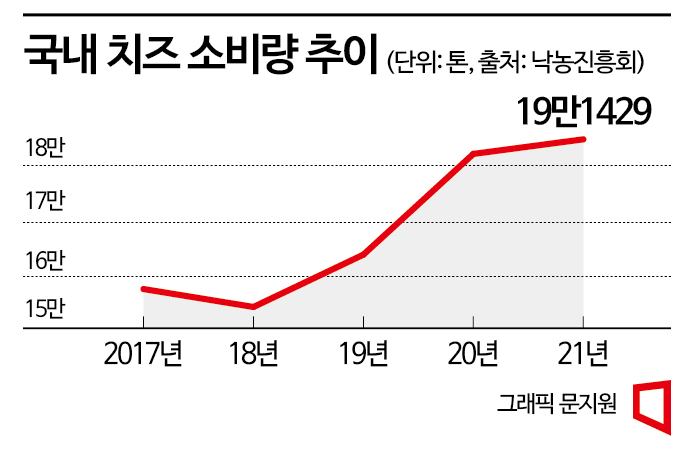

Domestic Cheese Consumption Reached 191,429 Tons Last Year, Up 2% YoY

Increase in Consumers Enjoying Premium Natural Cheese at Home

Cheese Market Shifts Focus from Processed Cheese to Natural Cheese

[Asia Economy Reporter Eunmo Koo] Cheese consumption in daily life is becoming increasingly diverse. From wine snacks to pasta and salads, as well as various Korean dishes like Tteokbokki and Jjimdak where cheese is blending in like a secret ingredient, the demand for cheese is expected to expand with the increase in gatherings as Christmas and the year-end approach.

According to the Dairy Promotion Committee on the 13th, domestic cheese consumption last year was 191,429 tons, showing a 1.7% increase compared to the previous year. Domestic cheese consumption, which was around 154,679 tons in 2018, steadily increased to 166,150 tons in 2019 and 188,231 tons in 2020, growing 23.8% over the past three years. With this upward trend continuing, it is expected to exceed 200,000 tons this year. As consumption increased, related sales naturally grew as well. According to market research firm Nielsen Korea, domestic cheese retail sales last year were 384.8 billion KRW, a 14.7% growth compared to 335.5 billion KRW in 2018.

What revitalized the somewhat stagnant domestic cheese market was the rapidly changing drinking culture. With the spread of COVID-19, home drinking and solo drinking cultures became common, and the wine market exploded, leading to increased interest in cheese that can be enjoyed together. As accessibility to wine, once perceived as a premium alcoholic beverage, improved especially among younger generations, consumers enjoying premium natural cheese at home, which was previously enjoyed at upscale restaurants or wine bars, are also increasing.

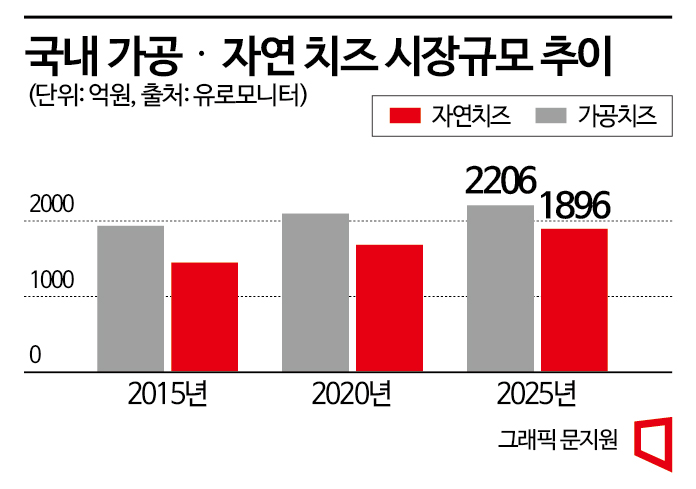

As cheese consumption patterns change, the center of the cheese market is shifting from processed cheese to natural cheese. Natural cheese can be eaten with various ingredients like basil and tomato without special cooking, so consumers are using cheese not only as a wine snack but also in other dishes such as salads and pasta. According to market research firm Euromonitor, the processed cheese market, which was around 209.9 billion KRW in 2020, is expected to grow by 5.1% over five years to 220.6 billion KRW by 2025. In contrast, the natural cheese market is expected to grow faster, increasing 12.7% from 168.3 billion KRW to 189.6 billion KRW during the same period.

The industry is also expanding the market by distributing various premium cheeses such as burrata cheese, fresh mozzarella cheese, and ricotta cheese in addition to the existing sliced processed cheese. Dongwon F&B is targeting the market with soft-textured natural cheese like ‘Denmark Ricotta Cheese’ made from domestic raw milk, while Seoul Milk is actively importing products such as Brie, Camembert, and Gorgonzola from German Sankt Pauli to meet the heightened consumer expectations beyond their existing products. Maeil Dairies, which owns the number one domestic cheese brand ‘Sangha Cheese,’ is also receiving positive responses in the market with its ‘Mini Portion Cube,’ emphasizing convenience with individually packaged portions, suitable as snacks and side dishes.

As cheese demand continues to expand, competition for market share is expected to intensify. Currently, the domestic cheese market is a three-way competition among Dongwon F&B, Seoul Milk, and Maeil Dairies. According to Nielsen Korea, Dongwon F&B, which was second in retail sales last year, rose to first place with a 21.3% market share in the first half of this year, increasing sales by 2.0% compared to the same period last year. Meanwhile, Seoul Milk’s sales decreased by 5.3% during the same period, dropping to second place with a 21.1% share. Third-place Maeil Dairies is closely trailing the two companies with a 17.8% share.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)