High Interest Rates and Liquidity Deterioration Block Funding

Participation in IPOs and Proprietary Account Management Also Challenging

[Asia Economy Reporter Park So-yeon] Newly established private equity fund (PEF) management firms are facing a wave of bankruptcies. This is because their funding sources, such as mutual aid associations, securities firms, and capital companies, are suffering from a cash shortage, making it difficult to operate the funds normally.

According to the investment banking (IB) industry on the 4th, recently, funding for newly established and small-to-medium-sized PEFs has virtually stopped due to high interest rates and worsening liquidity, leading to an increase in PEFs considering closure. A senior official in the PEF industry said, "Currently, the only places with money are pension funds and banks, but their funds cannot reach newly established PEFs," adding, "The juniors who became independent after COVID-19 are in a very difficult situation."

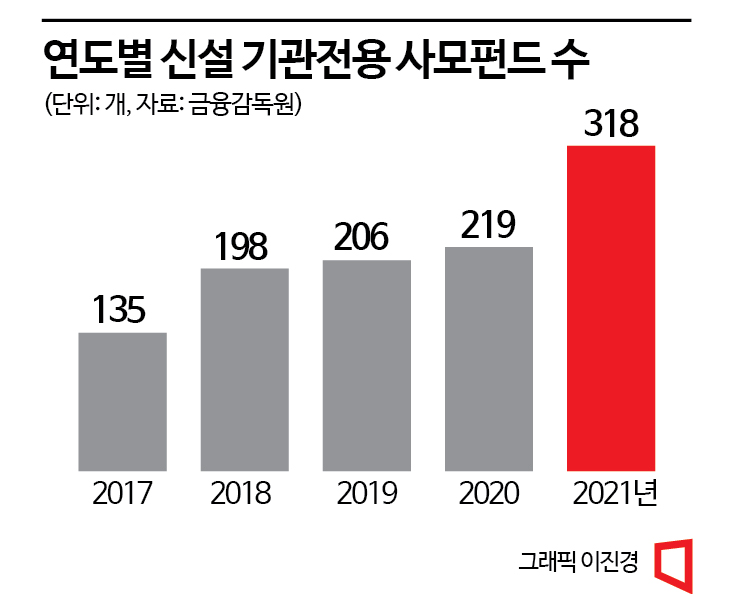

Except for mid-to-large-sized PEFs with solid portfolios and market reputations, the situation is mostly similar. After the COVID-19 pandemic, as funds flooded the market, newly established PEFs sprang up like mushrooms. However, the market has frozen to the extent that money does not flow to the investment destinations they propose.

A senior official from a mid-sized PEF said, "In the past, institutions would have sent letters from about ten places inquiring about the past management records of the operators who proposed projects during investment reviews, but this year, there has been not a single one." He added, "Since PEFs are at the forefront of the capital market, they usually feel the market sentiment the fastest, but institutions are in a situation where 'each has their own problems,' so there is no money to give elsewhere," and "It seems that a considerable number of management firms, especially newly established PEFs, will be liquidated."

Even trying to raise funds in the market is not easy. With concerns over interest rate hikes and fears of a recession overlapping, the cost of raising funds has exceeded 10%. An industry insider said, "In just one year, acquisition financing interest rates have skyrocketed from an average of the 3% range to the 10% range," adding, "Even borrowing from commercial banks at a high interest rate in the 10% range is considered a success, and people applaud."

Even borrowing at high interest rates in the 10% range is met with applause

As the market cools down, the polarization of private equity funds is expected to deepen for the time being. At one time, the private equity fund market was booming to the extent that premiums were attached to the sale of PEFs with rights to participate in initial public offerings (IPOs). This was because institutions were exempted from deposit requirements when participating in IPOs. Small-to-medium-sized funds could receive many shares through fictitious bids during IPO auctions. However, institutional changes such as penalties for fictitious bids and prohibitions on same-day sales have significantly narrowed the maneuvering room for small-to-medium-sized PEFs. Some management firms are trying to find a way out by shifting their focus to unlisted company investments or retirement pension businesses, but there are criticisms that these are only temporary measures.

A senior official in the IB industry said, "After the Lime scandal, institutions excluded small private equity funds from the league, so their sources of income were limited to IPO participation and proprietary account management," adding, "With the bubble bursting, IPOs have completely died, and proprietary account management has become a mess due to stock price declines, creating a serious situation." Another official expressed concern, saying, "Some management firms with high real estate exposure barely made it through the end of the year, but if the real estate market does not recover in the first quarter, the situation is expected to become severe."

There are also voices suggesting that for the private equity fund market, which boasts various strategies and flexible management as strengths, to continue growing, measures should be put in place to allow small firms to establish themselves.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.