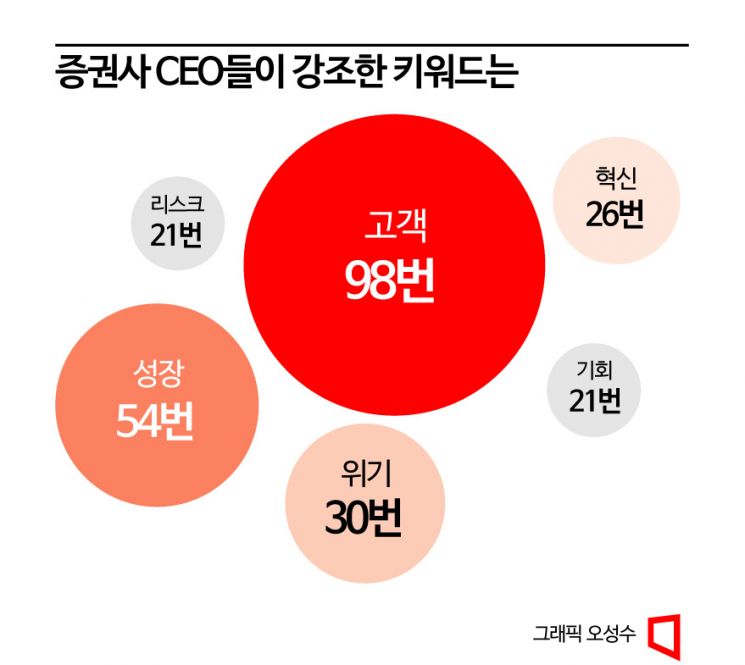

Analysis of New Year's Address Keywords by CEOs of 9 Securities Firms

Customer Mentioned 98 Times, Growth 54 Times, Crisis 30 Times

[Asia Economy Reporter Son Sunhee] Last year, the securities industry experienced a downturn, and the keyword for the new year is "growth amid crisis." As concerns about an economic recession grow stronger, the outlook for this year's stock market is also challenging. CEOs of major domestic securities firms have set a goal to return to basics, prioritize "customers," and seek opportunities for a new leap forward.

On the 3rd, Asia Economy analyzed the New Year's messages of CEOs from nine domestic securities firms (Mirae Asset, Korea Investment, NH Investment & Securities, Shinhan Investment, KB, Hana, Yuanta, IBK Investment & Securities, and Hi Investment & Securities) for the Year of the Rabbit (Gyemo Year), finding that the most frequently mentioned keyword was "customer" (98 times).

Jung Young-chae, CEO of NH Investment & Securities, emphasized customers 32 times in his New Year's message. Jung said, "After going through both good and difficult times consecutively, it seems necessary to reflect on what the unchanging 'essence and mission' were. The needs of customers make us exist. It is always the customers who gave us the opportunity to overcome crises and the strength to do so." He added, "No matter how favorable the market is, or how grand the services and solutions we promote are, survival and growth without customers are impossible from the start."

Following the COVID-19 pandemic, the domestic stock market in 2021 experienced a short-term boom to the extent that it was labeled an "asset bubble," but last year, the KOSPI plunged nearly 25%, riding a rollercoaster depending on economic conditions. Because of this, CEO Jung appears to have reiterated the customer-centric management philosophy by recalling the "essence." Kim Sang-tae, CEO of Shinhan Financial Investment, also pointed out that "the future of Shinhan Investment & Securities depends on whether we can improve the asset management business structure centered on customers," naming "customer" as the top priority value to focus on this year.

The stock market conditions for the new year are unfavorable. The fear of an economic recession is spreading due to high inflation continuing from last year and aggressive tightening by major countries such as the United States. The government and major institutions have issued gloomy forecasts that South Korea's economic growth rate this year will be around 1.5 to 1.6%.

Perhaps for this reason, securities CEOs mentioned "growth" (54 times) more than "crisis" (30 times), and "innovation" (26 times) more than "risk" (21 times) in their New Year's messages. This clearly reflects a determination to find growth opportunities even in difficult times.

Choi Hyun-man, Chairman of Mirae Asset Securities, ranked first in the industry, said in his New Year's message, "In 2023, a difficult business environment is expected to continue due to the contraction of investment sentiment caused by high market interest rates," but also noted, "There are greater growth opportunities visible amid the adjustment of global asset prices." Chairman Choi also emphasized "strengthening customer alliances" and urged, "Let's promote 'strategic innovation' that turns crises into opportunities."

Jung Il-moon, CEO of Korea Investment & Securities, expressed regret that "investment sentiment in the capital market has deteriorated along with the contracted real economy, and market liquidity has disappeared," but stressed, "The important thing is that we must be able to turn difficulties and crises that come regardless of our will into opportunities and transform them into growth momentum." He added, "The essence of our industry inevitably involves risk and creates value as a reward for it. Only by managing risks proactively, practically, and systematically can we operate a sustainable and stable business."

Securities CEOs cited "business diversification" as a way to overcome the crisis. KB Securities co-CEOs Park Jung-rim and Kim Sung-hyun emphasized, "We must strengthen the profit base through business portfolio diversification to remain unshaken despite internal and external environmental changes." Kang Sung-mook, newly appointed CEO of Hana Securities this year, stated upon his inauguration, "We will build a foundation for qualitative growth through diversification of revenue structures such as wealth management (WM) and investment banking (IB)."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.