the year.

Lee Yun-hee, team leader of Donga Membership Exchange, said, "Since the southern region membership market is a fierce battle of wits between sellers and buyers, inquiries about transaction timing are expected to increase."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.