US-Korea 'Rollontis' Only FDA Approved

Technology Export Exceeds 1 Trillion Won

Only ABL Bio and LegoChem Bio Successful

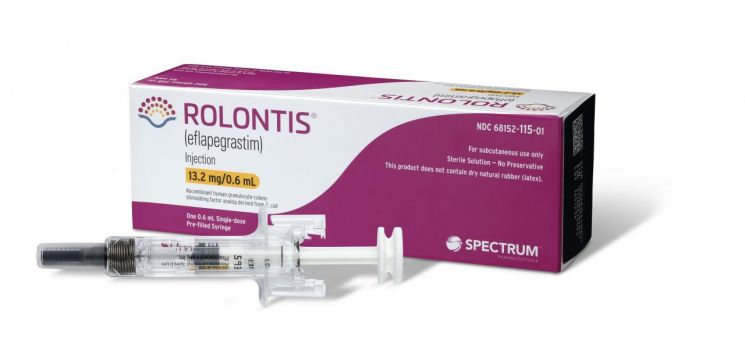

The only domestic new drug to successfully receive FDA approval this year is Hanmi Pharmaceutical's 'Rolontis' (Photo by Hanmi Pharmaceutical).

The only domestic new drug to successfully receive FDA approval this year is Hanmi Pharmaceutical's 'Rolontis' (Photo by Hanmi Pharmaceutical).

[Asia Economy Reporter Lee Chun-hee] While the domestic pharmaceutical and bio industries seemed to be actively expanding overseas amid the rapid growth triggered by the COVID-19 pandemic, their overseas expansion slowed down this year. Promising new drugs faced repeated setbacks at the threshold of approval by the U.S. Food and Drug Administration (FDA), a foothold for entering the world's largest market, the United States, and large-scale technology exports that could prove the technological capabilities of biotech companies also sharply declined.

According to the industry on the 31st, only one domestic new drug received FDA approval this year. Hanmi Pharmaceutical's neutropenia treatment 'Rolontis (Eflapegrastim)' succeeded in gaining approval after three attempts in September. At the beginning of the year, in addition to Rolontis, Hanmi Pharmaceutical's non-small cell lung cancer treatment 'Poziotinib,' GC Green Cross's blood fractionation product 'Aliglo (IVIG-SN 10%),' Mezzion's Fontan surgery patient treatment 'Udenafil,' and Hugel's botulinum toxin (BTX) 'Retivo' were expected to be approved within the year, but the number drastically decreased. Most approvals were canceled or significantly delayed due to the lack of on-site inspections by the FDA caused by the COVID-19 pandemic.

Hanmi Pharmaceutical aimed for consecutive FDA approvals within the year by challenging the approval of Poziotinib following Rolontis but faced disappointment. Earlier, the FDA Oncology Drug Advisory Committee (ODAC) issued a negative advisory, raising concerns, and ultimately, the FDA sent a Complete Response Letter (CRL) last month stating that approval is currently difficult. Due to questions about efficacy, Spectrum Pharmaceuticals, the U.S. partner for Rolontis and Poziotinib, announced that it would halt further development of Poziotinib and focus on the market launch of Rolontis.

The headquarters of the U.S. Food and Drug Administration (FDA) located in Maryland, USA

The headquarters of the U.S. Food and Drug Administration (FDA) located in Maryland, USA [Photo by Yonhap News]

However, the decrease in new drug approvals does not necessarily indicate a decline in the capabilities of the domestic pharmaceutical and bio industries. This is because the FDA approved only 35 new drugs this year, a 29% decrease from 50 last year, reflecting an overall sharp decline in FDA new drug approvals. Developers whose approvals were canceled this year plan to supplement the lacking on-site inspections and aim for approval again next year.

GC Green Cross received a CRL from the FDA for Aliglo in February. Although they submitted a Biologics License Application (BLA) in February last year, on-site inspections could not be conducted due to COVID-19. As a last resort, they underwent a remote evaluation of the Ochang production facility but ultimately received additional supplement requests. A company official explained, "We are coordinating the inspection schedule after receiving the CRL," adding, "Our goal is to undergo the inspection in the first half of next year and resubmit the BLA in the second half."

Hugel's BTX Retivo also received a CRL regarding manufacturing and quality control (CMC) from the FDA in March and has supplemented the related issues, resubmitting the application to the FDA in October. The review deadline under the Prescription Drug User Fee Act (PDUFA) is set for April 6 next year.

Meanwhile, new drug approvals continued domestically. SK Bioscience's domestic COVID-19 vaccine 'Skycovione' became the 35th new drug, making South Korea the third country to simultaneously possess a domestic COVID-19 vaccine and treatment. Subsequently, Daewoong Pharmaceutical also received approval for the diabetes treatment 'Enblo' last month, creating the 36th domestic new drug.

The technology export sector also experienced a cold wave. This year, domestic pharmaceutical and bio companies made a total of 15 technology export deals, with the total contract value excluding undisclosed amounts estimated at about 6.1 trillion KRW. This is roughly half compared to 34 deals and about 13 trillion KRW last year.

Only two companies succeeded in contracts exceeding 1 trillion KRW. Early in the year, ABL Bio raised expectations by signing a contract worth $1.06 billion (approximately 1.343 trillion KRW), including a $75 million upfront payment, with global big pharma Sanofi for the degenerative brain disease bispecific antibody treatment 'ABL301.'

However, no large contracts followed, and just before the year-end, LegoChem Biosciences broke the record by securing a contract worth about 1.6 trillion KRW. On the 23rd, LegoChem succeeded in a contract worth $1.2475 billion (approximately 1.5806 trillion KRW) with Amgen to transfer original antibody-drug conjugate (ADC) technology for five targets. Details such as the upfront payment amount were not disclosed due to contractual agreements.

Additionally, Novelty Nobility exported the autoimmune disease treatment candidate 'NN2802' to U.S. biotech Valenza Bio for a total of $733.25 million (approximately 929 billion KRW), including a $7 million upfront payment, and Kolon Life Science successfully licensed the osteoarthritis cell and gene therapy 'Invossa' to Singapore's Juniper Biologics for a total of $587.18 million (approximately 744 billion KRW), including a $12.18 million upfront payment.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)