Increase in Investors Targeting Surge Before Delisting

Expectations Rise for Injunction Approval

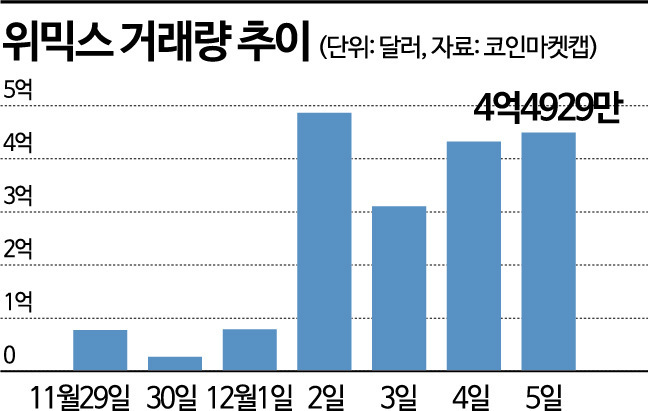

Trading Volume Soars Significantly from the 2nd

[Asia Economy Reporter Lee Jung-yoon] The trading volume of WEMIX, a virtual asset issued by Wemade, surged significantly ahead of the termination of its trading support (delisting). This is interpreted as a result of investors hoping for the approval of a provisional injunction filed by Wemade against the decision of the Digital Asset Exchange Joint Council (DAXA) and speculators rushing in to capitalize on the coin's price surge before delisting.

According to the global virtual asset market tracking site CoinMarketCap on the 7th, WEMIX's daily trading volume increased sharply starting from the 2nd. On that day, the trading volume was $486.74 million (approximately 642.7 billion KRW), which is 6.18 times higher compared to $78.77 million the previous day. The volume has remained high since then, recording $310.66 million on the 3rd, $432.43 million on the 4th, and $449.29 million on the 5th.

The sharp increase in WEMIX trading volume is due to speculative activity. When the termination of trading support was decided, panic selling by holders caused a surge in trading volume and a sharp price drop. Recently, a different speculative phenomenon has emerged. This occurred as market participants expressed hope for the approval of the provisional injunction. They anticipate that the court will grant the injunction because existing investors could face massive losses. The Seoul Central District Court Civil Division 50 (Presiding Judge Song Kyung-geun) is scheduled to decide on the approval of the provisional injunction to suspend the delisting of WEMIX later that afternoon.

Additionally, some are still trying to realize profits by exploiting the 'delisting pump' phenomenon. The delisting pump refers to the sharp price increase of a coin just before its delisting. During the Terra-Luna incident, speculators also thrived by targeting the delisting pump phenomenon despite the price crash and impending delisting.

This phenomenon is particularly noticeable on Upbit, the leading domestic exchange by market share. Most WEMIX trading occurs on domestic exchanges. Upbit accounts for 88.05% of the total trading volume, while Bithumb holds 7.58%. On Upbit, both trading volume and price surged significantly; the price was in the 600 KRW range on the 1st, rose to the 1,500 KRW range on the 2nd, and is currently trading around 1,100 KRW.

Given the high proportion of domestic holders of WEMIX, the domestic coin market is closely monitoring the WEMIX situation. Related posts have continuously appeared on virtual asset communities. Posts encouraging speculation such as "Buy WEMIX quickly because you can't make money if not today" and reactions like "Upbit must have earned a lot of fees because of WEMIX" have been posted.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.