Investor Trading Diverges Around Ex-Dividend Date

Major 'Big Hands' Avoiding Capital Gains Tax Engage in Net Buying

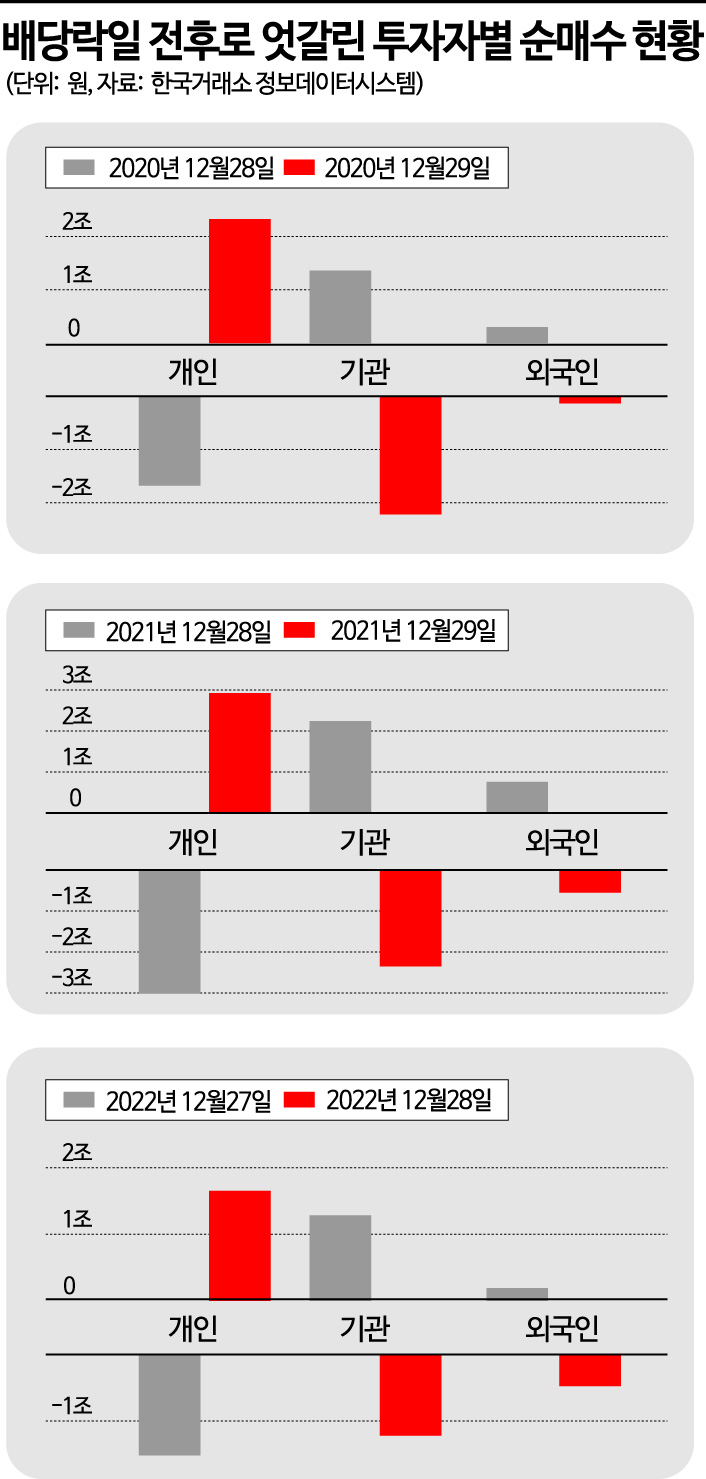

[Asia Economy Reporter Son Sunhee] Individual investors who sold stocks worth 1.5 trillion won only on the tax imposition reference date (the 27th) to avoid capital gains tax bought even larger volumes on the very next day, the 28th. However, the market closed lower on the 28th as institutional and foreign investors, who secured dividend rights, dumped stocks worth 1.8 trillion won.

According to the Korea Exchange, individual investors net purchased a total of 1.6508 trillion won worth of stocks (combined KOSPI, KOSDAQ, KONEX) in just one day on the 28th. This was the largest daily net purchase amount in about eight months since April 7 (1.7659 trillion won). They bought 1.0608 trillion won on the KOSPI and 590 billion won on the KOSDAQ. Individual investors who had net sold 1.5146 trillion won worth of stocks the previous day turned to massive buying in just one day. It is interpreted that so-called 'big hand' investors holding more than 1 billion won in stocks fluctuated between extremes to avoid capital gains tax imposition.

On that day, the stocks that individual investors bought on the KOSPI included Samsung Electronics, LG Energy Solution, POSCO Chemical, Kia, and Woori Financial Group (in order of net purchase transaction amount). Although they sold 158.6 billion won worth of Samsung Electronics the previous day, they recorded a net purchase of 292.3 billion won on this day. Next were LG Energy Solution (63.1 billion won), POSCO Chemical (63.0 billion won), Kia (57.6 billion won), and Woori Financial Group (52.9 billion won).

On the KOSDAQ, L&F had the largest net purchase amount at 83.8 billion won. This was followed by Celltrion Healthcare (48.2 billion won), EcoPro BM (47.2 billion won), EcoPro (37.7 billion won), and HLB (27.6 billion won).

However, despite the storm of net buying by individual investors, the market closed lower as institutional investors who secured dividend rights the previous day dumped large volumes. Institutional investors who bought 1.2846 trillion won worth of stocks on the day before the ex-dividend date (the 27th) sold 1.2191 trillion won worth on the 28th. Foreign investors also sold stocks worth 496.8 billion won, about 2.5 times the net purchase amount (190.1 billion won) from the previous day.

Accordingly, the KOSPI closed at 2,280.45, down 2.24% (52.34 points) from the previous day, and the KOSDAQ index closed at 692.37, down 1.68% (11.82 points). Although the Korea Exchange does not announce a separate cash dividend ex-rights index following global capital market trends, the market analyzed that the index decline was larger than estimated. Seo Sang-young, Head of Media Content Division (Managing Director) at Mirae Asset Securities, said, "The decline rate compared to the ex-dividend date is estimated to be around 1.5%, but the actual market index fell more than 2%," adding, "This is believed to be due to the impact of the ex-dividend date as well as the weakness of electric vehicle-related stocks in the U.S. stock market the previous day."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.