China's "Lithium Price Decline Next Year" Forecast

Will It Lead to Battery Price Drops?

[Asia Economy Reporter Oh Hyung-gil] The lithium prices, which had been soaring to unprecedented heights, have recently stabilized.

The upward trend in electric vehicle battery prices, which began with raw materials, is expected to slow down going forward. There are even concerns that an oversupply of lithium could occur next year, depending largely on the supply situation in China, which has had the greatest impact on driving prices down.

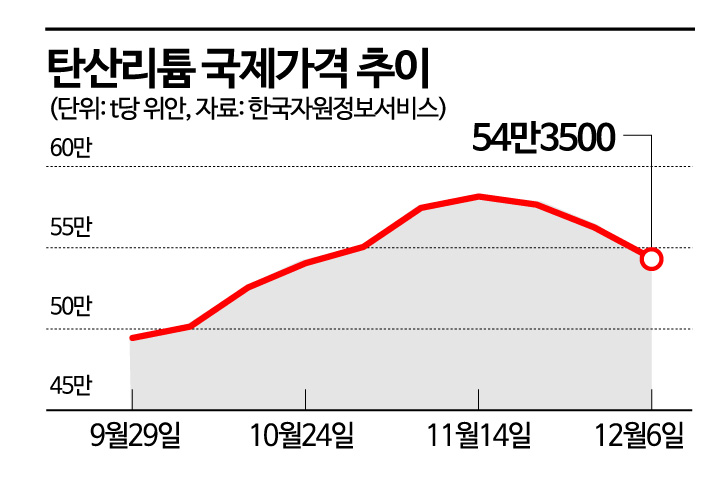

According to the Korea Resource Information Service on the 8th, the international price of lithium (lithium carbonate) was 543,500 yuan per ton as of the 6th, equivalent to 102 million KRW, down 2.8% from the previous day. Considering that the price was 110,000 yuan per ton during the same period last year, it is still at a high level, but it has been on a downward curve over the past two weeks.

Lithium prices began to surge in October, breaking through the 1 billion KRW per ton mark for the first time ever at 500,000 yuan, and reached an all-time high of 581,500 yuan on the 14th of last month.

The shift to a downward trend is partly due to concerns over the short-term rapid rise, but it is mainly attributed to China's influence. Chinese companies, which dominate the global lithium supply chain, are adjusting prices.

The Korea Mine Reclamation Corporation analyzed in its major mineral price trend report, "Prices fell as major Chinese battery and cathode active material manufacturers reduced inventory levels and cut back on purchases," adding, "As lithium salt prices began to weaken, many suppliers are lowering supply prices to promote sales."

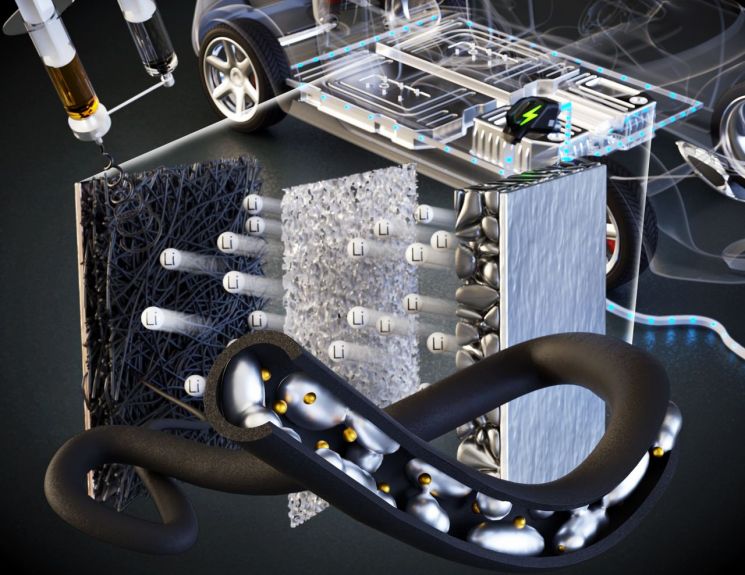

Lithium, known as "white petroleum," is a mineral widely used in batteries due to its excellent electrical conductivity. Australia and Chile hold 67% of the world's lithium reserves, and together with China, they account for 90% of total production. South Korea is the largest importer of lithium from China. As of October, lithium exports from China to South Korea amounted to 47,836 tons, nearly 63% of total exports.

Domestic battery manufacturers link most raw material prices, including lithium, to their product sales prices. Simply put, when the price of raw material lithium rises, the prices of batteries and electric vehicles increase sequentially.

However, recently, Chinese lithium producers have been intensifying efforts to expand production capacity in response to the growing electric vehicle sales, raising concerns that an oversupply of lithium originating from China may occur.

China's largest lithium company, Ganfeng Lithium, plans to secure resources through overseas mine acquisitions and equity investments, expanding production of lithium compounds such as lithium carbonate and lithium hydroxide from 90,000 tons in 2020 to 200,000 tons by 2025 (enough for 4 million electric vehicles).

Chinese battery market research firm GGII forecasts that the price of lithium carbonate in China will fall to around 520,000 yuan per ton in the first half of next year and to about 450,000 yuan per ton in the second half.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)