Average KOSPI Returns from 2001 to January 2020 at 1.4%

April and November Show Higher Average Gains Than January

[Asia Economy Reporter Park Hyungsoo] As the KOSPI and KOSDAQ indices have fallen sharply since the beginning of the year, many individual investors are expecting the 'January effect.' The January effect refers to the phenomenon where stock prices rise more in January than in other months, reflecting investors' optimistic outlook for the new year, even without any significant positive news. Individual investors have shown expectations of a rebound by focusing on buying semiconductor stocks such as Samsung Electronics and SK Hynix, which were the main causes of this year's index decline. However, experts advise caution, stating that the overall market is not optimistic enough to generate widespread warmth and recommend a wait-and-see approach for the time being.

According to the financial investment industry on the 27th, the KOSPI fell 6.3% since the beginning of this month. Although institutional investors recorded a net buying surplus of more than 1.1 trillion won, foreigners poured out net sales worth 1.3 trillion won. During the same period, the KOSDAQ index also dropped 4.8%. Despite the domestic stock market rebounding from October to November and raising expectations for a 'Santa rally,' the indices actually retreated.

Individual Investors Focused on Buying SK Hynix and Samsung Electronics in December

Researcher Kang Daeseok of Yuanta Securities explained, "The monetary tightening stance of the U.S. Federal Reserve (Fed), as well as the central banks of Europe and Japan, and concerns about an economic recession have led to a contraction in investor sentiment," adding, "Investor deposit funds, which reflect domestic individual investor sentiment, sharply declined from the 70 trillion won range at the beginning of the year to 45 trillion won."

Most individual investors suffered losses from stock investments this year. Investors whose account balances have shrunk tend to endure or employ an averaging down strategy in response to the declining market, hoping for the January effect. Since the beginning of this month, individuals have net bought SK Hynix and Samsung Electronics stocks worth 420 billion won and 310 billion won, respectively. It appears that individuals are absorbing the net sales volume poured out by foreigners. During the same period, foreigners recorded net sales of 500 billion won and 350 billion won, respectively. It is difficult to guess why individuals are buying despite no signs of improvement in the semiconductor industry. However, it is interpreted that this may be a 'dollar-cost averaging' strategy to lower the average purchase price as the prices of stocks already held fall, or a buying strategy hoping for a price rebound due to the January effect.

Optimists in the stock market expect that, given the large decline in the domestic stock market this year, a counter-buying force led by individual 'big players' who are free from the major shareholder stock transfer tax issue may flow in with the new year. This year, the KOSPI and KOSDAQ indices fell more than 20% and 30%, respectively. Researcher Roh Donggil of Shinhan Investment Corp. said, "The only time the global stock market annual returns fell consecutively was during the Information Technology (IT) bubble period," adding, "Considering the size of the bubble and the degree of central bank tightening, it is unlikely that the IT bubble will be repeated."

However, since external variables surrounding the domestic stock market are still full of negative factors and the bottom of the semiconductor industry, which has a large weight in the domestic stock market, has not been confirmed, there is a strong voice that observation rather than buying is necessary. Researcher Lee Kyungmin of Daishin Securities analyzed, "As the full-scale fourth-quarter earnings season begins, earnings estimates may be lowered," adding, "Short selling, which decreased at the end of the year, may increase again from the beginning of the year."

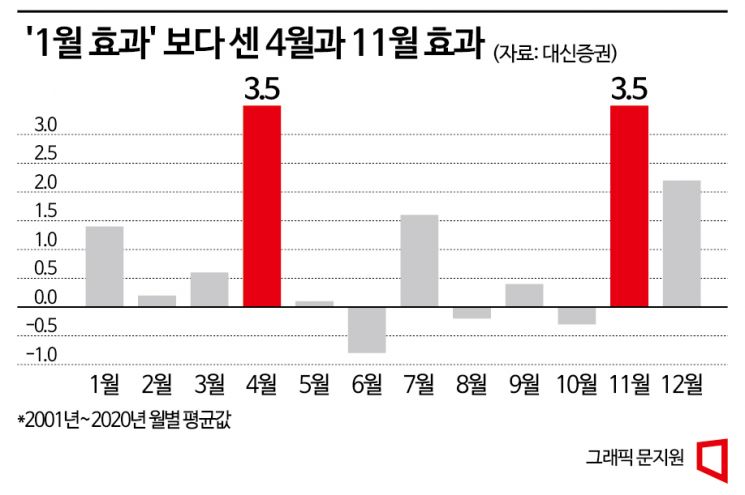

Analysis of the January index trends over the past 20 years shows that the January effect was practically insignificant. According to Daishin Securities' calculation of monthly KOSPI returns from 2001 to 2020, the average return in January was 1.4%. This was not relatively higher compared to other months. April and November had the highest average returns at 3.5%. Out of 20 Januarys, the KOSPI rose 12 times, which was similar to the average of all 12 months.

If Stock Prices Rise in January, KOSPI's Annual Success Rate is 80%

In the domestic stock market, if stock prices rise in January, the probability of the annual return finishing positive (+) is high. Extending the period from 1981 to 2020, a total of 40 years, when the KOSPI rose in January, the probability that the entire year’s KOSPI would rise was 80%. Conversely, when the index fell in January, the probability of recording a positive annual return was only 52.6%.

However, since corporate earnings are deteriorating due to rising interest rates, it is difficult to predict the KOSPI's annual performance based solely on the stock market results in January next year. Researcher Kim Byungyeon of NH Investment & Securities said, "January next year will be a period when the bottom of domestic corporate profits has not been confirmed," adding, "The profits of KOSPI-listed companies are expected to enter a declining phase for the next two to three quarters, with changes expected after the second half of next year." He continued, "The controlling shareholders' net profit of KOSPI-listed companies this year is expected to be around 138 trillion to 145 trillion won," adding, "This is a significant decrease compared to last year's 190 trillion won, returning to the average level of 2017-2018."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.