Fundamental Improvement Needed for Wholesale Supply Obligation System

Small and Medium Altteolpon Operators Lack Sufficient Self-Investment Efforts

[Asia Economy Reporter Lim Hye-sun] Small and medium-sized MVNO operators, who have claimed to be the 'relative underdogs' compared to the three major mobile carriers, have reportedly earned hundreds of billions of won in profits over the past five years but have failed to properly invest in customer service or infrastructure.

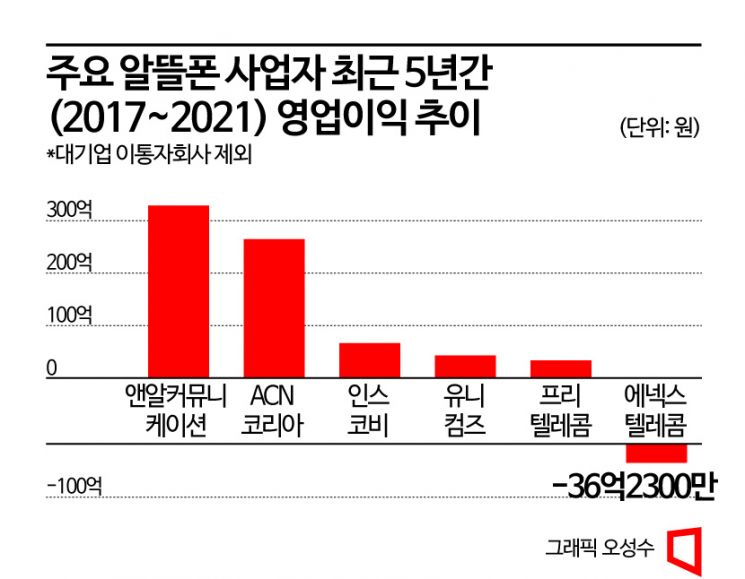

According to data submitted by the Ministry of Science and ICT to Rep. Yoon Young-chan of the Democratic Party on the 9th, among MVNO operators with a market share of 1% or more based on sales, only 7 out of 22 recorded losses in the past five years (2017?2021). Among small and medium MVNO operators, only Enex Telecom posted a loss. The rest all recorded profits in the hundreds of billions of won. During this period, operating profits for ANR Communication and ACN Korea were 32.879 billion won and 26.453 billion won, respectively.

As of November last year, the number of MVNO subscribers was 12,638,794, an increase of 2,060,856 this year. The MVNO market share, which was only 0.8% in its first year of introduction in 2011, rose to 16.4% last November. LG Uplus holds a market share of 20.7%. MVNO subscribers continue to increase, while users of the three major carriers continue to decline. At this rate, it is highly likely that MVNO subscribers will surpass LG Uplus subscribers within this year.

The problem is that although the number of MVNO users and profits are increasing, small and medium operators are not properly investing in infrastructure or even operating customer centers to protect users. Among MVNO operators, only one owns its own infrastructure. The rest are simple resellers. Customer complaints related to inadequate investment in user services, such as inability to connect to customer centers, are also increasing.

Within the telecommunications industry, there are calls to reconsider the current wholesale provision system. For 12 years, the government has provided policy support worth hundreds of billions of won annually by mandating wholesale provision, reducing wholesale fees, and exempting radio usage fees, all under the pretext of supporting the survival base of small and medium MVNOs. However, MVNO operators have not used the profits gained in this way for customer service or investment. It is suggested that only operators who make a certain level of infrastructure investment or user protection-related investment should be allowed to request wholesale provision, or that the government should not annually reduce wholesale fees for simple resellers without infrastructure investment, thereby encouraging MVNO operators to invest independently.

According to the financial statements of Pritelcom, an MVNO operator whose financials are publicly disclosed, sales in 2021 were 35.2 billion won, and gross profit excluding wholesale fees was 19.2 billion won. Operating profit was 4.4 billion won. The operating profit margin was 12.6%, higher than the single-digit operating profit margins of the three major carriers. Facility acquisition costs were only 88 million won, less than the acquisition cost of office supplies (1.58 billion won).

MVNO operators pay wholesale fees to telecom companies and lease networks to provide communication services. The wholesale provision obligation system, included in the Telecommunications Business Act in 2010, was originally scheduled to sunset after three years. However, it has been extended three times and finally expired in September last year. The National Assembly plans to discuss whether to extend it again or abolish the sunset system next month.

Rep. Yoon Young-chan said, "Based on the operational status survey of MVNO operators, it is necessary to change the system to focus on support for securing competitiveness and differentiation of MVNO operators." Measures must be taken to prepare for infrastructure investment and user protection by MVNO operators.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.