Chevron Forecasts Record High Earnings Since Inception

US Refinery Company Announces Share Buybacks and Dividend Increase

US Administration Criticizes "Non-American Actions"

[Asia Economy Reporter Lee Ji-eun] Due to the surge in international oil prices caused by the Russia-Ukraine war, the United States' "oil giants" are estimated to have recorded record-breaking sales last year, leading to a performance bonanza. However, since these profits are primarily being used only for share buybacks, there is speculation that the U.S. government may apply pressure to recoup excess profits.

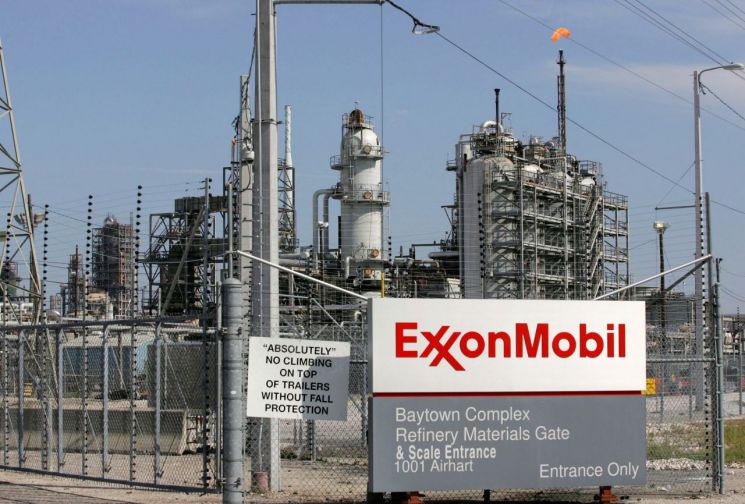

According to S&P Global Market Intelligence on the 1st (local time), ExxonMobil is estimated to have achieved sales exceeding $56 billion last year. Chevron is expected to have recorded sales of $37 billion last year, marking the highest performance since its founding.

Last year, oil companies earned enormous operating profits as crude oil prices soared due to the energy crisis triggered by the Ukraine war. West Texas Intermediate (WTI) crude oil prices surged to $123.70 per barrel intraday on March 8 and hovered around the $100 mark until June. As a result, Chevron's net profit in the third quarter of last year reached $11.23 billion, an 83% increase compared to the same period the previous year. ExxonMobil's net profit for the same period was estimated at $19.7 billion.

These oil companies decided to invest the massive profits gained from the oil price surge into share buybacks to boost their stock prices. ExxonMobil plans to repurchase $50 billion worth of shares by 2024 and raised shareholder dividends earlier last year. Chevron announced a $15 billion share buyback plan. Following these moves, the stock prices of oil companies have been rising continuously. ExxonMobil's stock price has increased by 80% since the end of 2021, closing at 109.2 on the 30th of last month. Chevron's stock price has risen by 53% since the end of 2021.

In this way, as high inflation exacerbates the suffering of ordinary people, the controversy over imposing so-called windfall taxes on oil companies that have earned excess profits is reigniting, as these companies focus solely on shareholder returns.

Amos Hochstein, the U.S. Senior Advisor for Energy Security, criticized in an interview with major foreign media last month that oil companies' focus solely on shareholder returns is an "un-American" act. He pointed out, "Companies need to make significant efforts to increase crude oil supply and lower prices." U.S. President Biden also expressed the opinion last October that windfall taxes should be imposed on oil companies.

The EU (European Union) already decided to impose windfall taxes last October to address energy price issues. In response, ExxonMobil filed a lawsuit with the EU General Court on the 28th of last month, arguing that the EU has no authority to recoup excess profits. Casey Norton, ExxonMobil spokesperson, countered, "Windfall taxes will ultimately discourage investment and increase dependence on imported energy."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.