Vietnam and Taiwan Manufacturing PMI Below 50 Indicating Contraction

Inventory Increase Signals Production Cuts... Economic Slowdown Likely to Accelerate

[Asia Economy Reporter Kwon Haeyoung] As the global economy enters a recession tunnel, the manufacturing sector in Asia, a global production base, is shrinking. Countries such as Vietnam and Taiwan, which have emerged as secondary production hubs due to conflicts between the U.S. and China, maintained high growth rates even as advanced economies fell into recession. However, with the weakening of the perceived economy, there is now an emergency regarding their future growth rate maintenance. This raises concerns that it could create a vicious cycle accelerating the global economic downturn caused by the slowdown in major economies such as the U.S., Europe, and China.

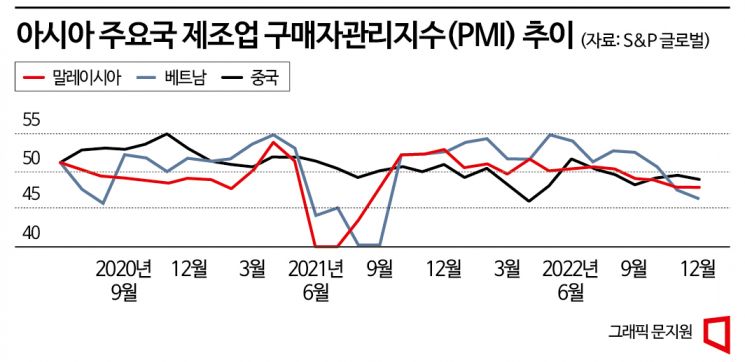

The Standard & Poor's (S&P) Global Purchasing Managers' Index (PMI) for Vietnam's manufacturing sector, which reflects the manufacturing conditions of various countries, recorded 46.4 in December last year. The PMI, surveyed among purchasing and HR managers of companies, uses 50 as the threshold: above 50 indicates expansion, below 50 indicates contraction. During the same period, Vietnam's PMI fell from 47.4 in the previous month to below 50, reaching its lowest level since September 2021. Malaysia's PMI in December last year also declined to 47.8 from 47.9 the previous month, marking the lowest level since August 2021. In Taiwan, although the PMI improved from 41.6 in November to 44.6 in December, it remained below 50 for seven consecutive months, failing to escape the contraction phase.

Not only in Southeast Asia but also in other countries such as South Korea and China, the manufacturing sector is cooling rapidly. China's Caixin Manufacturing PMI dropped to 49 last month after transitioning to 'With Corona' policy, continuing five consecutive months of contraction. South Korea's manufacturing PMI also fell to 48.2 last month, remaining below 50 for six consecutive months.

Since PMI is a leading indicator of manufacturing conditions, there are concerns that the contraction in the manufacturing sector across Asia could accelerate. Vietnam is a major production base hosting factories of global companies such as Samsung Electronics, while Taiwan hosts TSMC, Foxconn, Micron, and others. With major companies including Micron announcing production cuts due to increased inventory, the manufacturing outlook in this region appears increasingly bleak.

These concerns deepen especially because Vietnam and Malaysia were countries that maintained high growth rates even amid fears of recession as major economies declined last year. Vietnam's GDP growth rate is expected to reach 8.02% last year, the highest since 1997. It is anticipated to significantly exceed the previous year's growth rate (2.58%) and the initial target (6?6.5%) through domestic consumption and export activation. Malaysia is also expected to see growth rise from 3.1% in 2021 to 7.3% in 2022, according to the Asian Development Bank (ADB) forecast. This contrasts sharply with the expected slowdown in the U.S., Europe, and China. The Organisation for Economic Co-operation and Development (OECD) forecasts that the U.S. growth rate will fall from 5.9% in 2021 to 1.8% last year, Europe from 5.3% to 3.1%, and China from 8.1% to 3.2% during the same period.

With even countries that had withstood the recession of advanced economies now sounding warnings of contraction, gloomy forecasts that the global economy will fall into a 'recession' this year are gaining strength. As major countries, including the U.S., rush to tighten monetary policy to curb high inflation, the economies of key markets such as the U.S., China, and Europe have weakened, raising concerns that the resulting demand decline could lead to reduced exports and trade from Asian production bases. Andrew Harker, Director at S&P Global Market Intelligence, said, "In the short term, many companies will struggle due to suppressed demand," adding, "It will also become difficult to find new jobs until the market recovers." Earlier, Kristalina Georgieva, Managing Director of the International Monetary Fund (IMF), also warned that the global economy would face a tougher year due to the slowdown in these 'Big 3' economies.

Annabelle Fides, Director at S&P Global Market Intelligence, said, "Signals are being detected that both domestic and external demand are contracting simultaneously," adding, "Companies are mentioning demand declines in major countries such as Europe, mainland China, and the U.S., and corporate sentiment remains quite negative, with expectations of further manufacturing production cuts in the coming months. If global demand does not recover, the likelihood of this situation continuing increases."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.