Rapid Recovery to Pre-Demerger Stock Levels

Notable Contrast with Plummeting OCI and Dongkuk Steel

Enhanced Shareholder Returns... Securing Growth in New Distribution Platforms and New Businesses

[Asia Economy Reporter Lee Seon-ae] Hyundai Department Store's stock price is rapidly recovering ahead of its planned transition to a holding company in March. Since the split decision in September last year, the stock price, which had been declining, has gradually drawn an upward curve, approaching the pre-split level.

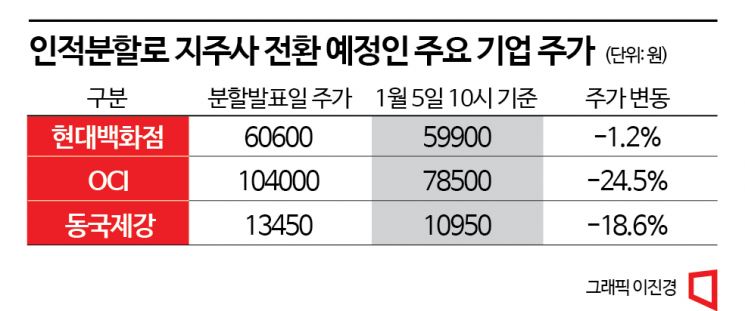

According to the Korea Exchange on the 5th, as of 10 a.m. that day, Hyundai Department Store's stock price reached 59,900 won, approaching the level before the announcement of the spin-off (closing price on September 16: 60,600 won).

After the announcement of the spin-off, the stock price initially plunged about 3% due to market concerns, then fell to 53,700 won amid unstable market conditions and the impact of the Daejeon outlet fire, but has since shown a steady stock price trend. On December 5 last year, it even recorded 61,400 won, higher than the pre-split price.

Earlier, on September 16 last year, Hyundai Department Store approved the agenda to spin off into an investment division (holding company) and a business division (operating company). A spin-off means that existing shareholders receive shares of the newly established company in proportion to their shareholding, contrasting with a physical split where the existing company owns shares of the new company.

What draws attention is that while companies that recently announced spin-offs have seen their stock prices plummet day by day, Hyundai Department Store has maintained a relatively favorable stock price trend. For example, OCI and Dongkuk Steel, which announced spin-offs, have seen their stock prices fall by 17-24% compared to the announcement date, whereas Hyundai Department Store has recovered to a level similar to before the split.

In the investment banking (IB) industry, unlike other companies whose spin-offs are seen as means for succession, Hyundai Department Store is free from such controversies, which has increased market expectations for the holding company transition. Additionally, active IR activities targeting not only domestic but also overseas institutions to dispel market misunderstandings have also played a role.

Jong-ryeol Park, a researcher at Heungkuk Securities, emphasized, "Hyundai Department Store's spin-off and holding company transition are proceeding smoothly as originally planned," adding, "Through the spin-off and holding company transition, changes different from the past may take place." Park also said, "Management activities focused on shareholder value will be carried out, and an active shareholder return policy through dividend expansion is expected," and "The holding company transition will enable strengthening shareholder return policies and securing growth potential through new distribution platforms (complex shopping malls, premium outlets) and new businesses (beauty, healthcare, logistics, IT infrastructure)."

The future stock price outlook is also positive. This is due to Hyundai Department Store's strong performance, as well as expectations for reduced deficits at its affiliate duty-free shops and improved performance at Zinus.

In this regard, Heungkuk Securities recently stated in a report, "Although the overall consumption environment this year is negative, the strength of the luxury goods market will be maintained," and analyzed, "With the duty-free shops turning profitable and the improving performance trend of Zinus, Hyundai Department Store's solid performance momentum will continue."

An IB industry official said, "Hyundai Department Store is demonstrating the competitiveness of its solid retail business with the successful opening of The Hyundai Seoul, the recent reopening of The Hyundai Daegu, and plans to open a complex shopping mall in Gwangju," adding, "Once the governance restructuring following the holding company transition is completed, investments to secure future growth engines will be in full swing."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.