[Asia Economy Reporter Jeong Dong-hoon] The Korea Chamber of Commerce and Industry (KCCI) urged the National Assembly to promptly pass the pending Corporate Tax Act amendment, stating that Korean companies are at a disadvantage compared to American companies under the current corporate tax system.

According to KCCI on the 7th, in 2018, the Trump administration passed the "Tax Cuts and Jobs Act," lowering the corporate tax rate from 15-39% to 21% and unifying the previous eight tax brackets into a single bracket. In contrast, Korea raised its corporate tax rate from 22% to 25% in the same year and increased the number of tax brackets from three to four.

Additionally, KCCI explained that the Investment Win-Win Cooperation Promotion Tax (with a 20% rate), which exists only in Korea, also contributes to the additional corporate tax burden.

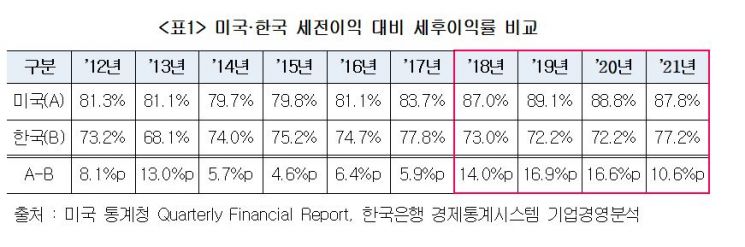

In fact, comparing the pre- and post-tax net profits of companies in both countries over the past decade, the decrease in after-tax profits for Korean companies was greater than that of American companies. Last year, the after-tax profit ratio relative to pre-tax profit was 87.8% for American companies, whereas it was only 77.2% for Korean companies. From 2012 to 2017, the average difference in after-tax profit decline rates between the two countries was 7.3 percentage points, but from 2018 to 2021, when corporate tax rate changes occurred, the average gap widened to 14.5 percentage points, more than double.

The decline in pre- and post-tax net profit margins relative to sales was also greater for Korean companies. From 2018 to 2021, the average pre-tax net profit margin relative to sales was 8.9% for American companies but only 4.9% for Korean companies. During the same period, the after-tax net profit margin relative to sales was 7.9% for American companies and 3.6% for Korean companies. While American companies saw a decrease of 1.0 percentage point, Korean companies experienced a 1.3 percentage point decline.

KCCI stated, "The net profit margin relative to sales itself is already less favorable for Korean companies compared to American companies, and the gap between pre- and post-tax profits is widening."

Transferring overseas investment income back to the domestic market is also disadvantageous. The United States adopted a territorial tax system in 2018, taxing only income earned within the U.S. mainland, whereas Korea taxes both domestic and foreign income but provides a foreign tax credit for a certain portion. However, there is a limit on the amount, and some cases occur where the credit cannot be applied.

To improve this, the Corporate Tax Act amendment includes provisions to relax the requirements for foreign subsidiaries eligible for the foreign tax credit, but its passage in the National Assembly remains uncertain. According to the International Institute for Management Development (IMD) in Switzerland, Korea's tax policy competitiveness fell 11 places from 15th in 2017 to 26th this year, and its corporate tax rate competitiveness dropped 12 places from 27th in 2017 to 39th this year.

Meanwhile, the International Monetary Fund (IMF) has called for eliminating corporate tax distortions through measures such as unifying tax brackets, and the Organisation for Economic Co-operation and Development (OECD) pointed out that the 2018 corporate tax rate increase led to reduced corporate investment, acting as a downward factor for the economy.

Kang Seok-gu, head of the KCCI Research Department, said, "In a situation where concerns about an economic recession are growing, a corporate tax cut would greatly help companies' investment execution and planning."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![From Bar Hostess to Organ Seller to High Society... The Grotesque Con of a "Human Counterfeit" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)