Martial Arts Report... "Top Beneficiary of US Semiconductor Restructuring is Taiwan, Not Korea"

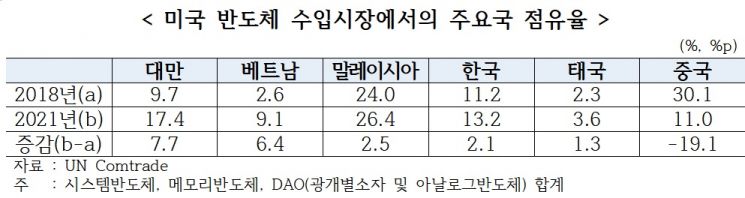

Taiwan 9.7→17.4%, Korea 11.2→13.2% Over 3 Years

"Korea's Exports and Imports Both Depend on China and Other Specific Countries... Diversification Urgent"

[Asia Economy Reporter Moon Chaeseok] It has been revealed that Korean semiconductors have been overtaken by Taiwan in the U.S. market. There are criticisms that Taiwan has capitalized on the opportunity to restructure the semiconductor supply chain in the U.S. much better than Korea. There are also growing calls to significantly raise the investment tax credit rate, which is only 8% for large corporations in Korea, to levels comparable to major countries such as 25% in the U.S., 15% in Taiwan, and 10% (for power semiconductors) in Japan.

On the 28th, the Korea International Trade Association’s International Trade and Commerce Research Institute released a report titled "Opportunities and Threats for Korea Arising from the Global Semiconductor Supply Chain Restructuring," containing these findings.

Looking at the market share trends of U.S. semiconductor imports over the three years from 2018 to last year, Taiwan’s share rose by 7.7 percentage points from 9.7% to 17.4%, while Korea’s increased by only 2 percentage points from 11.2% to 13.2%. Even Vietnam’s share rose by 6.5 percentage points from 2.6% to 9.1%. China’s share, however, plummeted by two-thirds from 30.1% to 11%. It is analyzed that the U.S. shifted its supply sources to Taiwan, Vietnam, and other allied countries as it restructured the semiconductor supply chain. Korea did not gain significant benefits from this shift.

A more serious problem for Korean semiconductors is the high dependence on specific countries for both exports and imports. Exports are overwhelmingly concentrated in China. As of last year, the shares were absolute: 32.5% for system semiconductors, 43.6% for memory semiconductors, 54.6% for equipment, and 44.7% for materials. This explains why memory semiconductor companies like Samsung Electronics and SK Hynix are anxious about the U.S. restrictions on importing Chinese equipment.

The rapid growth of the U.S. semiconductor market cannot be ignored either. According to the Korea International Trade Association, the U.S. accounted for 21.6% of global semiconductor demand last year. The association explained, "There is an increasing need to diversify exports away from China to other countries," adding, "The U.S. is an indispensable market not only for export diversification but also for targeting large semiconductor demand companies headquartered in the U.S."

Another chronic issue for Korean semiconductors is the low ratio of research and development (R&D) investment and high dependence on foreign equipment and materials. As of last year, Korea’s R&D ratio relative to semiconductor sales was 8.1%, lower than major countries such as the U.S. (16.9%), China (12.7%), Japan (11.5%), and Taiwan (11.3%). Regarding equipment, among 80 items with import values exceeding $10,000 (about 12.7 million KRW) last year, 30 items had import dependence on specific countries exceeding 90%, accounting for 37.5% of the total. This is three times higher than Taiwan’s 12.1%. The U.S., China, and Japan had no equipment items with over 90% dependence on a single country.

The status of material import dependence was not much different from that of equipment. Among 66 items, Korea had 12 items with import dependence exceeding 90%, recording 18.2%, the highest among major countries. This was similar to Taiwan (16.7%) but much higher than the U.S. (7.8%) and China and Japan (0%).

The Korea International Trade Association urged that even after legislative amendments by the political sector, the investment tax credit rate for facility investments, which is only 8% for large corporations, should be significantly raised to competitive levels. According to the association, the U.S. facility investment tax credit rate is 25%, and Taiwan’s is 15%. Last month, Taiwan proposed an "Industrial Innovation Act Amendment" to raise the R&D and facility investment tax credit rate to 25%. Korea only raised it by 2 percentage points from 6% to 8%.

Considering the current situation where the global economy is slowing down and the recent delay in Intel’s new server central processing unit (CPU) release has caused a sharp drop in memory semiconductor demand, leading to a rapid increase in inventory assets for Samsung Electronics and SK Hynix, the association advised that support levels must be significantly increased. The association emphasized, "There is a risk that Korea will fall behind in the global semiconductor competition, so the investment tax credit rate for facilities should be expanded to encourage semiconductor companies’ investments," adding, "As the semiconductor market deteriorates and major semiconductor companies reduce investments, more proactive tax support measures need to be devised."

The Korea International Trade Association views the current time, when the U.S. has started to check China, as a golden opportunity to enhance the presence of Korean semiconductors in the U.S. market. Researcher Do Wonbin of the association said, "Taiwan is expanding its influence in the U.S. market based on active government support," emphasizing, "Now is the right time to secure a foothold in the U.S. market as the U.S. is trying to curb China’s semiconductor rise." He urged, "In the short term, Korea should participate in the U.S.-led supply chain restructuring to enhance the stability of core equipment and material supply, and in the long term, it is important to secure an advanced technology 'super-gap' through R&D and facility investment support."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)