Dividend Expectations and Policy Risk Eased

Foreign and Institutional Investors Actively Buying

Up Over 14% Since November

Stock Prices Usually Fall After Dividends

If Price Returns Lag, Selling Is Also an Option

[Asia Economy Reporter Minji Lee] As the saying "bank stocks at year-end" proves true, bank stocks are showing strength. With the resolution of dividend policy uncertainties and solid earnings acting as dual drivers, foreign investors are also actively participating in buying.

◆ Bank Stocks Up 14% in One Month

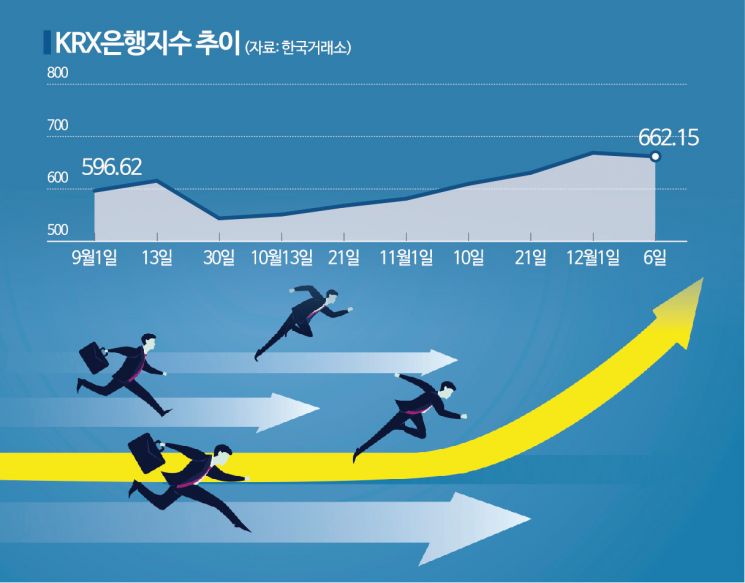

According to the Korea Exchange on the 7th, the KRX Bank Index rose 3.41% from the 28th of last month to the day before, showing the highest increase among all KRX indices. During the same period, it also outperformed the KOSPI's rise of -1.83%. Expanding the period from last month to the day before, the increase exceeded 14%, overwhelmingly surpassing the KOSPI's 4.34% rise during this time.

Looking at individual stock returns since last month, regional banks such as DGB Financial Group (15%) and BNK Financial Group (13%) posted higher returns than commercial banks. Since financial firms experienced significant stock price declines due to liquidity crises in October, their rebound was also substantial. Others followed in order: Hana Financial Group (10%), Woori Financial Group (9%), KB Financial Group (8%), Industrial Bank of Korea (6%), and Shinhan Financial Group (4%). KakaoBank surged over 62%, but as a growth stock, its price increase was driven more by expectations of changes in the U.S. Federal Reserve's interest rate policy than by dividend prospects.

In the market, foreign investors are actively buying bank stocks. Since last week, foreigners have accumulated shares in Shinhan Financial Group (62.5 billion KRW), Hana Financial Group (40.5 billion KRW), KB Financial Group (17.6 billion KRW), and Industrial Bank of Korea (14.7 billion KRW). Institutions also purchased significant amounts of Woori Financial Group (24.7 billion KRW) and KB Financial Group (17.2 billion KRW).

The notable rise in bank stocks can be summarized by dividend expectations and the resolution of policy risks. As demand to receive dividends increases toward year-end, remarks by the Financial Supervisory Service (FSS) Governor respecting banks' autonomous shareholder return policies have alleviated dividend uncertainties. Earlier this year, the FSS instructed commercial banks to increase their provisioning due to concerns about uncertain economic conditions, leading investors to expect reduced dividends due to lower net profits. SK Securities analyst Kyung-Hoe Koo said, "Bank stock investors place great importance on the supervisory authorities' stance on dividends," adding, "The upward revision of earnings forecasts for bank stocks next year compared to other listed companies is also positive for bank stock gains."

◆ Mid-December Selling Tug-of-War

However, experts advise considering the timing of investment as bank stock prices have risen sharply in a short period. After mid-December, investors who have increased returns through bank stock investments may exit without receiving dividends. Choi Jung-wook, a researcher at Hana Securities, explained, "Although expectations for dividend increases are high and the price uptrend will continue, it is necessary to consider the significant impact of dividend drops (ex-dividend effects) on bank stocks in the past," adding, "After mid-December and before the dividend record date, profit-taking selling is expected to intensify trading battles."

According to financial information provider FnGuide, expected dividend yields for bank stocks range from 6% to 8%. By stock, Woori Financial Group (8.46%), JB Financial Group (8.42%), BNK Financial Group (8.4%), DGB Financial Group (8.3%), Industrial Bank of Korea (7.68%), Hana Financial Group (7.04%), Shinhan Financial Group (6.36%), and KB Financial Group (6.25%) are noted.

Considering that commercial banks' deposit interest rates remain in the 5% range, the incentive to invest in bank stocks has significantly increased. However, for high-dividend stocks, many investors attracted solely by dividend yields may consider selling if they have already realized capital gains exceeding expected dividend yields. Typically, after the ex-dividend date (the day after the dividend record date), stock prices tend to decline by 5-10% until the end of January the following year. For example, if an investor has already gained over 10% by investing in bank stocks since early last month, it may be better to sell in advance considering the price drop after the ex-dividend date. Researcher Choi said, "If considering bank stock investment now, it is effective to focus on stocks of commercial banks with strong shareholder return intentions and attractive dividend investment appeal."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.