Stock Prices Rise About 12% in the First Week of the New Year

Advantage Seen in Jeon-Wolse Funds and Mortgages Analysis

[Asia Economy Reporter Kwon Jaehee] KakaoBank has recorded a rise of over 10% just this year. Although the securities industry holds mixed views on KakaoBank, foreigners continue their net buying spree.

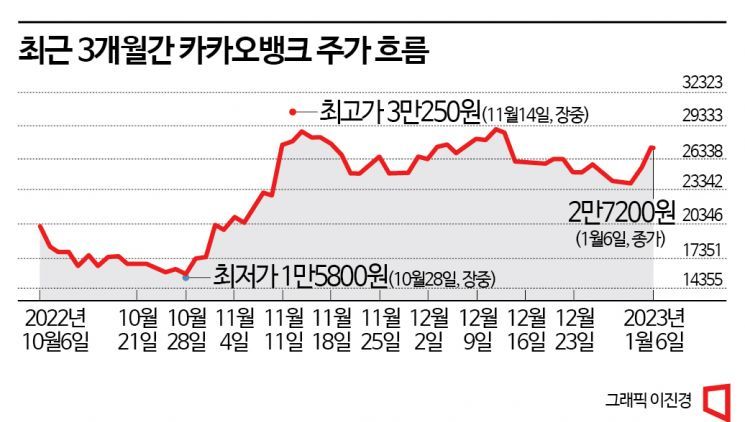

According to the Korea Exchange, on the 6th, KakaoBank closed at 27,200 KRW, down 0.37%. During the day, it rose as much as 1.09% but gave back the gains by the close. This is interpreted as a result of profit-taking after three consecutive days of gains. KakaoBank's stock price rose sharply by 5% on the 4th and 7% on the 5th. The stock price has increased about 12% in just four trading days since the new year.

Foreign demand is also favorable. Foreigners have been net buyers of KakaoBank for the past nine trading days (December 26 to January 6). During this period, foreigners purchased shares worth 61.534 billion KRW.

Last year, KakaoBank's stock price plunged about 59%, cutting its value in half. At the time of listing, it was regarded as a rising platform company with a market capitalization exceeding 40 trillion KRW, but the current market capitalization is around 13 trillion KRW, less than half of the initial listing value. The current stock price is also significantly below the IPO price of 39,000 KRW.

The securities industry's views on KakaoBank are divided. Daishin Securities downgraded its investment opinion to 'market perform,' citing slowed loan growth and weak fee income. 'Market perform' means a neutral stance, suggesting conservative action when the expected return over six months is within 10% of the market average. Researcher Park Hyejin of Daishin Securities analyzed, "The slowed loan growth and weak fee income, including platform revenue, are disappointing. A breakthrough for improving fee income currently seems distant."

In contrast, Shinhan Investment Corp. raised KakaoBank's target price by 16% from 25,000 KRW to 29,000 KRW, expecting it to benefit from eased real estate loan regulations and its sales of non-face-to-face mortgage loans. Researcher Eun Kyungwan of Shinhan Financial Investment analyzed, "Although cautious lending in unsecured loans will continue, KakaoBank is likely to gain an advantage over other banks in areas such as jeonse and monthly rent funds, mortgages, and loans to individual business owners, which it focuses on."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.