Clear Preference for Monthly Rent Emerges This Year

[Asia Economy Reporter Kim Hyemin] This year, the rental market showed a clear preference for monthly rent. Due to the impact of rising interest rates, a significant portion of jeonse demand shifted to monthly rent, with 'high-priced monthly rents' exceeding 1 million KRW per month accounting for nearly 20% of all monthly rent transactions. Ultra-high monthly rents exceeding 10 million KRW also noticeably increased.

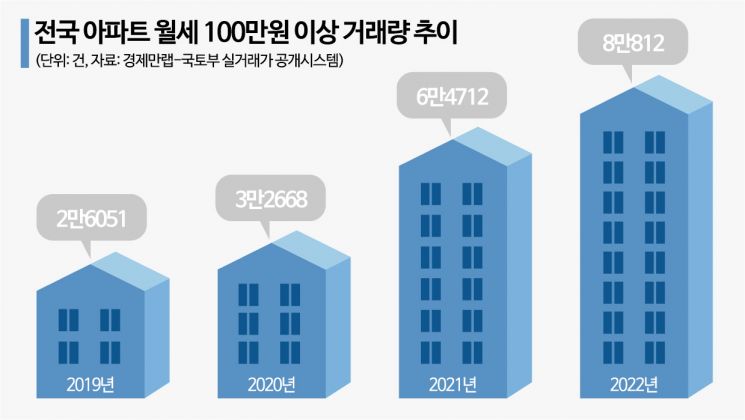

On the 25th, real estate information provider Economy Man Lab analyzed the Ministry of Land, Infrastructure and Transport's actual transaction price statistics system and found that the number of high-priced monthly rent contracts exceeding 1 million KRW nationwide in apartments this year was 80,812.

This is the first time that the volume of high-priced monthly rent transactions exceeding 1 million KRW has surpassed 80,000. Compared to last year (64,712 cases), it increased by 24.8%. Considering that the total monthly rent transactions this year were 415,336, 19.5% of all transactions were high-priced monthly rents. This means that 2 out of 10 contracts were for high-priced monthly rents where tenants paid landlords more than 1 million KRW per month.

By region, Seoul accounted for the largest share with 33,116 cases. Next were Gyeonggi with 27,663 cases and Incheon with 5,141 cases, together making up 80% of the total in the metropolitan area.

The number of 'ultra-high monthly rents' exceeding 10 million KRW is also on the rise. The volume of ultra-high monthly rent transactions, which was around 24 cases in 2020, increased to 91 cases last year and reached 138 cases this year. The apartment with the highest monthly rent this year was 'PH129' in Cheongdam-dong, Gangnam-gu, Seoul, with an exclusive area of 273.96㎡. In March, it was contracted with a jeonse deposit of 400 million KRW and a monthly rent of 40 million KRW.

The rapid increase in high-priced monthly rents is interpreted as the result of multiple factors. First, after the revision of the Lease Protection Act in July 2020, jeonse prices rose sharply. This year, with the rapid increase in jeonse loan interest rates, more tenants preferred monthly rent over jeonse. They judged that it was more advantageous to reduce the deposit and pay monthly rent than to repay the jeonse loan interest every month. Additionally, as the decline in sales prices became more evident, concerns about not being able to get the deposit back on time when signing a jeonse contract also fueled the 'conversion of jeonse to monthly rent.'

Because of this, despite the simultaneous decline in sales prices and jeonse prices, monthly rent prices have risen this year. According to the Korea Real Estate Board, from January to November this year, the nationwide apartment jeonse price change rate fell by 5.33%, while monthly rent prices rose by 1.97%. For example, in Jamsil-dong, Songpa-gu, Seoul, the 'Resentz' apartment with an exclusive area of 84㎡ was contracted last December with a deposit of 100 million KRW and a monthly rent of 2.43 million KRW, but this month, the same area was traded with a deposit of 100 million KRW and a monthly rent of 4 million KRW. The monthly rent increased by 1.57 million KRW in one year.

Hwang Hansol, a research fellow at Economy Man Lab, said, "Due to the increased burden of jeonse loan interest from the interest rate hike and concerns about jeonse deposit fraud, more tenants prefer monthly rent over jeonse, which appears to have led to an increase in high-priced monthly rent apartment transactions."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.