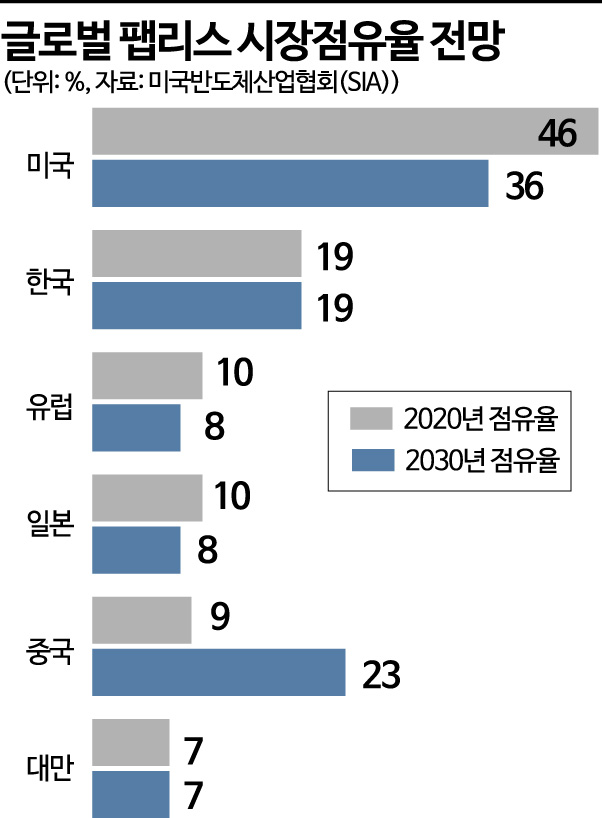

US Global Market Share 36%

China's Advanced Technology Rapidly Closing In... 23% by 2030

Korea 19%, World No. 2 at Risk

[Asia Economy Reporter Han Ye-ju] As fabless semiconductor design, dominated by the United States, emerges as the core of the system semiconductor market, China is rapidly catching up and asserting its presence. While South Korea's semiconductor industry has focused solely on maintaining its memory sector, China is pursuing a "semiconductor rise" through technological advancement, raising concerns that South Korea may lose its foothold in the fabless sector.

According to the Semiconductor Industry Association (SIA) in the U.S. on the 21st, China's global market share in semiconductor design is expected to grow to 23% by 2030, following the U.S. at 36%. Considering that China's market share was only 5% in 2015, this represents a remarkable growth rate. In contrast, South Korea, which held a 19% share in 2020, is projected to remain at 19% in 2030, failing to break the 20% barrier. This means that China could surpass South Korea to become the world's second-largest player in the fabless sector by 2030.

China's semiconductor design has also shown notable achievements in research recently. This year, at the International Solid-State Circuits Conference (ISSCC), known as the "Semiconductor Design Olympics," the number of Chinese papers accepted surpassed South Korea's for the first time. South Korea had 32 papers accepted at this conference, ranking third after China with 59 and the U.S. with 42. This is the first time since the ISSCC began that China has had more accepted papers than South Korea.

The number of system semiconductor design patent registrations by Chinese companies domestically also surged more than sixfold from 2,154 in 2016 to 13,087 last year. The number of Chinese fabless companies reached 2,810, more than doubling from 1,362 in 2016 over five years. Currently, South Korea has only about 120 fabless companies, most of which are small and medium-sized enterprises, resulting in very slow growth in the domestic fabless industry. An analysis of the operating profits of 17 major listed fabless companies in South Korea for the first three quarters of this year found that five companies are operating at a loss, meaning about one in three is unprofitable. Only five companies?LX Semicon, Jeju Semiconductor, Telechips, Above Semiconductor, and AD Technology?exceeded 100 billion KRW in cumulative sales for the first three quarters. LX Semicon is the only company with sales exceeding 1 trillion KRW. Among the world's top 50 fabless companies, only LX Semicon is South Korean.

Experts say the biggest weakness of South Korean fabless companies is the absolute shortage of specialized design personnel. There is a lack of graduates in the relevant fields, and since graduates prefer large corporations, the inflow of talented personnel into fabless companies, mostly small and medium-sized enterprises, has been cut off. Small fabless companies also face structural limitations, relying on foreign companies for design intellectual property (IP) and design tools necessary for semiconductor design. This indicates a lack of a foundation to independently develop next-generation semiconductors.

Professor Lee Hyuk-jae of the Department of Electrical and Computer Engineering at Seoul National University said, "The biggest problem in the domestic fabless industry is the shortage of personnel, and it is also necessary to expand the scale of the fabless industry itself," adding, "Since fabless companies are mostly small and medium-sized enterprises, government support to activate mergers and acquisitions (M&A) would be beneficial."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)