Loan delinquency begins, tax delinquent borrowers' loans classified as non-performing risk loans

Hidden under financial support until now, but will be revealed from next year

Vulnerable borrowers' non-performing risk rate rises close to 20%

[Asia Economy Reporter Sim Nayoung] Loans to self-employed individuals have exceeded 1,000 trillion won. Amid the failure of self-employed income to recover since COVID-19, the growth rate of loans to the self-employed has rapidly increased by more than 10%. The hidden non-performing loans, overshadowed by financial support measures for the self-employed including interest deferrals and maturity extensions, are expected to reveal themselves starting next year. It is estimated that the scale of non-performing loan risk for the self-employed will reach about 40 trillion won due to rising interest rates, economic downturn, and the expiration of financial support policies.

According to the Bank of Korea's Financial Stability Report on the 22nd, loans to the self-employed amounted to 1,014.2 trillion won as of the end of the third quarter this year. This is a 14.3% increase compared to the same period last year. Loans to the self-employed are rapidly increasing mainly among vulnerable borrowers (18.7%) and non-bank financial institutions (28.7%). By industry, the real estate sector accounts for a high proportion of loans (32.7%).

When calculating the non-performing loan risk rate of self-employed loans, despite the economic contraction after COVID-19, the risk rate did not rise but rather declined. The non-performing loan risk rate refers to the proportion of loans to borrowers who have started delinquency or have tax arrears, which are considered high-risk loans, within the total loans to the self-employed.

Compared to the end of 2019, the non-performing loan risk rate for vulnerable borrowers as of the third quarter of 2022 fell by 6.5 percentage points (from 17.8% to 11.3%). For non-vulnerable borrowers, it also decreased by 0.1 percentage points (from 0.7% to 0.6%). The report explained, "This phenomenon was clearly observed among vulnerable borrowers, non-bank financial institutions, and face-to-face industries, which is because financial support measures were focused on vulnerable sectors during the COVID-19 crisis."

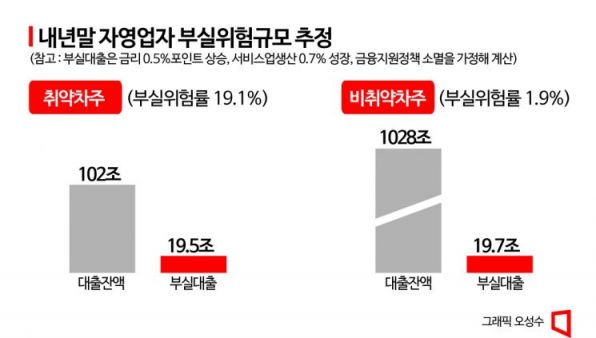

It is predicted that the loan situation for the self-employed will deteriorate sharply from the end of next year. Assuming a 0.5 percentage point increase in loan interest rates and a slowdown in sales recovery due to economic downturn (assuming 0.7% growth in service industry production), and with the expiration of financial support policies, the non-performing loan risk rate for vulnerable borrowers could jump to as high as 19.1%. For non-vulnerable borrowers, the risk rate could rise up to 1.9%.

The scale of non-performing loans will also increase. Assuming that loans to the self-employed continue to grow at the pre-COVID-19 trend, the estimated non-performing loan risk scale for the self-employed by the end of next year is up to 19.5 trillion won for vulnerable borrowers and up to 19.7 trillion won for non-vulnerable borrowers. This means that about 40 trillion won of self-employed loans could become unpayable.

As measures to reduce the non-performing loan risk for the self-employed, the report suggested "promoting debt restructuring for vulnerable borrowers, gradually ending financial support measures for normal borrowers, and converting lump-sum maturity loans into installment repayment loans." It also stated that "financial institutions should expand the size of loan loss provisions in preparation for an increase in non-performing loans among the self-employed."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.