Samsung Securities Presents 3 Investment Strategies

Bonds Attractive in H1, Stocks in H2

"Buy the Dip During Increased Volatility"

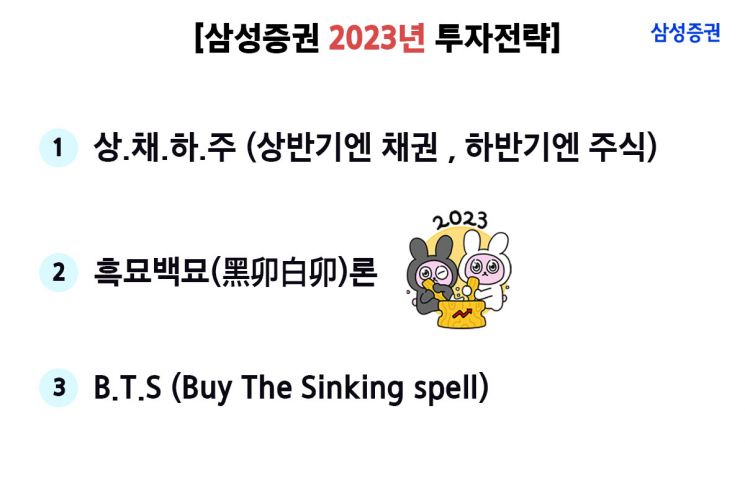

[Asia Economy Reporter Lee Seon-ae] Samsung Securities has presented three investment keywords for 2023: ‘Sangchae-Haju’, ‘Heukmyo-Baekmyo’, and ‘BTS’.

On the 5th, Samsung Securities explained, "This year, with significant economic uncertainty, the era of ‘high growth + low inflation’ is ending and the era of ‘low growth + high inflation’ is beginning, causing investors to face considerable challenges in their investment strategies. Investors need to actively pay attention to new investment opportunities beyond the familiar assets or methods."

The first keyword presented by Samsung Securities is ‘Sangchae-Haju’. It forecasts that bonds will be a more attractive investment tool in the first half of the year, while stocks will be more attractive in the second half. Samsung Securities suggested that bond investment is necessary in the first half from the perspectives of inflation and the economy. The absolute level of inflation is expected to remain high, and with the anticipated economic slowdown indicated by the decline in the US leading economic index and US consumer sentiment indicators, interest-bearing assets should definitely be included in portfolios. In particular, considering the high interest rates on medium- to long-term government bonds and the steep rise in the yield gap between government bonds and corporate bonds compared to past crises, corporate bonds with high credit ratings were identified as promising investment assets. For the second half, when expectations for a stock market rebound are high, it recommended increasing the proportion of stock investments. In an environment of high real interest rates and difficult financial conditions, value stocks are promising, especially those with strong financial structures and accompanied by earnings improvements, such as high-dividend and low-volatility stocks.

The second keyword is ‘Heukmyo-Baekmyo (黑卯白卯)’. It means that a practical investment strategy is necessary to generate additional returns. ‘Heukmyo-Baekmyo’ is a phrase from Chinese leader Deng Xiaoping emphasizing pragmatism in reform and opening-up, meaning that whether the cat is black or white, as long as it catches mice well, it is good. Considering that this year is the Year of the Rabbit, the homophone ‘Heukmyo-Baekmyo’ is used to mean ‘whether a black rabbit or a white rabbit, as long as it yields profits.’ This implies adopting a practical approach to seek additional returns. Given the ongoing uncertainty this year, investors should not stick to just one asset but utilize various investment opportunities.

Generally, investors tend to invest centered on preferred assets such as stocks or bonds. However, this year, investors should broaden their horizons beyond familiar assets to seize profit opportunities. For example, customers who have only invested in stocks should be able to include bonds in their portfolios, and customers seeking stable returns through bonds should be ready to reinvest in stocks when the stock market rebounds. It is necessary to expand the view not only to stocks and bonds but also to overseas or other alternative investment products.

The third keyword is ‘BTS (Buy The Sinking spell)’. It means starting to buy at low prices by taking advantage of market fluctuations. This year, as US tightening approaches its final stages, there is a possibility of a turning point in the financial market. If you are looking for stock investment opportunities, it is necessary to focus on sectors that have experienced significant declines and consider the market turning point as an investment opportunity.

Yoon Seok-mo, Head of Samsung Securities Research Center, said, "It is not too late to invest after confirming the peak of the US Federal Reserve’s (Fed) benchmark interest rate, corporate first-quarter earnings, and demand outlook," adding, "It is time to start investments based on these three investment strategies to secure returns."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.