‘Unconditional Discounts’ Fade,

‘Living Expense Discounts’ on the Rise

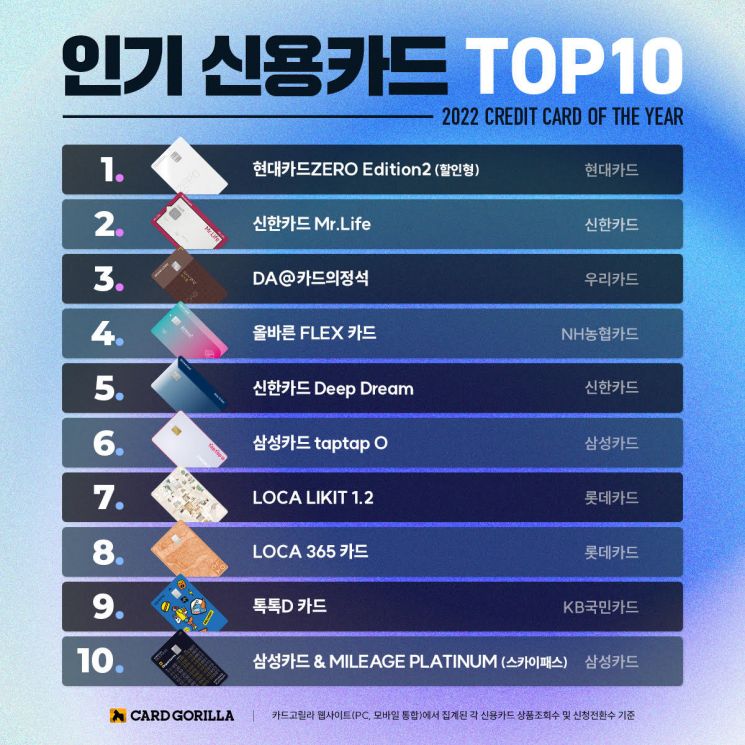

[Asia Economy, reporter Lee Minwoo] Hyundai Card ranked first in the credit card popularity rankings last year, maintaining its top position for a second consecutive year following the previous year. As the era of high inflation continues, discounts related to essential living expenses-such as various utility bills-have attracted more attention than unconditional merchant discounts.

On January 1, CardGorilla, the nation’s largest credit card platform, announced its annual rankings based on product page views and application conversion counts from January 1 to December 25 of last year. The "Hyundai Card Zero Edition 2 (Discount Type)" was named "Credit Card of the Year." After reclaiming the top spot in the annual rankings for the first time in five years, it maintained its number one position for a second straight year. Starting at number one in the first quarter, it consistently held the lead throughout the year. The card’s appeal lies in its 10,000 won annual fee, 0.7% statement discount at all merchants without performance conditions, and a 1.5% statement discount in essential living categories.

The second place went to "Shinhan Card Mr. Life." Its strength was highlighted by benefits for various living expenses, including monthly utility payments such as electricity, city gas, and apartment management fees, as well as discounts at convenience stores, hospitals, supermarkets, online shopping, and gas stations. Next in the top rankings were "Woori Card DA@Card’s Signature" (3rd), "NH Nonghyup Right Flex Card" (4th), and "Samsung Card TapTap O" (5th).

‘Unconditional Discounts’ Fade, ‘Living Expense Discounts’ Rise

Toward the end of the year, as the burden of living expenses increased due to high inflation and high oil prices, cards offering discounts for living expenses gained popularity. A prime example is the "Lotte Loca 365 Card," which provides monthly payment discounts for apartment management fees and utility bills, as well as benefits for transportation, telecommunications, insurance, streaming services, and up to three months of interest-free installments, ranking 8th overall.

In fact, among the top 20 cards, the number of cards offering unconditional discounts decreased from 11 last year to 8 this year. In contrast, cards specializing in fuel, such as "Shinhan Card Deep Oil" (19th), and those specializing in utility payments, such as "Lotte Loca 365 Card" and "Hana OneQ Daily Plus" (20th), newly entered the rankings. Meanwhile, Samsung Card had the most products in the top 20, with four cards. Shinhan Card, Woori Card, and Lotte Card each had three cards in the top 20.

Ko Seunghoon, CEO of CardGorilla, commented, "Last year could be summed up as the 'post-COVID' and 'high inflation' period. As major public utility fee hikes are scheduled, cards offering benefits for utility payments and living expenses are expected to remain popular next year. Cards with travel and outdoor-related benefits-such as airline mileage, airport lounge access, leisure, and sports-are also worth paying attention to."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.