[Asia Economy Reporter Bu Aeri] "Dear customer, we would appreciate it if you could kindly cancel your subscription." An unprecedented situation has occurred where some regional Nonghyup branches are asking customers to cancel their subscriptions as funds flood into high-interest special products. As more financial technology enthusiasts seek high-interest products, regional mutual financial cooperatives have faced management crises due to a single mistake.

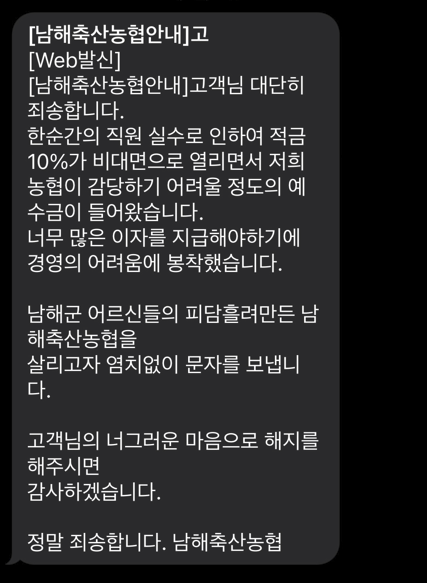

According to the Nonghyup Central Association on the 8th, Namhae Livestock Nonghyup in Namhae, Gyeongnam, recently attracted contract amounts of around 140 billion KRW for its special savings product with interest rates in the 10% range, and the interest expenses are expected to reach approximately 7 to 8 billion KRW annually. According to Namhae Livestock Nonghyup's management disclosure, the interest expenses last year were about 883 million KRW. A representative from Namhae Livestock Nonghyup said, "This product was originally supposed to be offered face-to-face, but due to a mistake, the non-face-to-face channel was opened," adding, "We received deposits beyond what we could handle, leading to management difficulties."

Similar situations unfolded at Donggyeongju Nonghyup in Gyeongju, Gyeongbuk, and Hapcheon Nonghyup in Hapcheon, Gyeongnam. Donggyeongju Nonghyup started selling a savings product with up to 8.2% interest from the 25th of last month, but without setting limits, an overwhelming number of customers subscribed, making it difficult to manage when the savings matured. Hapcheon Nonghyup experienced the same issue. They sold savings products with up to 9.7% annual interest without a maximum subscription amount and allowed multiple account openings through non-face-to-face channels. Jeju Sara Credit Union also offered a free installment savings product with 7.5% interest, but after tens of billions of KRW flooded in, they requested customers to cancel their subscriptions.

The central associations have begun investigating these incidents. A Nonghyup Central Association official stated, "For the three identified branches, large amounts have been attracted relative to the size of the cooperatives, and we are discussing countermeasures to prevent any harm to customers." A representative from the Credit Union Central Association also said, "The central association and the respective cooperatives are maintaining continuous communication."

Meanwhile, as the high-interest rate period continues, savings and installment savings products offering high rates have emerged as popular financial tools, impacting the mutual finance sector as well. Recently, financial authorities are understood to have sent messages to credit unions and Saemaul Geumgo urging restraint in interest rate competition. This is based on the judgment that if high-interest savings products cause negative margins, it could threaten financial soundness, and excessive competition for funds in the financial sector could disrupt the market.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.