[Asia Economy Sejong=Reporter Kim Hyewon] Last year, the average pre-tax annual salary of office workers was recorded at 40.24 million KRW. The number of workers earning "hundreds of millions KRW" annually exceeded 1 million for the first time.

The National Tax Service announced the "2022 Q4 Public National Tax Statistics" containing this information on the 7th.

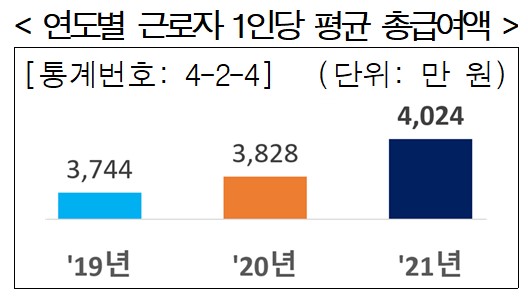

The number of workers who filed year-end tax settlements for earned income last year was 19.959 million, an increase of 2.4% from the previous year. Their total salary (taxable earned income) amounted to 803.2086 trillion KRW. The average salary per worker was 40.24 million KRW, a 5.1% increase from the previous year (38.28 million KRW). This is the first time the average salary per worker has exceeded 40 million KRW.

By region, Sejong had the highest average salary per person at 47.2 million KRW, followed by Seoul (46.57 million KRW), Ulsan (44.83 million KRW), and Gyeonggi (41.19 million KRW).

The number of workers with total salaries exceeding 100 million KRW was 1.123 million. This is a 22.6% increase from 916,000 in 2020, marking the first time it surpassed 1 million.

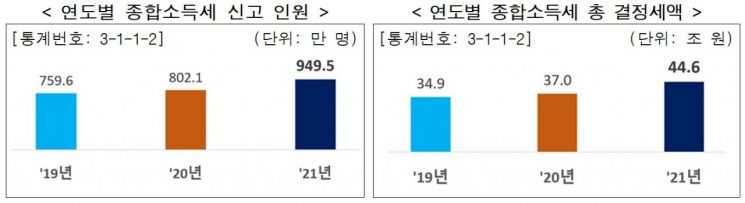

Among workers who filed year-end tax settlements with earned income, 7.04 million paid no earned income tax due to various tax credits, accounting for 35.3% of the total. The number of people who filed comprehensive income tax returns including business income and interest income last year was 9.495 million, an 18.4% increase from the previous year.

The number of people who filed comprehensive income tax returns subject to comprehensive taxation due to financial income exceeding 20 million KRW was 179,000, similar to the previous year. The average comprehensive income amount per financial income taxpayer was 296 million KRW. By residence, Seoul had the highest average comprehensive income amount per person at 394 million KRW, followed by Busan and Daegu at 249 million KRW each.

The number of capital assets reported for capital gains tax last year was 1.68 million, a 15.5% increase from the previous year. Land transfers (724,000 cases) were the most frequent, followed by stocks (431,000 cases) and houses (354,000 cases). The average transfer price of houses reported for capital gains tax last year was 347 million KRW, a 1.7% decrease from the previous year. The average transfer price of houses in Seoul was the highest at 712 million KRW, followed by Sejong (371 million KRW) and Gyeonggi (365 million KRW).

The number of completed tax audits last year was 14,454, similar to 14,190 the previous year. The tax amount imposed through tax audits was 5.5 trillion KRW, higher than 5.1 trillion KRW the previous year. The National Tax Service plans to maintain the number of tax audits at around 14,000 this year, considering economic difficulties.

Last year, earned income and child tax credits were paid to 4.936 million households totaling 4.9 trillion KRW. The National Tax Service expects that including "late applications" accepted until the end of last month and paid by the end of January next year, the total will be similar at 4.966 million households and 5.1 trillion KRW.

The National Tax Service plans to publish the "2022 National Tax Statistics Yearbook," containing a total of 552 statistics, on the 20th of this month.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Hostess to Organ Seller to High Society... The Grotesque Scam of a "Human Counterfeit" Shaking the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)