[Asia Economy Reporter Ryu Tae-min] The popularity of Gangnam-area reconstruction apartments in court auctions, known as a 'leading indicator of housing prices,' seems to be waning. Due to consecutive interest rate hikes increasing the burden of financing and ongoing negative outlooks on the housing market, buyers have become more cautious in bidding. Although Apgujeong Hyundai, a representative reconstruction complex in Gangnam, has appeared in the auction market for the first time in over two years, there are concerns that it may fail to sell due to its high appraised price.

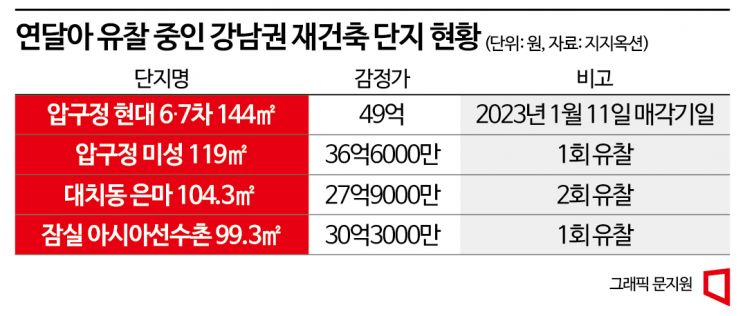

According to the Korean Court Auction Information website on the 4th, a 144㎡ (exclusive area) unit in Apgujeong-dong Hyundai 6th complex, Gangnam-gu, Seoul, was listed with an appraised price of 4.9 billion KRW. The sale date is set for the 11th of this month. This is the first time the complex has appeared in a court auction since October 22, 2020, over two years and three months ago.

Apgujeong Hyundai Apartments are considered the 'flagship apartments' in Apgujeong, the most prestigious neighborhood symbolizing Gangnam's wealth, and are a reconstruction project. In April 2021, a 245㎡ unit in this complex drew significant attention when it was sold for 8 billion KRW, nearly the price of an entire building. In fact, in the previous auction of this complex, nine bidders competed, and the property was sold without failure at a price 303.09 million KRW (14%) higher than the appraised value.

However, due to the impact of consecutive interest rate hikes, the housing market has slowed, and transactions have frozen, causing prices in this complex to continue declining. For example, the same 144㎡ unit in Apgujeong Hyundai 6th, which appeared in this auction, reached 4.9 billion KRW on February 19 last year but dropped to 4.65 billion KRW by September 30, seven months later.

Judging by the previous transaction prices, the appraised price for this auction is higher than the market price. This reversal appears because the appraisal was conducted in July last year, before the price decline was fully reflected, resulting in the appraised price exceeding the market price. Industry experts widely predict that this Apgujeong Hyundai apartment auction will likely fail to sell.

Apgujeong Hyundai is not the only property whose popularity has declined in court auctions. For example, the 104.3㎡ unit in Eonma Apartment, Daechi-dong, a representative reconstruction complex in Gangnam-gu, was put up for auction twice in November and December last year but failed to attract any bidders and was unsold both times. Similarly, a 118.6㎡ unit in Miseong Apartment, Apgujeong-dong, another reconstruction complex, was also unsold in an auction held in November last year due to lack of interest.

The reason for these failures is analyzed to be the excessively high appraised prices. The appraisals were conducted between May and July last year, when the decline in market prices was not yet severe. For instance, the appraised price of the Eonma Apartment unit is 2.79 billion KRW, but the lowest recent sale price for the same unit was 1.77 billion KRW in November last year, 1.02 billion KRW lower than the appraisal. The Miseong Apartment unit's appraised price is 3.66 billion KRW, which is 210 million KRW higher than the previous highest sale price of 3.45 billion KRW recorded in April 2021.

The reason appraised prices are set higher than buyers' perceptions is due to the nature of court auctions. Typically, appraisals for auctioned apartments are conducted six months to a year before the auction starts. Since these appraisals were done when concerns about housing prices peaking were emerging, the appraised prices feel even more inflated.

Senior Researcher Lee Joo-hyun of Gigi Auction explained, “This contrasts with a few years ago when reconstruction complex properties attracted many bidders and auction prices soared. With high interest rates and reconstruction projects slowing down, investment demand is cautious and hesitant to jump in recklessly.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.