BOK, '2023 US Economic Outlook and Key Issues' Report

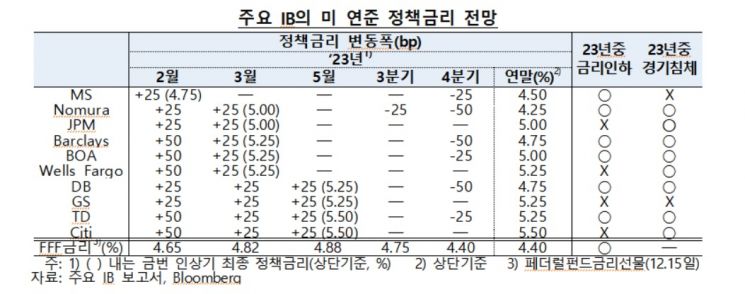

[Asia Economy Reporter Seo So-jung] Major global investment banks have suggested the possibility that the U.S. Federal Reserve (Fed) will raise policy interest rates until March or May next year, then begin cutting rates by the end of next year.

In a report titled "2023 U.S. Economic Outlook and Key Issues," published on the 25th in the Overseas Economic Focus, the Bank of Korea stated, "According to major investment banks, the cumulative effects of interest rate hikes will impact the economy with a time lag, and depending on the degree of economic and labor market contraction, the Fed may start cutting rates by the end of next year."

The global economy next year is expected to show growth significantly below the long-term average due to continued tightening policies by major countries, accompanying economic sluggishness, and a contraction in global trade. Advanced economies are expected to experience weakened growth centered on Europe, where concerns about energy supply instability are high, while emerging economies are likely to see relatively smaller slowdowns due to factors such as China's easing of zero-COVID policies and high commodity prices, potentially widening regional growth disparities.

Going forward, the global economy faces significant downside risks including financial instability due to major countries' financial tightening policies, sharp rises in food and energy prices caused by intensified geopolitical conflicts, and a deepening slowdown in China's economy.

In particular, the U.S. economy next year is expected to show sluggishness mainly in domestic demand as the effects of economic reopening diminish and the cumulative impact of tightening policies manifests with a lag, resulting in growth significantly below potential levels. Major forecasting institutions predict that the U.S. growth rate will fall below 1% due to high interest rates and inflation, with some expecting negative growth on an annual basis.

Quarterly, a sharp slowdown in growth is expected in the first and second quarters of next year, followed by some recovery in growth in the second half of the year as inflationary pressures ease and real income trends improve.

The Bank of Korea assessed the possibility of a U.S. recession, stating, "Considering the ripple effects of rapid monetary tightening, weakening growth momentum, and the high economic costs expected for restoring labor supply-demand balance, the likelihood of a U.S. economic recession has increased at present." It added, "Taking into account the U.S. labor market situation, private sector economic conditions, and the impact of easing inflation, the economy is expected to show a soft landing with a gradual slowdown."

Regarding U.S. inflation outlook for next year, the Bank of Korea said, "U.S. inflation is expected to continue its recent decline mainly in goods prices, but service sector prices will remain sticky due to concentrated consumer demand in services and wage increases, resulting in a gradual decline." It added, "The future inflation path will be greatly influenced by wage growth due to labor market imbalances, the normalization level of supply chains, and whether inflation expectations stabilize."

According to the report, many investment banks (IBs) expect that U.S. inflation will trend downward, leading to the end of interest rate hikes when the policy rate surpasses inflation at a level in the low 5% range. Most IBs anticipate that the Fed will halt rate hikes at a terminal rate (upper bound) of around 5 to 5.25% in March or May next year, and a significant number of them forecast that the Fed will cut rates by the end of next year.

The Bank of Korea stated, "The path of the Fed's policy rate next year will largely depend on the pace of inflation and labor market slowdown," adding, "The final policy rate is likely to be determined when inflation trends downward and falls below the policy rate (timing)." It further noted, "Regarding whether rate cuts will occur next year, the speed of labor market slowdown (and whether a recession occurs) is crucial." The Bank also cautioned, "Given that IB forecasts are heavily influenced by Fed policy decisions, it is important to be aware that future Fed policy stance and outlook could lead to significant changes."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.