'Split Listing' Small Shareholder Protection Measures

Determine Dividend Amount First and Confirm Dividend Shareholders

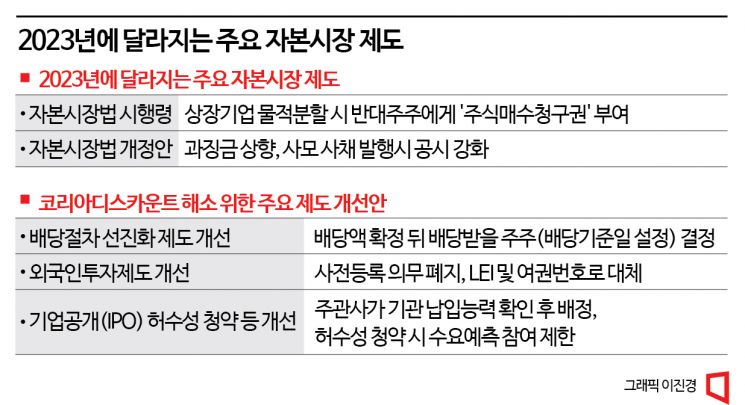

[Asia Economy Reporter Lee Seon-ae] In the new year, regulations protecting investors in the capital market will be strengthened. Attention is focused on whether the 10 million Donghak Ants (individual investors) can have their shareholder rights protected. Additionally, institutional improvements aimed at resolving the Korea Discount (the undervaluation phenomenon of the Korean stock market) will be pursued. There is interest in whether the domestic stock market can break free from undervaluation and take a step forward.

'Stock Purchase Request Right' for Minority Shareholders Opposing 'Split Listing'

From the new year, minority shareholders opposing physical division in the domestic stock market will be able to sell their shares to the listed company at the pre-division stock price. According to the Financial Services Commission and the financial investment industry on the 30th, the Enforcement Decree of the "Capital Market and Financial Investment Business Act" (hereinafter referred to as the Capital Market Act), which includes such content, was approved at the Cabinet meeting on the 20th.

Physical division refers to a corporate split method where a parent company separates a specific business unit to establish a separate corporation. LG Chem-LG Energy Solution and Kakao-Kakao Pay are representative cases. When a physical division occurs, the majority of the parent company's shareholders often suffer from the 'holding company discount,' which has always been controversial.

When exercising the stock purchase request right, the purchase price is determined through negotiation between the shareholder and the company. If no agreement is reached, the market price under capital regulations (the arithmetic average of the weighted average prices over the past 2 months, 1 month, and 1 week from the date of the board resolution) is applied. If negotiation still fails, the shareholder can request the court to determine the purchase price. If the physical division listing causes a decline in corporate value and many general shareholders oppose it, the physical division itself may become difficult. Listed companies can only proceed with physical division after preparing shareholder protection measures and persuading general shareholders.

With the enforcement of the revised stock purchase request right, the Financial Services Commission explained that the triple protection measures related to the listing of physical division subsidiaries have all been institutionalized. In addition to the stock purchase request right for dissenting shareholders, which was a legal amendment, two other measures?disclosure of restructuring plans and strengthened listing examination?have already been implemented. Since September 28, the listing examination for physical division has been strengthened. The financial authorities review the parent company's efforts to protect general shareholders when a physical division subsidiary is listed. The implementation of shareholder protection measures disclosed during the listing process and companies' responses to shareholder protection issues are subject to review. Furthermore, from October 18, the disclosure obligations of companies pursuing physical division have been strengthened. Companies must disclose restructuring plans, including the purpose of the physical division, expected effects, shareholder protection measures, and listing plans, through a "major event report."

A Financial Services Commission official said, "We have prepared various institutional improvement measures to resolve the issue of insufficient protection of general shareholders, which is one of the causes of the Korea Discount in the capital market," adding, "In the new year, we will continue to discover and promote new policy tasks to protect the rights and interests of general shareholders."

Sanctions on Phantom Subscriptions during IPOs

The financial authorities will reform the system in three major areas (dividends, foreign investor registration system, and IPO) to resolve the undervaluation of the domestic stock market. Accordingly, there is an expectation that dividend investment by individual investors will be further activated in the new year. The dividend system will be reformed so that when domestic companies decide on dividend amounts, investors can confirm this and then decide whether to invest. Additionally, the foreign investor registration system (IRC), introduced in 1992, will be abolished, and institutional improvements to reduce phantom subscriptions during IPOs will be pursued.

The core content of the dividend system reform is to change it to a method where the dividend amount is decided first, and investors can decide whether to invest accordingly, similar to other advanced countries (including amendments to the Commercial Act). Currently, domestic companies hold regular shareholders' meetings in mid to late March each year and decide the dividend amount for shareholders registered as of December 31 of the previous year (dividend record date). Since the shareholders entitled to dividends are determined first and then the dividend amount is decided, the predictability of dividends for investors is low, and dividend-related information is difficult to be reflected in stock prices. Kim So-young, Vice Chairman of the Financial Services Commission, said, "Global dividend fund managers downgrade Korean dividend stock investment as 'blind investment' and are reluctant to invest," adding, "If the system is improved, dividend investment will be activated, leading to an increase in corporate dividends and creating a virtuous cycle where long-term investment for dividend income expands."

The foreign investor registration system will be abolished. Instead of managing individual transaction information of foreigners in real time, it will switch to a method of post-investigation when necessary, such as for unfair trade investigations. Foreigners investing in domestic listed securities must first register their personal information with the financial authorities and input related information into the 'Foreign Investor Management System.' No major advanced countries operate such a registration system. The United States, Germany, Japan, and others operate 'foreign investment review systems' for companies in national security sectors. A Korea Exchange official explained, "It is desirable to replace it with internationally recognized passport numbers or Legal Entity Identifiers (LEI)."

Institutional improvements to reduce phantom subscriptions during IPOs will also be pursued. The lead manager will verify the payment ability of institutions before allocating public offering shares, and participation in demand forecasting will be restricted in cases of phantom subscriptions, among other improvements.

The final plan for the dividend system reform and abolition of the foreign investor registration system will be confirmed early next year after additional discussions. Since Morgan Stanley Capital International (MSCI), the world's largest index provider, cited unclear dividend systems and lack of information accessibility for foreign investors as reasons for not including Korea in the developed market index in June, the financial authorities expect these institutional improvements to contribute to the advancement of the domestic stock market.

Adjustment of '5% Rule' and Increased Penalties for Disclosure Violations by Listed Companies

Penalties for violations such as strengthening disclosure of private bond issuance are also expected to be increased. On the 20th, the Cabinet approved amendments to the Capital Market Act, including increased penalties and strengthened disclosure for private bond issuance. With the amendment, the penalty limit for violations of the large shareholding report (5% rule) will be adjusted from 1/100,000 to 1/10,000.

Investors holding 5% or more of shares must report and disclose this within 5 days so that general investors can be aware of it. Failure to do so results in penalties. The reporting includes ▲new reports when holding 5% or more (new report), ▲reports when the holding ratio changes by 1% or more thereafter (change report), and ▲reports when the purpose of holding or important matters change (modification report). The average penalty is expected to rise from about 350,000 KRW to about 15 million KRW.

The penalty standards applied when violating disclosure obligations such as business reports will also be adjusted. The existing Capital Market Act stipulates that the penalty limit for disclosure violations for listed companies is 10% of the average daily trading volume in the previous business year (up to 2 billion KRW), and for unlisted companies, it is a fixed amount of 2 billion KRW.

Under the amendment, the penalty limit for small listed companies will be raised to a minimum of 1 billion KRW (maintaining the 2 billion KRW upper limit). The penalty limit for unlisted companies will be lowered from 2 billion KRW to 1 billion KRW. The Capital Market Act amendment submitted by the Financial Services Commission to the National Assembly is scheduled to be enforced six months after promulgation upon the National Assembly's approval. A Financial Services Commission official said, "By minimizing blind spots in corporate disclosure and rationally adjusting penalty levels for disclosure violations, this will contribute to enhancing the soundness of the capital market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)