Enforcement Decree Amendment of the Financial Consumer Act and Supervisory Regulations Effective from the 8th

Expansion of Prohibition Scope on Unsolicited Solicitation to Protect Consumers

[Asia Economy Reporter Song Hwajeong] Door-to-door sales of investment products are only permitted with the consumer's consent. However, even if the consumer agrees, high-risk products cannot be solicited.

On the 7th, the Financial Services Commission and the Financial Supervisory Service announced that the revised Enforcement Decree of the Financial Consumer Act, supervisory regulations, and the model code for door-to-door sales containing these provisions will take effect on the 8th, when the amended Door-to-Door Sales Act is implemented.

The amended Door-to-Door Sales Act, effective from the 8th, excludes transactions for concluding financial product contracts from the scope of the Door-to-Door Sales Act. Accordingly, it is expected that door-to-door sales of financial products, which had been restrained due to regulations under the Door-to-Door Sales Act, will be revitalized. However, concerns have been raised about regulatory gaps in procedures for door-to-door sales previously governed by the Door-to-Door Sales Act, which could lead to financial consumer harm. In response, financial authorities have worked with the industry to improve the system to promote sound activation of door-to-door sales while strengthening consumer protection.

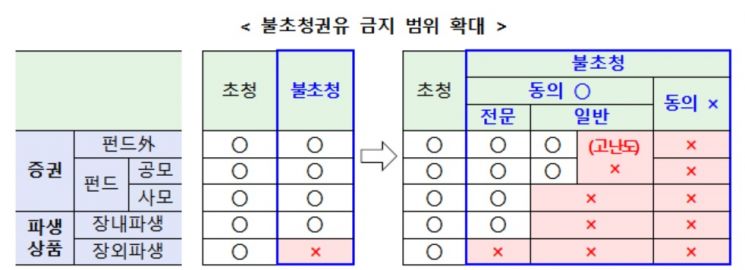

The amendment expands the prohibition on unsolicited solicitation to prevent excessive door-to-door sales and protect consumers from harm. Unsolicited solicitation refers to promoting financial products through visits or phone calls without the consumer's active request. Door-to-door sales are only allowed if the consumer's consent is obtained prior to the visit when there is no specific and active request from the financial consumer. Even in this case, solicitation of high-difficulty products (such as securities, public funds, discretionary accounts, trusts), private funds, and high-risk products like on-exchange and over-the-counter derivatives is prohibited for general financial consumers.

Additionally, sector-specific associations will establish and implement a "Model Code for Door-to-Door Sales" that sets out the obligations for financial product sellers during door-to-door sales. Financial product sellers must comply with the model code, including managing the list of door-to-door sales agents, verifying identity upon consumer request, and providing prior notice during door-to-door sales.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.