[Asia Economy Reporter Song Hwajeong] Household loans continued to slow down last month, with a year-on-year decrease for the first time since statistics began in 2015.

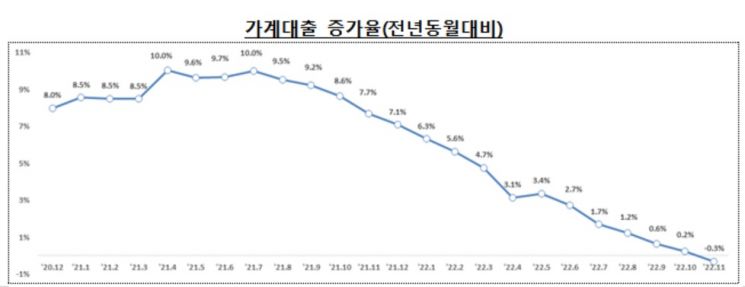

According to the 'Household Loan Trends for November 2022' announced by the Financial Services Commission on the 8th, total household loans across all financial sectors decreased by 3.2 trillion KRW last month, marking a 0.3% decline compared to the same month last year. This year-on-year decrease is the first since statistics began in 2015.

The overall decline in household loans widened as the increase in mortgage loans shrank compared to the previous month and other loans decreased further. Mortgage loans increased by 500 billion KRW last month, with the growth narrowing mainly due to jeonse loans. Other loans decreased by 3.6 trillion KRW, with the decline expanding mainly in credit loans compared to the previous month.

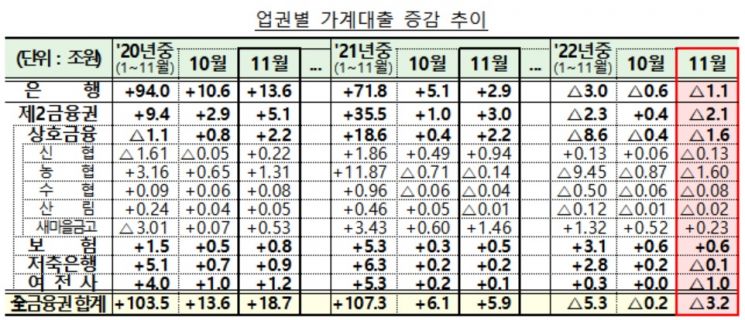

By sector, the decline in household loans in the banking sector continued, and loans in the secondary financial sector also turned to a decrease. Household loans in the banking sector fell by 1.1 trillion KRW last month. Mortgage loans increased by 1 trillion KRW, centered on policy mortgages (2.6 trillion KRW) and group loans (600 billion KRW), but the growth narrowed compared to the previous month (1.3 trillion KRW). Other loans decreased by 2 trillion KRW, mainly due to credit loans (-1.8 trillion KRW), with the decline expanding compared to the previous month (-1.9 trillion KRW). In the secondary financial sector, insurance loans increased by 600 billion KRW, while mutual finance (-1.6 trillion KRW), credit card companies (-1 trillion KRW), and savings banks (-100 billion KRW) decreased, resulting in a total reduction of 2.1 trillion KRW.

A Financial Services Commission official explained, "Mortgage loans increased compared to the previous month due to continued demand for group loans, but the growth narrowed as jeonse loan issuance decreased," adding, "Other loans such as credit loans continue to decline, with the decrease expanding due to rising loan interest rates."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.