Russia's Cutoff of European Gas Pipelines

Many Factors Like China's Demand Recovery Potential

Fuel Price Increases

Individuals Buying Leverage ETNs

[Asia Economy Reporter Minji Lee] Volatility in natural gas prices is increasing. This is supported by forecasts that European Union (EU) countries will engage in fiercer competition to secure natural gas next year. While Russia is trying to reduce supply by cutting all gas pipelines, China is showing signs of economic recovery, which is expected to increase demand.

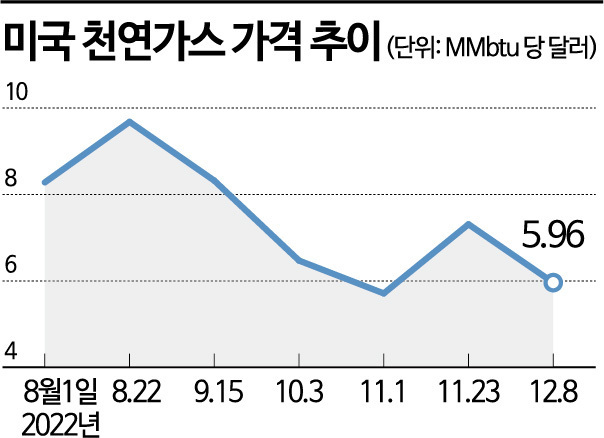

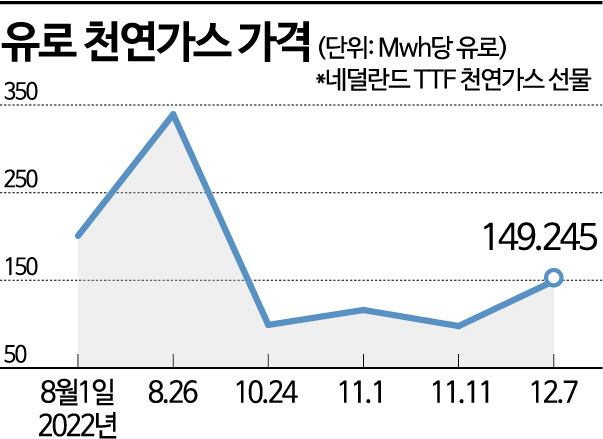

On the 9th, the January delivery Dutch TTF natural gas futures, which serve as the benchmark for European natural gas prices on the London ICE exchange, recorded 149.245 euros per megawatt-hour (MWh), up 7.77% from the previous trading day. Natural gas, which traded at 99.170 euros on October 24, surged more than 50% in less than two months. Natural gas, which had soared to $340 in August due to supply concerns from Russia, has been rising stepwise again this month. The Henry Hub natural gas futures price, a key indicator of natural gas prices on the New York Mercantile Exchange in the U.S., hovered around a similar level of $5 to $6 per MMBTU, standing at $5.96 as of the previous day.

The reason for the increased volatility in natural gas prices is that the energy security of European countries is once again under threat. The sharp rise in natural gas prices this year was due to a mismatch between supply and demand. After Russia started a war with Ukraine and cut off the natural gas pipelines to Europe, European countries had to buy natural gas from other countries at higher prices. Fortunately, news that Europe’s early winter weather was warmer than usual and that European countries had aggressively secured more than 95% of natural gas stocks helped stabilize gas prices downward. The problem lies in next year. As analyses suggest that Russia will not actively supply natural gas, concerns about natural gas supply and demand are resurfacing.

Jae-young Oh, a researcher at KB Securities, said, "If the Nord Stream 1 supply stoppage that began last September continues, Europe will need to import an additional 50 bcm (about 400 million tons) or more of LNG and other sources compared to this year," adding, "LNG exporting countries such as the U.S. and Norway, which transport natural gas via tanker ships, are also reaching their limits, so competition to secure natural gas imports will be fiercer than this year."

There are many variables that could further fuel price increases. Russia is threatening to cut off all remaining gas supply pipelines to Europe. Of the six gas supply networks from Russia to Europe, the remaining pipelines are the TurkStream pipeline and the Ukraine pipeline. Researcher Oh analyzed, "When looking at natural gas price trends, if the supply volume decreases by about 10 bcm (80 million tons), there will be upward pressure on natural gas prices by around 13 euros."

The timing of China’s lifting of its COVID-19 lockdown policy is also a variable. Due to China’s zero-COVID policy and economic slowdown, natural gas demand decreased by about 20% last year. Thanks to this, Europe was able to secure natural gas stocks more easily, but if China actively pursues economic stimulus next year, Europe’s natural gas procurement will inevitably become more difficult.

Influenced by the rise in European natural gas prices, U.S. natural gas prices are also expected to rise. U.S. natural gas prices are heavily influenced by coal prices, which have an inverse relationship with inventory levels. Currently, U.S. natural gas inventories are low due to increased exports, and coal prices are also soaring. Byung-jin Hwang, a researcher at NH Investment & Securities, said, "Gas inventories are at a lower level compared to the past five-year average," and predicted, "Amid tight supply and demand, U.S. natural gas prices will frequently attempt to rise in the first quarter of 2023."

As price rise expectations expand, domestic investors are busy trying to increase returns through exchange-traded note (ETN) products. Looking at the top individual net purchases of ETNs over the past 10 trading days, the Samsung Leverage Natural Gas Futures ETN B product was the most purchased, totaling 14.6 billion won. This ETN seeks to earn twice the returns of the natural gas futures movements listed on the New York Mercantile Exchange. It was followed by TRUE Leverage Natural Gas Futures (currency-hedged) with 7.4 billion won and Shinhan Leverage Natural Gas Futures ETN with 6.7 billion won, respectively.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.