Overseas Exchange OKX Also Delists WEMIX, Ends Trading Support

Domestic Exchange Gidax Lists It, But No KRW Trading, Limited Access

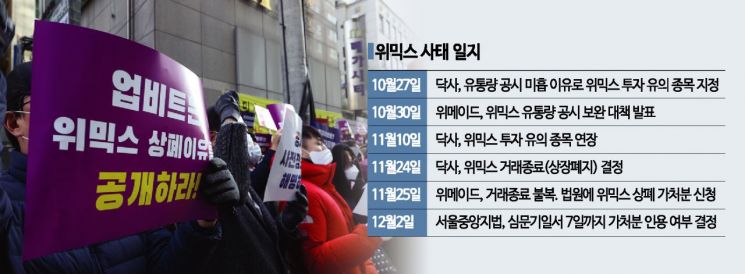

[Asia Economy Reporter Kang Nahum] WEMIX, the cryptocurrency of Wemade, has been delisted from the four major Korean won cryptocurrency exchanges in South Korea, and now overseas exchanges are also showing signs of delisting WEMIX. With the red light turned on even for the listing on Binance, the world's number one exchange, concerns about WEMIX's liquidity crisis have arisen.

WEMIX Turns Away Even from Overseas Exchanges

According to the industry on the 9th, OKX, one of the three major Chinese virtual asset exchanges based in Hong Kong, decided to delist WEMIX and ended support for spot and margin trading. OKX is the first overseas exchange to join the delisting trend following domestic exchanges. OKX was virtually the only exchange supporting margin trading for WEMIX. OKX explained, "We decided to delist WEMIX by reflecting the delisting regulations and user feedback."

Another major exchange, Bybit, also hinted at delisting, stating that "WEMIX did not meet Bybit's virtual asset management rules." MEXC designated WEMIX as a trading caution item. Huobi inserted a warning phrase on the WEMIX trading window, labeling it as a "high-risk blockchain asset."

As the possibility of delisting increases even on overseas exchanges, there is analysis that the listings on Binance and Coinbase, which Wemade had long hoped for, have become uncertain. Binance is the world's largest cryptocurrency exchange with a daily trading volume reaching 12 trillion KRW. It is more than five times larger than Upbit, which holds the number one domestic market share. Wemade had previously put effort into listing on Binance, including using Binance's custody service under the pretext of enhancing WEMIX's transparency.

Wemade and investors also had expectations that if WEMIX were listed on Binance, the damage caused by delisting from domestic exchanges would be somewhat offset. On the 25th of last month, Jang Hyun-guk, CEO of Wemade, expressed confidence, saying, "We are in discussions for listing with Coinbase and Binance," and added, "Although I cannot give a definite timeline, the discussions have progressed significantly. We will appropriately share the details with the market as soon as they are finalized."

An industry insider said, "With even domestic exchanges turning their backs on WEMIX and its future uncertain, it is doubtful whether prominent overseas exchanges will take on such risks to list it," expressing a negative outlook.

A Ray of Hope... GDAC Listing

Amid ongoing adverse conditions, the only good news is the listing on the domestic exchange GDAC. According to GDAC, from 5:30 PM the previous day, WEMIX, a KCT digital asset based on Klaytn, was listed on GDAC's BTC and ETH markets. Withdrawals will be available from 10 AM on the 15th.

GDAC, a domestic exchange, uses the solutions of Upbit, Bithumb, Coinone, and Korbit. Existing WEMIX investors can easily transfer WEMIX to GDAC and trade. This creates a new alternative for investors to trade without going through overseas exchanges.

Han Seung-hwan, CEO of PeerTech, the operator of GDAC, said, "After receiving the delisting notice from DAXA, WEMIX has improved its review status to date," and added, "Since WEMIX has over 100,000 investors and is connected to listed companies under the Capital Markets Act, we judged that minimum deposit, withdrawal, custody support, and a minimal trading market are necessary for investors, so we decided to list it."

He added, "WEMIX is a blockchain project with one of the few applied cases in Korea, and many such projects should emerge in the future," and said, "We hope the WEMIX incident will serve as an opportunity to significantly raise the standards of the virtual asset market, including industry revitalization."

However, despite being a domestic exchange, the limitation is that trading in Korean won is not possible. The exchanges where Korean won trading is available are the five members of the Digital Asset Exchange Association (DAXA): Upbit, Bithumb, Coinone, Korbit, and Kopax.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)