A red light is on at a traffic signal near an apartment in downtown Seoul. (Photo by Asia Economy DB)

A red light is on at a traffic signal near an apartment in downtown Seoul. (Photo by Asia Economy DB)

[Asia Economy Reporter Ryu Taemin] Amid a sharp downward trend with apartment prices falling at a record-breaking rate, small apartments in Seoul are declining more than three times faster than larger units. The market is turning away as the ‘young-chul’ demand that supported high prices disappears, along with the benefits for rental business operators. Additionally, price polarization is intensifying, with prices of older apartments targeted for reconstruction and remodeling falling faster than newly built ones.

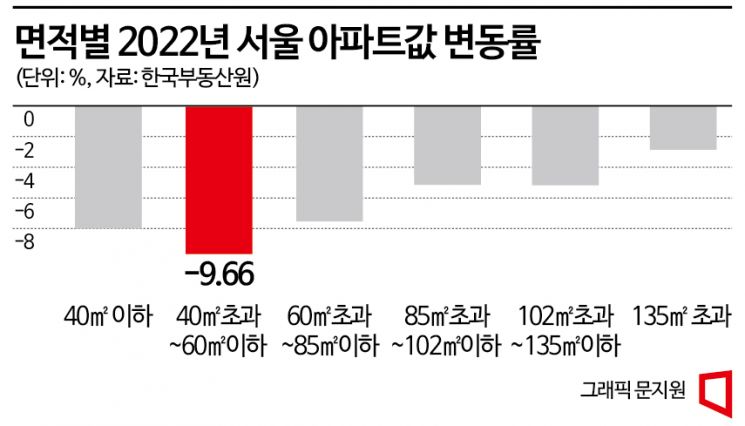

According to statistics from the Korea Real Estate Board on the 3rd, last year, the cumulative sales price of small-to-medium apartments in Seoul (exclusive area over 40㎡ up to 60㎡) dropped 9.66% compared to the previous year, marking the highest decline among all size categories. During the same period, small apartments (exclusive area 40㎡ or less) fell by 8%, ranking second. In contrast, extra-large apartments (exclusive area over 135㎡) saw the smallest decline at 2.86% compared to the previous year.

This trend was even more pronounced in the Gangbuk area. Looking at the entire area north of the Han River, small-to-medium apartments fell by 11.64%, and small apartments by 11.47% last year. Particularly in the northeastern region, which includes Nowon, Dobong, and Gangbuk districts, both small-to-medium (12.08%) and small apartments (13.26%) recorded the highest declines among Seoul’s regions. Meanwhile, extra-large apartments in the northeastern region only dropped 2.4% during the same period. This means the decline gap between the smallest small apartments and the largest extra-large apartments is sixfold.

This phenomenon is attributed to the collapse of the 2030 ‘young-chul’ generation concentrated in affordable small apartments. Since 2020, when the housing price surge began, young people dreaming of homeownership flocked to the Gangbuk area, where the price entry barrier was relatively low, causing small complex prices to skyrocket. However, recently, as the housing market slowed and consecutive interest rate hikes increased loan interest burdens, more sellers have been putting out ‘urgent sale’ listings at low prices.

Moreover, the disappearance of incentives for rental business operators is believed to have flooded the market with listings. The Moon Jae-in administration expanded benefits for rental business operators in its first year to alleviate tenants’ housing instability. However, the policy was later criticized for encouraging speculation by multi-homeowners and causing housing price increases, leading to reduced tax benefits and excluding apartments from new rental registration targets. Currently, long-term rental business registration is only possible for non-apartment multi-family households.

In fact, as urgent sale listings flood the market, prices of small apartments are falling while their transaction share is rising. According to the Ministry of Land, Infrastructure and Transport’s actual transaction price system, out of a total of 12,111 apartment transactions reported in Seoul last year, 6,506 transactions were for small apartments with an exclusive area of 60㎡ or less, accounting for 53.7% of the total. This is a 7.2 percentage point increase compared to the 46.5% share of small apartment transactions during the same period in 2021.

On the other hand, large-sized apartments appear to have relatively smaller price fluctuations as transactions are mainly driven by actual residents. Song Seunghyun, CEO of City and Economy, explained, "Unlike small apartments with many investors, large complexes mostly have actual residents. They are relatively less sensitive to interest rate changes and still have demand from people who intend to live there, so the price decline is more gradual than in small apartments."

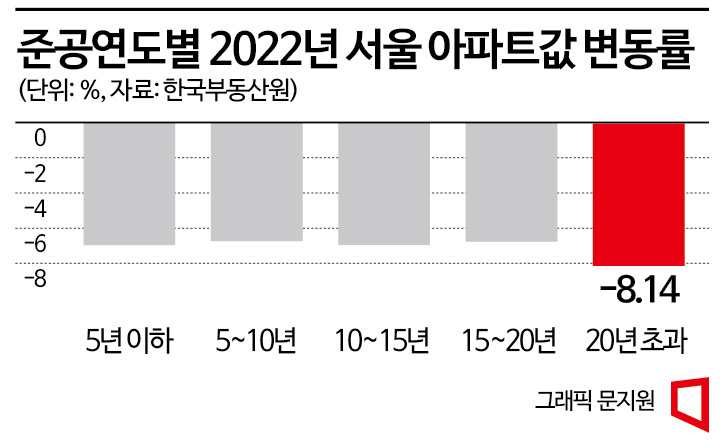

The decline also varies by year of completion. According to Korea Real Estate Board statistics, newly built complexes under five years old fell 6.96% last year, showing a smaller decline than older complexes over 20 years old (-8.14%). Particularly in the northeastern region, where investors flocked due to lower price entry barriers, complexes over 20 years old fell 11.05% last year alone.

This phenomenon is analyzed as being due to most newly built complexes having actual resident demand, while older apartments attract relatively more investment demand targeting reconstruction/remodeling and other redevelopment projects. CEO Song said, "Expectations for reconstruction are not high, and as the housing market turns downward, investment demand that surged during the upswing is withdrawing. Along with the impact of interest rate hikes, older apartments are being shunned."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.