Rising Interest Rates Increase Debt Burden

Larger, Cheaper Listings Appear

Home Price Declines Deepen 'Hard Landing' Risk

For Now, Holding Steady

But Many May Struggle If Rates Rise Further

Possibility of 'Panic Selling' Despite Losses

[Asia Economy Reporter Kim Hyemin] A man in his 30s, Mr. A, who purchased an apartment in Nowon-gu last July, was recently shocked when he saw listings on a real estate app. The listings for larger units were priced lower than what he paid a year ago. The actual transaction prices from direct deals are already similar to his purchase price. The interest rate recalculated after one year has risen by nearly 5%, increasing his monthly principal and interest payments to over 800,000 won. Mr. A said, "I am trying to get by by cutting living expenses, but if the interest rate rises once more, it will be impossible to manage. Seeing the house prices plummet so rapidly makes me question whether I made a foolish choice, and I find it hard to sleep every night."

Those who thought they caught the "last train" to homeownership and bought houses in the outskirts of Seoul, known as Yeonggeuljok (borrowing to the limit, even to the soul), are enduring a harsh winter due to falling house prices and rising interest rates.

Typically, these are people in their 20s and 30s who, during the housing price boom, maximized mortgage loans, credit loans, and even insurance company loans to successfully purchase homes for actual residence. However, compared to middle-aged groups, their incomes are lower, making them vulnerable to the direct impact of interest rate hikes. Nesting in the Nowon-Dobong-Gangbuk (Nowon-gu, Dobong-gu, Gangbuk-gu) areas, where house prices have fallen sharply, they are also facing the risk of a "hard landing" in housing prices. Although they are currently in "hold on" mode, experts warn that if interest rates rise once more next year, many may be unable to bear the interest burden and could engage in mass "panic selling."

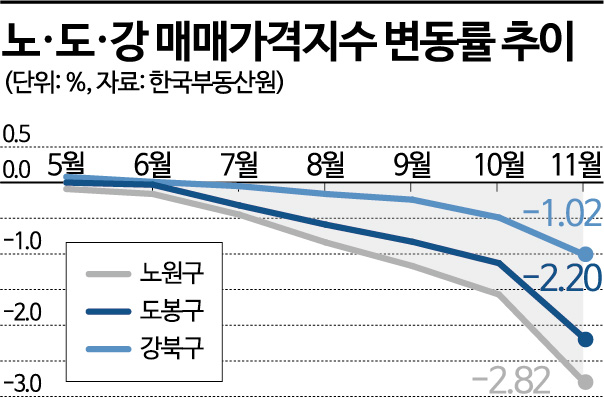

According to the nationwide housing price trend report by the Korea Real Estate Board on the 16th, house prices in the Nowon-Dobong-Gangbuk areas are all showing significant declines. The largest drop is in Nowon-gu, which fell 2.82% month-on-month in November, the biggest decline among 25 autonomous districts. Nowon-gu's cumulative decline for the year reached 7.34%, fully giving back last year's gains. Actual transaction prices have dropped by hundreds of millions of won, with many cases returning to levels seen two years ago. For example, Foretna Nowon in Sanggye-dong, a representative apartment in Nowon-gu, was traded at 770 million won for a 59㎡ unit last November, down 217 million won from the previous transaction in August.

Dobong-gu and Gangbuk-gu are also on the brink of a hard landing. Dobong-gu's sale prices have been declining since June this year, when they fell 0.03% month-on-month, expanding to a 1.13% drop in November. Gangbuk-gu showed a slight increase of 0.01% until June but has fallen 1.96% cumulatively over five months since July. The problem is that this is not a pause but an ongoing trend. The decline is growing every month, and experts warn that this trend may continue or even worsen next year.

For Yeonggeuljok who are living in their homes, falling house prices bring frustration, while interest rate hikes impose direct burdens. The COFIX (Cost of Funds Index), which serves as the benchmark for recalculating loan interest rates, rose to 4.34% in November based on new loan amounts. This is the first time since its announcement in 2010 that it has exceeded 4%, and reflecting this, banks' variable mortgage loan interest rates are expected to rise to the high 7% range.

This is also an ongoing situation. The U.S. Federal Reserve (Fed) raised its benchmark interest rate by 0.5 percentage points in its last meeting this year, pushing the upper bound to 4.5%. The gap between Korea's and the U.S.'s benchmark rates widened by 1.25 percentage points, increasing the likelihood of further domestic rate hikes next year. Additionally, with the U.S. signaling aggressive rate hikes next year, there are forecasts that Korea's mortgage interest rates could reach the 10% range. For Yeonggeuljok with one-year variable rate products facing recalculation next year, this means they may find it increasingly difficult to afford the interest payments.

Experts advise, "If you can endure, you should endure." In fact, among Yeonggeuljok, many repay loans or cut living expenses when they have extra money. Mr. B, who bought an apartment in Dobong-gu last year, recently repaid all 60 million won borrowed through a credit loan to prepare for homeownership. Mr. B said, "It was leftover money saved for family planning after marriage, but I repaid the loan first because I don't know how much more the burden will increase when the interest rate is recalculated next year." Mr. C, who purchased an apartment in Gangbuk-gu, recently canceled his subscription savings account and used the 15 million won to partially repay his credit loan. Mr. C said, "Although it's generally advised to keep the subscription savings account, as a one-home owner, its usefulness has decreased, and I thought it was more important to reduce the immediate interest burden by even a few hundred thousand won. I have been saving for over 10 years, so it is a regrettable choice, but it was unavoidable."

However, there are forecasts that if interest rates rise once more next year, the number of Yeonggeuljok who cannot even manage this will increase. A representative from a real estate agency in Nowon-gu said, "There are quite a few single-person households in their 20s who bought apartments in Nowon-gu, and if interest rates rise further, those who panic-bought one or two years ago may panic-sell their properties even at a loss this time. If such cases increase noticeably, house prices in the area will decline even faster."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.