Rejection of KEPCO Act Amendment... Government Holds Emergency Meeting

March Next Year is the Deadline... KEPCO Faces Imminent Liquidity Crisis

Power Producers Suffer Inevitable Damage... Concerns Over Mass Bankruptcies of Small and Medium Suppliers

[Asia Economy Sejong=Reporter Lee Junhyung] As the bill to increase Korea Electric Power Corporation's (KEPCO) corporate bond issuance limit failed to pass the National Assembly, the government held an emergency meeting to discuss countermeasures. The government plans to reintroduce the amendment to the KEPCO Act during the next National Assembly extraordinary session.

The Ministry of Trade, Industry and Energy announced that Park Iljun, the ministry’s 2nd Vice Minister, held a "KEPCO Financial Crisis Countermeasure Meeting" on the 9th at KEPCO’s Nam Seoul Headquarters in Seoul. The ministry convened the emergency meeting because the amendment to the KEPCO Act was rejected in the plenary session of the National Assembly on the 8th due to opposition from opposition parties. The amendment aimed to raise the KEPCO bond issuance limit, currently capped at twice the sum of KEPCO’s capital and reserves, to five times that amount.

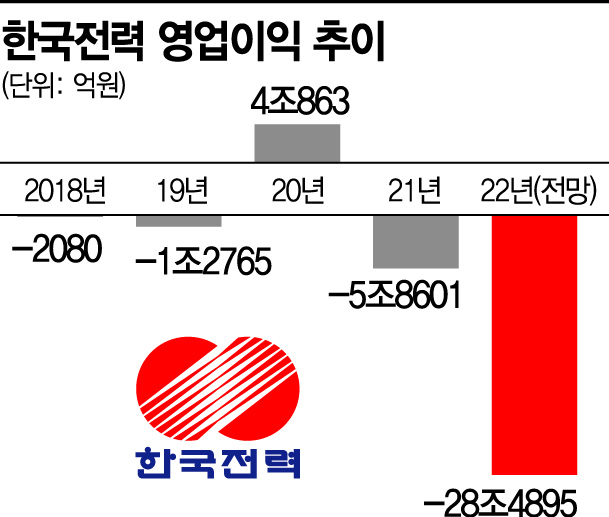

The government insists that amending the KEPCO Act is essential to secure KEPCO’s liquidity. KEPCO’s "negative margin" structure, where electricity is sold at a loss, has solidified, causing deficits to accumulate like a snowball. The ministry believes that if the KEPCO bond issuance limit is not increased, KEPCO will likely face a liquidity crisis after March next year due to exceeding the corporate bond limit. A ministry official said, "The rejection of the KEPCO Act amendment raises concerns that uncertainty could intensify in the financial market, which had been entering a stabilization phase."

Concerns are also growing that if KEPCO’s corporate bond issuance is blocked, the domestic power ecosystem could suffer damage. If KEPCO defaults, not only the power generation subsidiaries that KEPCO must pay for electricity but also private power companies would inevitably suffer damage. The possibility of the bankruptcy of about 2,200 small and medium-sized KEPCO partner companies cannot be ruled out.

Accordingly, the Ministry of Trade, Industry and Energy has decided to actively respond by re-pushing the KEPCO Act amendment during the next National Assembly extraordinary session and striving for its passage in the plenary session. Since the fundamental solution to KEPCO’s deficit lies in normalizing electricity rates, the ministry plans to establish an "Electricity Rate Normalization Roadmap" at an early stage. The ministry will also request cooperation from the financial sector to ensure smooth financial support to KEPCO beyond corporate bonds, such as commercial paper and bank loans.

Vice Minister Park also expressed concerns about the economic crisis triggered by KEPCO at the meeting. He said, "KEPCO’s financial crisis could spread to become a crisis for the entire economy," and added, "We must cooperate at the government-wide level to overcome the crisis." He further urged, "KEPCO should continue its efforts to secure liquidity independently and strengthen plans for fiscal soundness to overcome the crisis."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.