[Asia Economy Reporter Sunmi Park] The foundry (semiconductor contract manufacturing) industry, which had experienced a boom due to a flood of orders from fabless (semiconductor design) customers, has reached a turning point of decline after growth in the third quarter. Samsung Electronics, the world's second-largest, has already seen a drop in sales and market share from the third quarter, widening the gap with the number one TSMC.

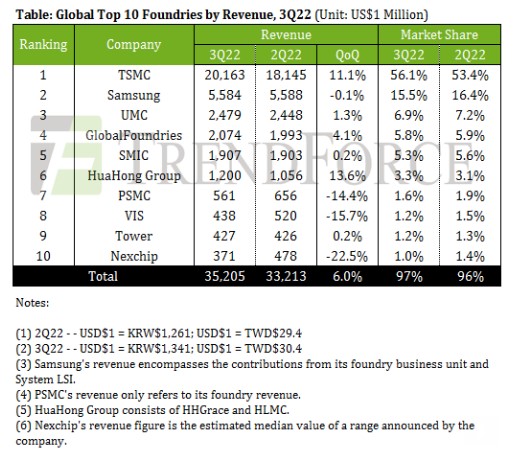

On the 9th, Taiwanese market research firm TrendForce reported that the combined sales of the global 'Top 10' foundry companies in the third quarter of this year reached $35.21 billion, a 6% increase compared to the previous quarter. The overall sales increase was largely influenced by Apple launching the iPhone 14 series, significantly boosting the sales of Taiwan's TSMC, the world's number one company with Apple as its largest customer.

However, TrendForce analyzed that the sluggish global economic growth, China's stringent COVID-19 control policies, and high inflation rates continue to affect consumer sentiment, causing semiconductor inventory depletion to proceed slowly. They added, "This atmosphere is significantly impacting foundry orders in the fourth quarter," and "The total sales of the top foundry companies in the fourth quarter are inevitably expected to fall short of those in the third quarter." They noted that the foundry industry's boom, which saw continuous sales growth over the past two years, has reached a turning point after the third quarter of this year.

In the third quarter, TSMC ranked first with sales of $20.163 billion, an 11.1% increase from the second quarter. Its market share also rose by 2.7 percentage points to 56.1% compared to the second quarter. Samsung Electronics ranked second with sales of $5.584 billion, a 0.1% decrease from the previous quarter. Its market share dropped by 0.9 percentage points to 15.5%. Third-place UMC, fourth-place GlobalFoundries, and fifth-place SMIC recorded sales of $2.479 billion, $2.074 billion, and $1.970 billion respectively, showing sales growth rates ranging from 0% to 4%. Due to industry characteristics, the top one or two companies monopolize over 70% of the market, and the top five companies occupy about 90% of the total market.

When a specific top company secures large-scale orders, the rest inevitably suffer losses in sales and market share. Accordingly, the market share gap between TSMC and Samsung Electronics, competing in advanced foundry processes, widened to 40.6 percentage points in the third quarter from 37.0 percentage points in the second quarter. TrendForce explained, "Most foundry companies except TSMC were affected by reduced orders from customers in the third quarter," adding, "Samsung Electronics partially benefited from the iPhone new product series effect like TSMC, but its market share fell to 15.5%."

Meanwhile, the foundry industry, which had recorded record-high quarterly performances, is now feeling the impact of actual order reductions. A foundry industry official said, "We expect the foundry market to be unfavorable next year as well," explaining, "Due to the nature of the contract manufacturing industry, some companies may experience temporary order boosts depending on contract timing and securing specific customer groups, but overall, the foundry industry is expected to face worse conditions than this year due to sluggish semiconductor demand caused by economic slowdown." He added, "As a result, competition to secure new customers will inevitably become more intense."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.