Power Struggle Between Government, Ruling Party, and Opposition Over Major Shareholder Criteria for Capital Gains Tax

Individual Investors Waiting on Sidelines May Sell on 26th-27th... Over 8 Trillion Won Sold at End of Last Year

[Asia Economy Reporter Lee Seon-ae] It is expected that high-net-worth individuals will unload 'avoidance volumes' worth trillions of won to evade year-end capital gains tax on stocks. The financial investment income tax is set to be postponed for two years. However, the government and opposition parties have failed to reach a consensus on the major shareholder threshold for the 20% capital gains tax, remaining at an impasse. As 'big players' among individual investors watch the direction of the capital gains tax, there is a possibility that they will flood the market with sell orders ahead of the year-end closing, which is likely to increase stock market volatility.

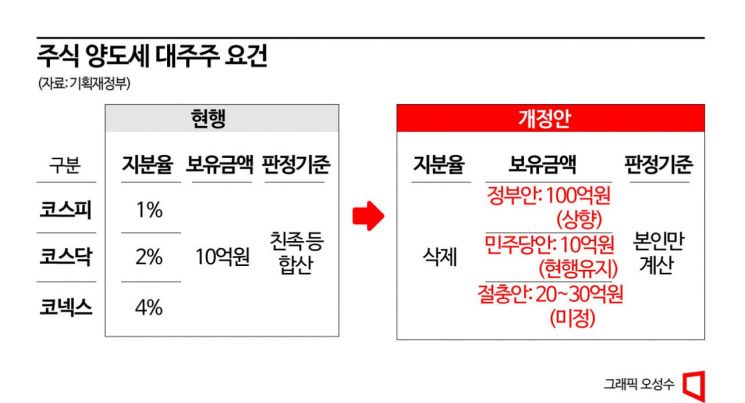

Currently, the government and ruling party and the opposition have not reached an agreement on the major shareholder threshold subject to capital gains tax. Although only minor adjustments to the threshold amount remain, no common ground has been found. The capital gains tax imposition threshold has been a point of contention between the opposition's demand to maintain the current standard of KRW 1 billion per stock and the government's proposal of KRW 10 billion. Recently, there have been rumors that the opposition may compromise at around KRW 2 billion to 3 billion, stepping back from maintaining the current standard. Even if the threshold is set at around KRW 3 billion per stock, the securities industry expects that it will be impossible to avoid a sell-off worth trillions of won by 'big hand' retail investors at year-end.

Under tax law, those classified as major shareholders must pay 20% tax on capital gains from stock transfers. According to the Korea Exchange, individual investors unloaded sell orders worth KRW 8.507 trillion from December 21 to 28 last year. In particular, on the last trading day of the stock market, December 28, individuals alone sold more than KRW 3 trillion worth of stocks in a single day. A significant portion of this is likely to be tax avoidance-related sell orders.

The Korea Exchange has designated December 30 as a year-end holiday, reducing the number of trading days by one compared to last year. Considering the settlement days, stock holdings must be finalized by the 27th at the latest.

The securities industry has raised its voice for raising the major shareholder threshold, citing concentrated sell-offs due to major shareholder taxation every year-end. On the 11th, the Korea Financial Investment Association, together with 31 domestic securities firms, issued a statement urging the National Assembly to actively engage in tax reform to raise the major shareholder threshold. They expressed concern that if the financial investment income tax is fully implemented immediately, the predictability and tax acceptance of individual taxpayers would be significantly reduced.

If year-end sell orders flood the market, stock market volatility is expected to increase. This year, the market may be even more volatile. The ruling and opposition parties are sharply divided over the major shareholder threshold for capital gains tax, causing many individual investors to take a wait-and-see approach. Since many intend to wait until the final decision on whether the threshold will be raised before selling, there is a possibility that sell orders will concentrate on the 26th and 27th. Typically, big players holding more than KRW 1 billion in a single stock sell off their holdings at year-end to reduce their holdings below KRW 1 billion to enjoy tax benefits and then repurchase the following year.

A private banker (PB) at a securities firm said, "In the past, to avoid the major shareholder capital gains tax threshold, sell-offs were made sequentially from October, but this year, anticipating changes to the threshold, almost no sell-offs occurred." He added, "If the capital gains tax threshold is raised to KRW 10 billion, the number of big players who do not need to sell stocks will increase, but if it is only slightly raised from the current KRW 1 billion to around KRW 2 billion to 3 billion, sell orders that usually come out over two months will be released all at once, which will burden the stock market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.