[Asia Economy Sejong=Reporter Dongwoo Lee] The government will begin full-scale management of key minerals for electric vehicle batteries, such as cobalt and lithium, starting next year. The Public Procurement Service will initiate the unification of stockpiling for nine types of rare metals it holds, aiming to secure more than 90% of the target stockpile volume by 2027.

According to the Korea Mine Reclamation Corporation’s “Mid- to Long-term Management Goals (2023?2027),” obtained from the corporation on the 26th, the corporation plans to first secure the entire amount of cobalt (126 tons) and lithium (585 tons) among the nine rare metals held by the Public Procurement Service under the Ministry of Economy and Finance starting next year. The Ministry of Trade, Industry and Energy has allocated 28.3 billion KRW in the government budget to expand rare metal stockpiles and 9 billion KRW for the cobalt transfer process.

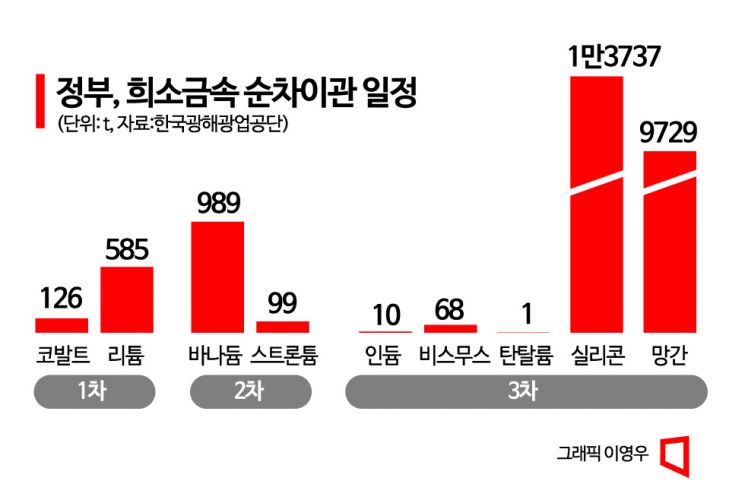

Rare metals refer to metals that are either scarce in quantity or difficult to extract, unlike common metals such as iron or copper that are produced in large quantities, but have high demand. They are mainly used as core materials in secondary batteries, new industries, and low-carbon sectors, and their importance is gradually increasing. Currently, the nine rare metals held by the Public Procurement Service total about 25,000 tons, including cobalt, lithium, silicon (13,737 tons), vanadium (989 tons), strontium (99 tons), manganese (9,729 tons), indium (10 tons), bismuth (68 tons), and tantalum (1 ton). The corporation plans to complete the transfer of cobalt and lithium by 2024, then sequentially transfer vanadium and strontium in the second phase from 2025 to 2027, followed by the remaining five metals in the third phase.

The acceleration of the transfer process is driven by the increasing importance of minerals used in electric vehicle batteries amid energy transition and carbon neutrality efforts, leading the government to unify and intensively manage stockpiles. According to the Korea International Trade Association, imports of lithium hydroxide surged by a staggering 477.3% to 3.259 billion USD from the beginning of this year through last month compared to the previous year. During the same period, cobalt oxide imports also increased by 11.0% to 183 million USD.

Along with unifying rare metal stockpiles, the stockpile duration (quantity) will also be expanded. The corporation plans to additionally secure cobalt (65 days), lithium (19 days), and tungsten (40 days) by 2024. As of this month, the stockpile durations for cobalt and lithium held by the Public Procurement Service are known to be about 40 days and 12 days, respectively. The corporation envisions expanding the rare metal stockpile target (100 days) from 24.9 days this year to 47.19 days next year, and 90.47 days by 2027.

The challenge lies in securing the related budget. The corporation estimates that the budget required to transfer all nine types of rare metals from the Public Procurement Service ranges from 80 billion to 100 billion KRW. Assuming an annual budget of 9 billion KRW for the transfer next year is secured every year, it is calculated that about 10 years will be needed to transfer all the stockpiles.

Securing additional stockpile bases is also a task. The only dedicated rare metal stockpile base in Gunsan, Korea, has a total land area of 132,229 square meters with five warehouse buildings, but its storage rate is about 97%. The corporation is conducting a preliminary feasibility study to secure a new site in Gunsan for the “Establishment of a Dedicated Stockpile Base for Key Minerals.” A corporation official said, “To ensure a stable supply chain of key minerals, we will accelerate the unification of rare metals starting next year. Following last year’s addition of nickel, lithium, and cobalt, manganese, zinc, and bituminous coal have been newly added to the supply stabilization index to prepare for the energy industry structure transition.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.