Deposit like a savings plan and receive coins as a reward

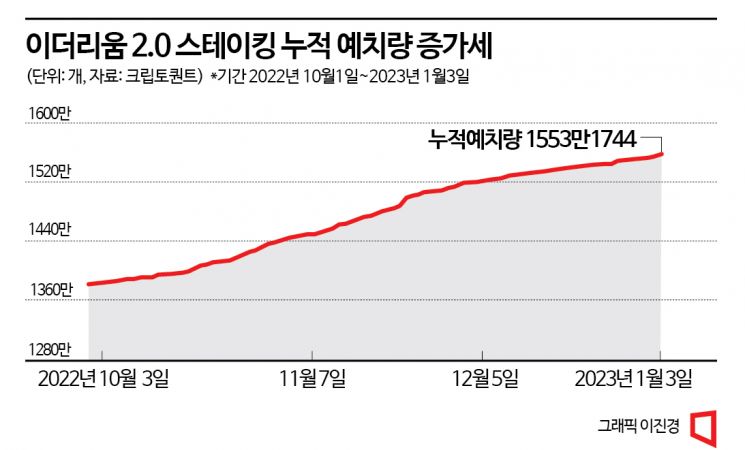

Ethereum 2.0 cumulative staking volume on the rise

[Asia Economy Reporter Lee Jung-yoon] Interest in staking has remained steady even during the crypto market winter. This is because it allows relatively stable returns even in highly volatile markets. Staking refers to the act of entrusting virtual assets to a blockchain network that uses the Proof of Stake (PoS) method and earning coins as a reward for participating in blockchain operation and verification. Ethereum is a representative blockchain network using the Proof of Stake method. Therefore, the most staking is done with Ethereum.

According to virtual asset data provider CryptoQuant on the 4th, the cumulative deposit amount of Ethereum 2.0 was recorded at 15,531,744 coins as of the previous day. The cumulative staking deposit amount has steadily increased even this year, when the virtual asset market faced a crypto winter. Compared to the cumulative deposit amount of 13,822,816 coins in early October last year, it increased by 12.36%, and compared to early January last year, it rose by 76.86%.

The continuous increase in the cumulative deposit amount of Ethereum 2.0 is because investors’ Ethereum staking guarantees steady returns. In the case of Ethereum 2.0 staking, a minimum of 32 Ethereum must be deposited into the blockchain network, but when conducted through virtual asset exchanges, it is possible to participate with a smaller amount by paying a certain fee.

Although virtual asset prices are declining due to tightening concerns and the FTX incident, staking allows investors to receive coins as rewards. This enables stable returns even during a coin downturn, attracting investors’ attention. Although the estimated reward rates vary by exchange, the annual estimated reward rate at domestic exchange Upbit is up to 4.5%, at Korbit it is 3.8%, and at Coinone it is 2.96%.

Ethereum originally adopted the Proof of Work (PoW) method, which obtains coins by mining through computer calculations to participate in the blockchain, but it switched to the Proof of Stake method in the 'Merge Upgrade' last September. Ethereum 2.0 staking began in November 2020, ahead of the Merge Upgrade as a preparatory step.

Because it can generate stable returns, investors continue to entrust Ethereum despite the drawback that early withdrawal is not possible. This is interpreted as a psychological move to earn staking income amid the downward trend in virtual asset prices. In the case of Ethereum 2.0 staking, Ethereum entrusted can be withdrawn through the Shanghai Upgrade, which is the next stage after the Merge Upgrade. The Shanghai Upgrade is scheduled for March this year.

Additionally, unlike Ethereum 2.0 staking, there are products where investors can set the period themselves or freely unstake. Upbit offers a product that allows free staking and unstaking for the virtual asset Cosmos. Coinone has launched a product where virtual asset Klaytn can be entrusted for a preset period.

An industry insider said, "Since there is no outlook for improvement in the crypto winter until the Shanghai Upgrade scheduled for March this year, Ethereum 2.0 staking is attracting attention," adding, "Staking, which is a concept similar to deposits and savings with relatively lower risk than trading, could be an alternative investment option."

In response to this staking demand, exchanges are expanding related services. Last month, Coinone launched an Ethereum 2.0 staking product. Any individual member can participate with a minimum of 0.01 Ethereum up to a maximum of 32 coins. Korbit, which only provided Ethereum 2.0 staking, started offering additional services for virtual assets Cardano, Kusama, Polkadot, Solana, and Tezos from last month.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)