Government 'Struggles' with UK Nuclear Power Project... Profitability Not Confirmed

Due to Local Business Model... Nuclear Construction Costs Charged to Electricity Bills

Introduced by UK Government for 'Cost Reduction'... Profitability Decline Inevitable

The Hinkley Point C nuclear power plant being built by ?lectricit? de France (EDF) in southern England.

The Hinkley Point C nuclear power plant being built by ?lectricit? de France (EDF) in southern England. [Photo by ?lectricit? de France (EDF) website capture]

[Asia Economy Sejong=Reporter Lee Jun-hyung] The government is facing a dilemma over the new nuclear power plant project being promoted by the United Kingdom. The UK government insists that it will only confirm the project's viability, including the electricity sales price, after finalizing the new nuclear power plant operator. Analysts suggest that the government is caught between its national agenda of exporting 10 nuclear reactors and the associated business risks.

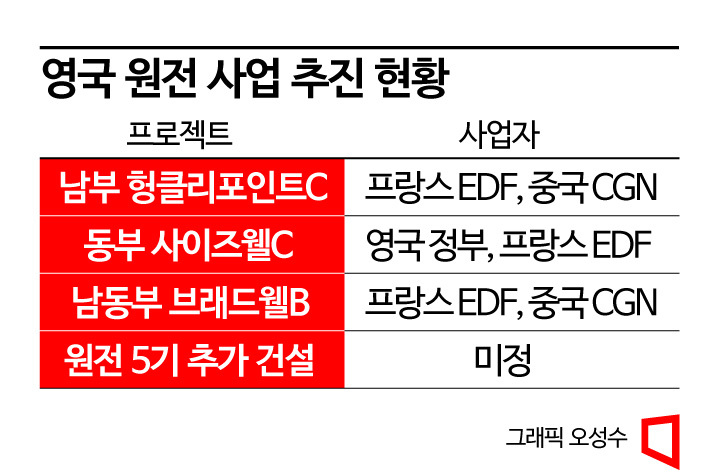

According to related ministries on the 8th, the government has not yet decided whether to participate in the UK nuclear power project. The UK government is pushing a project to build up to eight new nuclear reactors to achieve carbon neutrality and energy security. Among these, three sites and operators have already been decided. It is reported that the UK government hopes for Korea to participate in the project to build the remaining five reactors.

The UK government has already sent several 'love calls' to Korea. Earlier, Kwasi Kwarteng, the UK Secretary of State for Business, Energy and Industrial Strategy (BEIS), visited Korea in August to discuss nuclear cooperation plans with Lee Chang-yang, Minister of Trade, Industry and Energy. Tom Greatrex, chairman of the UK Nuclear Industry Association (NIA), stated at a seminar held domestically at the end of last month, "The UK will be an important market for global nuclear companies, including Korea."

Introduction of RAB... Difficult to Predict Profitability

However, the government is hesitant to jump into the UK nuclear project. This is because the UK government is introducing a unique business model called the Regulated Asset Base (RAB) for its domestic nuclear power plants. RAB is a method that compensates nuclear operators' profits by gradually charging nuclear construction costs in the monthly electricity bills.

The problem is that under RAB, Korea cannot accurately gauge the profitability of the UK nuclear project. The UK government maintains that it will only confirm the electricity sales price after the new nuclear operator is finalized, permits are completed, and site acquisition is finalized?when the project development reaches a mature stage. Since RAB is still in its early stages in the UK, there are no precedents that Korea can refer to. From Korea's perspective, it must decide whether to participate in the project before even confirming the nuclear construction costs that will be added to UK electricity bills.

The nuclear industry views that the introduction of RAB is likely to reduce the profitability of nuclear operators. The UK government’s motivation for introducing RAB is to reduce costs. Initially, the UK applied the Contract for Difference (CfD) system to its nuclear projects. CfD sets a predetermined profit for nuclear operators and the UK government compensates the difference between this and the actual market electricity price. Under this system, the UK government paid existing nuclear operators profits amounting to three times the general electricity price. Therefore, RAB is being introduced to cut these costs.

UK Labor Laws Also a Challenge... Japanese Firms Withdraw One After Another

UK labor laws are another hurdle to overcome. Experts agree that building nuclear plants under the UK's sophisticated labor market regulations inevitably increases construction costs and extends construction periods. Professor Jeong Beom-jin of Kyung Hee University's Department of Nuclear Engineering explained, "Domestic nuclear construction companies have no experience building reactors in advanced countries," adding, "Due to complex regulatory systems requiring worker welfare, hiring UK construction firms, and using local components, delays in construction schedules are highly likely."

It is also analyzed that the reason Japanese companies have repeatedly withdrawn from the UK nuclear projects is not unrelated to these challenges. Hitachi of Japan entered the UK nuclear project in 2012 but announced its withdrawal in 2020. The sunk costs incurred by Hitachi during the UK new nuclear project are estimated at about 3 trillion won. Toshiba of Japan also invested ?15 billion (approximately 24 trillion won) in the northwest UK region to build three nuclear reactors with a capacity of 3.4GW but decided to liquidate its local subsidiary in 2018 due to low profitability.

Given this situation, some view that the government is caught in a dilemma. The current administration set "exporting 10 nuclear reactors" as a key national agenda immediately after its inauguration in May. Korea Hydro & Nuclear Power is actively strengthening relations with the Czech Republic and Poland, where it is pursuing new nuclear projects. However, for public enterprises like Korea Electric Power Corporation (KEPCO) to make upfront investments, internal investment reviews and preliminary feasibility studies by the Ministry of Economy and Finance must be passed. This is why there are criticisms that upfront investments in the UK nuclear project, whose viability is unconfirmed, face procedural limitations.

The government maintains that the UK nuclear project remains a "target for pursuit." A Ministry of Industry official said, "The UK's new nuclear project can be seen as an investment attraction concept," adding, "Regular meetings related to the UK nuclear project are being held with KEPCO and other related organizations."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)