If Applied by the 19th, Pre-Increase Interest Rates Apply

Safe Conversion Loans Maintain Interest Rates

[Asia Economy Reporter Minwoo Lee] Korea Housing Finance Corporation has raised the interest rates on its long-term fixed-rate installment mortgage loan product, Bogeumjari Loan, which had been frozen for four months, resulting in rates reaching up to the 5% range.

On the 9th, the Housing Finance Corporation announced that it will increase the Bogeumjari Loan interest rates by 0.5 percentage points starting from the 20th. Accordingly, the ‘u-Bogeumjari Loan’ applied for through the Housing Finance Corporation website will have rates ranging from 4.75% per annum (10 years) to 5.05% per annum (50 years), and the ‘Akkim e-Bogeumjari Loan’ applied for online via electronic contracts will have rates ranging from 4.65% per annum (10 years) to 4.95% per annum (50 years).

Previously, despite the sharp rise in market interest rates, the Housing Finance Corporation had frozen the Bogeumjari Loan rates since lowering them by 0.35 percentage points on August 17. A representative from the Housing Finance Corporation explained, "With the Bank of Korea’s base rate and mortgage-backed securities (MBS) issuance rates continuously rising, it has become inevitable to adjust the Bogeumjari Loan rates to reflect market conditions." However, to minimize customer inconvenience, customers who plan to execute loans within a maximum of 90 days from the application date (previously up to 70 days) can still apply for the Bogeumjari Loan by the 19th and receive the pre-increase interest rates.

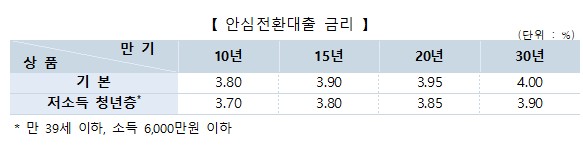

Meanwhile, the interest rates for the Safe Conversion Loan will remain unchanged at 3.7% to 4.0% per annum until the end of the year. A Housing Finance Corporation official advised, "Variable-rate mortgage borrowers should check when their loan interest rate adjustment date is and how much the base loan interest rate has increased during the adjustment period." He added, "Refinancing through the ‘Special Bogeumjari Loan’ will still be possible next year, but since higher rates than currently may apply, we strongly encourage taking advantage of the opportunity to switch to the Safe Conversion Loan within this year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.