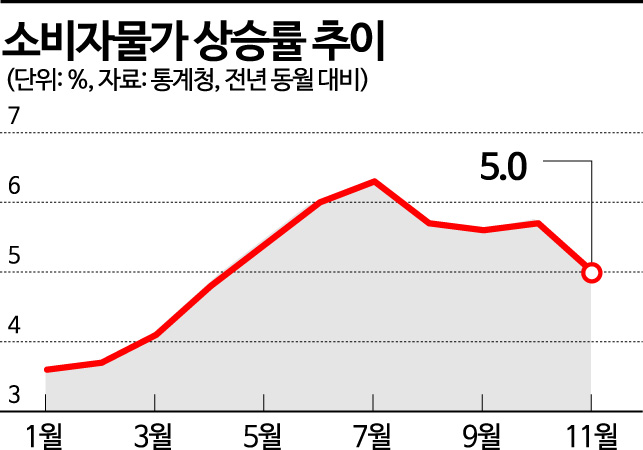

Growth Rate Peaks in July Then Slows Down

Core Inflation Rate Rises for Four Consecutive Months

Bank of Korea Governor Lee Chang-yong is explaining the "2022 Second Half Inflation Target Operation Status" at the Bank of Korea press room in Jung-gu, Seoul, on the 20th. Photo by Joint Press Corps

Bank of Korea Governor Lee Chang-yong is explaining the "2022 Second Half Inflation Target Operation Status" at the Bank of Korea press room in Jung-gu, Seoul, on the 20th. Photo by Joint Press Corps

[Asia Economy Reporter Seo So-jeong] The Bank of Korea indicated that it will continue its interest rate hike policy, forecasting that consumer prices will maintain an increase rate of around 5% for the time being due to high international raw material prices and other factors. Consumer prices rose by 5.1% year-on-year from January to November this year, significantly exceeding the price stability target (2%). This level is higher than during the 2008 financial crisis (4.7%) and is the highest since 1998 (7.5%). In particular, core inflation, which reflects the underlying trend of prices, has increased its rate of rise for four consecutive months, raising concerns about the prolonged high inflation situation.

On the 20th, the Bank of Korea released a price outlook in its "Price Stability Target Operation Status Review Report." The Bank stated, "Consumer prices will continue to rise at a rate of around 5% for the time being. However, as the increase in petroleum prices narrows and downward pressure on the domestic and international economy grows, the upward trend is expected to gradually slow."

The consumer price inflation rate peaked at 6.3% in July, then eased somewhat to 5.7% in August, 5.6% in September, 5.7% in October, and 5.0% in November. However, the core inflation rate (excluding food and energy) has continued to rise, from 3.9% in July to 4.0% in August, 4.1% in September, 4.2% in October, and 4.3% in November. The annual core inflation rate for this year is expected to reach the level seen during the price surge in 2008 (3.6%). The rise in core inflation, which excludes agricultural products and petroleum affected by external factors such as seasons, indicates that high inflation may continue.

Especially, if not for government intervention, the rise in core inflation would be even greater. The core inflation rate excluding administered prices?which are price indices for items directly or indirectly influenced by the government?rose from 4.7% in July to 4.8% in August and September, and further to 5.1% in October. Administered prices include 46 items such as electricity, city gas, water charges, and communication fees.

The Bank of Korea explained, "There is high uncertainty regarding future price paths related to oil prices and exchange rate trends, the degree of public utility fee increases such as electricity charges, and the extent of domestic and international economic slowdown. In the short term, upward pressure from public utility fee hikes and downward pressure from falling international oil prices are likely to largely offset each other."

Bank of Korea Governor Lee Chang-yong stated, "Consumer prices will continue to rise at around 5% for the time being, but as downward pressure on the domestic and international economy increases, the upward trend will gradually slow, showing a pattern of high in the first half and low in the second half next year, and then gradually decline. However, regarding the speed of this slowdown, there is significant uncertainty surrounding future domestic and international growth and oil price trends." He emphasized, "Even if the inflation rate gradually decreases next year following a high-first-half, low-second-half pattern, it is expected to remain at a high level above the 2% inflation target, so it is necessary to continue monetary policy focused on price stability."

Meanwhile, in last month's revised economic outlook, the Bank of Korea projected next year's consumer price inflation rate at 3.6%. Specifically, it is expected to decline to 4.2% in the first half and 3.1% in the second half of next year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.