Expected 100,000 Visitors but Less Than 20,000 in Two Days

Single-Digit Competition Rate for Jangwijai

Waiting Candidates Weigh In... Price Competitiveness Is the Key Factor for Success

The scene of the Dunchon Jugong Apartment reconstruction site in Gangdong-gu, Seoul, where ready-mix concrete pouring was halted due to disruptions in the supply of construction materials amid the Cargo Solidarity Union's general strike entering its seventh day on the 30th. Photo by Hyunmin Kim kimhyun81@

The scene of the Dunchon Jugong Apartment reconstruction site in Gangdong-gu, Seoul, where ready-mix concrete pouring was halted due to disruptions in the supply of construction materials amid the Cargo Solidarity Union's general strike entering its seventh day on the 30th. Photo by Hyunmin Kim kimhyun81@

[Asia Economy Reporter Kim Hye-min] Olympic Park Foreon (Dunchon Jugong) in Gangdong-gu, Seoul, which attracted attention as the biggest property in the year-end pre-sale market, recorded results lower than expected. Although it was anticipated that 100,000 people would flock, fewer than 20,000 actually came, reaffirming the frozen sentiment. As the pre-sale environment next year is likely to remain challenging, it is expected that price competitiveness will become an even more decisive factor for success.

According to the Korea Real Estate Board's subscription website on the 7th, Olympic Park Foreon's first-priority subscription over two days saw a total of 17,378 applicants for 3,695 units, recording an average competition rate of 4.7 to 1.

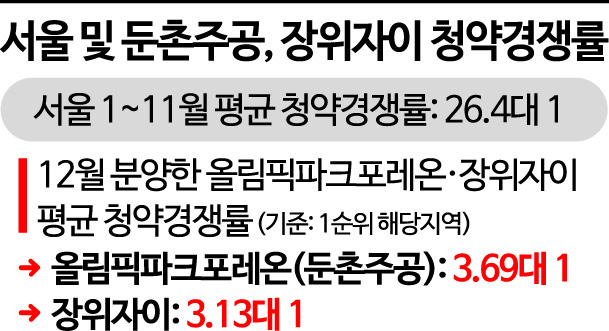

Initially, it was expected that the first-priority subscription for the designated area (residents of Seoul for over 2 years) held on the first day would be fully subscribed, but most housing types failed to meet the 500% reserve applicant requirement, leading to the continuation of the first-priority subscription for other areas (residents of Seoul for less than 2 years and residents of the metropolitan area) the following day. The first-priority subscription for the designated area recorded an average competition rate of 3.69 to 1. Only 3,731 additional applicants applied in the first-priority subscription for other areas, causing some housing types to proceed to the second-priority subscription.

The subscription for Jangwi Xi Radiant in Seongbuk-gu, which was held consecutively, also recorded an average competition rate of 3.13 to 1 with 2,990 applicants for 956 units based on the first-priority designated area. Here too, only 4 out of 16 housing types met the reserve applicant requirement, leading to the first-priority subscription for other areas being held on the same day. The 49E㎡ exclusive area had 11 units available but only 10 applicants, resulting in undersubscription.

The sales results of these complexes have been regarded as a barometer to gauge the atmosphere of Seoul's pre-sale market early next year. Since there was no notable pre-sale supply in Seoul during the ongoing real estate downturn this year, it was difficult to assess the market mood. Olympic Park Foreon attracted attention as the largest-scale reconstruction complex in the Gangnam area, and Jangwi Xi Radiant was symbolic as a large branded apartment complex in the Gangbuk area.

However, as both complexes failed to succeed, there are forecasts that next year's pre-sale market will also be difficult. With surrounding house prices falling and the burden of loan interest increasing due to interest rate hikes, it is pointed out that speculative demand engaging in 'blind subscriptions' will be hard to find anymore. Instead, the market is being reorganized around actual demand, making the pre-sale price a crucial factor for success. It is expected that the trend of carefully selecting complexes with clear price advantages compared to surrounding market prices will intensify further.

Olympic Park Foreon and Jangwi Xi Radiant were the most outstanding complexes in terms of location and scale among those pre-sold in Seoul this year, but the dominant view is that their prices held them back. According to Real Estate R114, the average subscription competition rate in Seoul from January to November this year was 26.4 to 1, higher than the average of these complexes.

Ye Kyung-hee, senior researcher at Real Estate R114, said, "There will be pre-sale supply in the Gangnam area next year, and as real estate prices decline and urgent sales appear, buyers are weighing their options." She added, "Next year's subscription market may continue to see demand concentrated on complexes with good cost-effectiveness as price sensitivity to pre-sale prices increases."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.