FKCCI '2023 Export Outlook Survey'

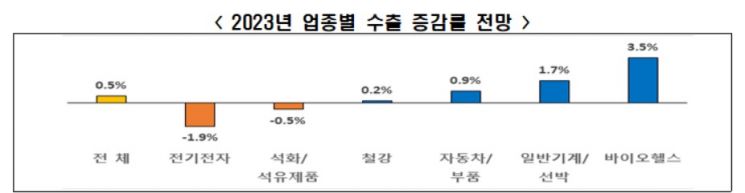

[Asia Economy Reporter Park Sun-mi] South Korea's exports next year are expected to increase by only 0.5%, signaling an end to the export boom enjoyed over the past two years. In particular, the electrical and electronics sector, including semiconductors and displays which have large export volumes, is projected to decline by 1.9%.

On the 16th, the Federation of Korean Industries (FKI) commissioned market research firm Mono Research to conduct a "2023 Export Outlook Survey" targeting major export industries. Respondent companies on average forecast that exports next year will increase by only 0.5% compared to this year. The survey covered 12 major export sectors among the top 1,000 companies by sales, including semiconductors, general machinery, automobiles, petrochemicals, steel, petroleum products, shipbuilding, auto parts, displays, biohealth, computers, and mobile communication devices. The export growth rate outlook by sector for next year is as follows: ▲Electrical and Electronics (-1.9%), ▲Petrochemicals and Petroleum Products (-0.5%), ▲Steel (+0.2%), ▲Automobiles and Auto Parts (+0.9%), ▲General Machinery and Shipbuilding (+1.7%), ▲Biohealth (+3.5%).

While 60.7% of companies expect exports to increase next year, 39.3% anticipate a decline. Companies forecasting a decrease in exports cited weakened export competitiveness due to sustained high raw material prices (45.7%), economic downturns in major export destinations (33.9%), and logistical difficulties such as rising maritime and air freight costs (10.2%) as key factors.

Among respondents, 53.3% expect export profitability next year to be similar to this year, but more companies (28.0%) anticipate a deterioration in export profitability than those expecting improvement (18.7%). Sectors with a high outlook for profitability decline include Electrical and Electronics (40.7%), Steel (31.3%), Petrochemicals and Petroleum Products (28.6%), and Automobiles and Parts (26.5%). Factors contributing to worsening export profitability include rising prices of raw materials such as crude oil and minerals (54.7%), increased import costs due to exchange rate hikes (14.3%), and higher interest expenses caused by interest rate increases (11.9%).

Companies expecting exports to decline next year are considering cost-cutting measures such as reducing factory operating expenses and selling, general, and administrative expenses (35.6%), employment adjustments including hiring freezes (20.3%), and postponing or reducing investments (15.3%) as strategies to cope with export sluggishness. For government policy priorities to strengthen export competitiveness, companies identified tax support related to raw material supply (38.0%), support to prevent export logistics disruptions (24.7%), and enhanced diplomatic efforts to resolve supply chain difficulties (21.3%).

Yoo Hwan-ik, head of the Industry Division at FKI, advised, “As the export growth that has driven South Korea’s economic growth since COVID-19 is expected to stagnate, the government needs to make every effort to create an environment that improves export performance for our companies, including expanding tax support related to raw material imports and preventing export logistics disruptions.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.